Week Ahead FX outlook:

The global environment continued to weigh on Asian currencies in the 2nd week of 2025, with a combination of higher US yields, concerns around China’s growth prospects, and the capriciousness of Trump whipsawing markets. For instance, the WSJ article this week that Trump’s team is considering broad tariffs but only on critical supply chains led to some temporary relief in markets only for Trump to deny it vehemently. Pronouncements by Trump about Greenland have certainly resulted in consternation among allies and adversaries alike, but more broadly there is an important geopolitical and strategic consideration there, at a time when climate change is transforming the geopolitical rules of the game in the Arctic. Meanwhile, recent news suggest swift implementation of executive action on immigration, energy and regulatory reform on Day 1 of Trump 2.0, including plans to tighten border crossings and putting a hiring freeze on the government.

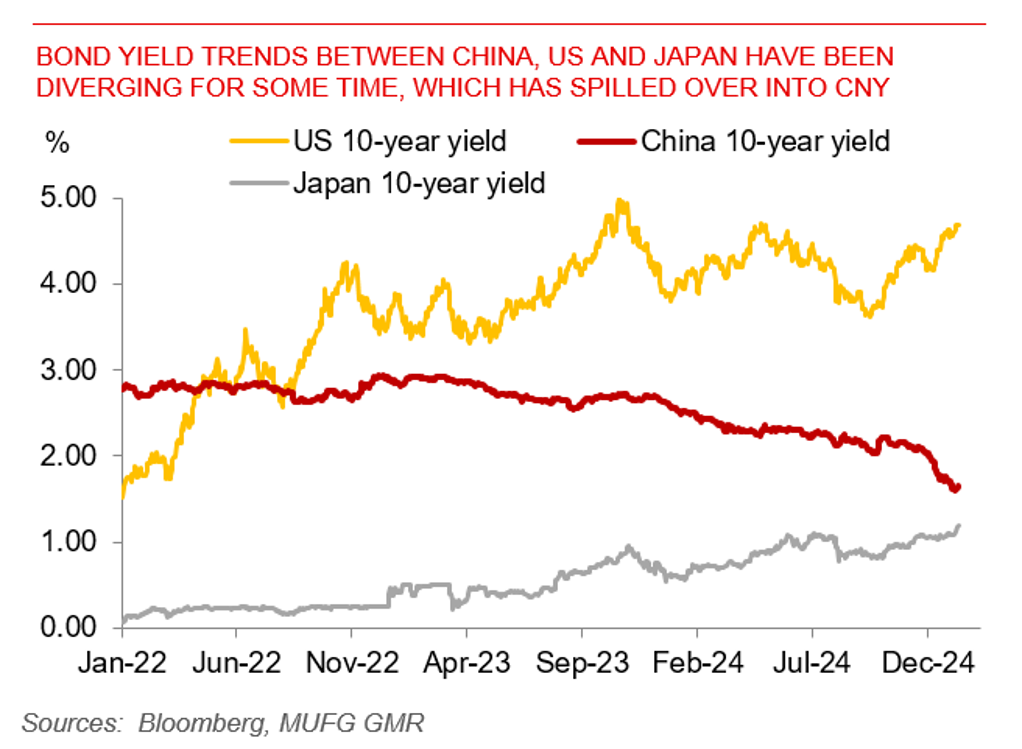

In Asia, Chinese authorities continued to push back against excessive CNY weakness. The onshore USD/CNY pair at 7.3322 as we speak continues to push up close to the upper end of the exchange rate band. The PBOC has used a combination of tools to manage the pace of CNY weakness, including tightening offshore CNH liquidity by withdrawing liquidity offshore, and keeping a stable USD/CNY fix relative to what has happened on the US dollar. More recently this week, the PBOC announced a temporary end to purchase of bonds in what had been part of a structural shift in its broader monetary policy framework. Clearly the sharp drop in Chinese bond yields from the end of 2024 to start 2025 could have played a part, but FX is also a key consideration.

Next week, Asian markets will watch closely for China’s monthly macro datapoints such as GDP and retail sales, together with Bank Indonesia’s monetary policy decision, with the tone also taking the lead from global announcements such as non-farm payrolls out to start the week.

Bond yield trends between China, US and Japan have been diverging for some time, which has spilled over into CNY