Week Ahead FX outlook:

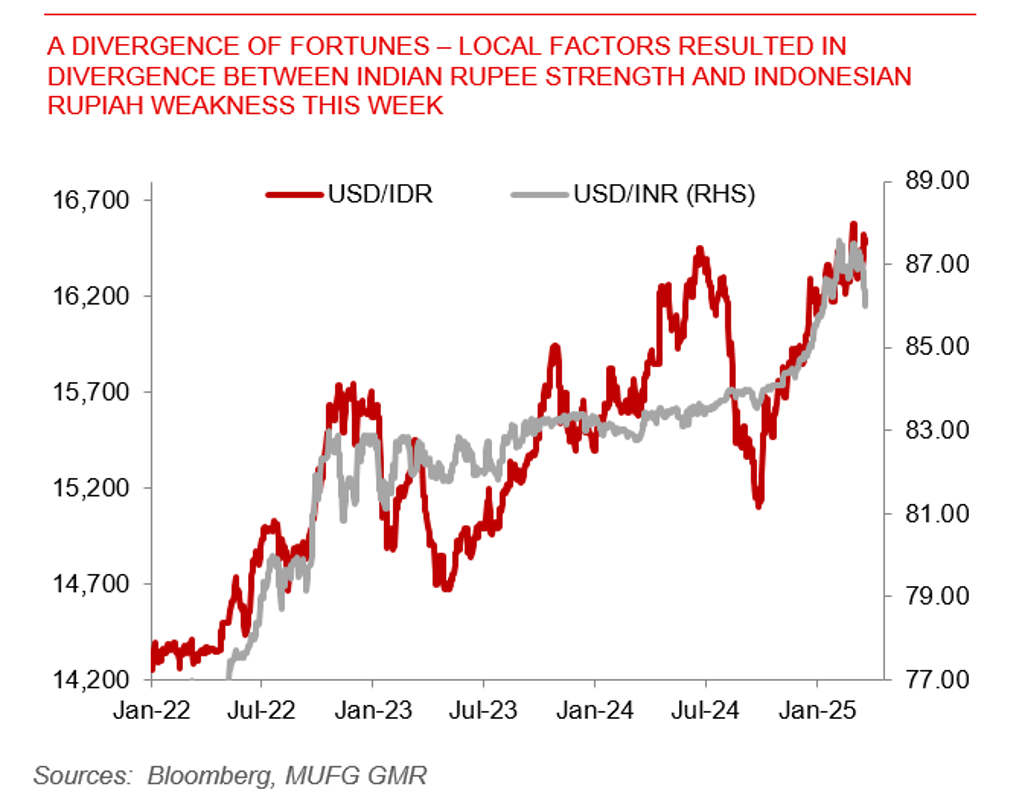

This week was characterised not just by key central bank policy meetings, but in Asia also importantly characterised by how local factors drive dispersion of outcomes beyond global factors.

On one hand, we had the Indian Rupee having its best weekly performance in two years with inflows into the bond and equity markets. We have been having a cautious view on India’s FX due to a softer growth outlook, higher FDI repatriation, modest deterioration in the credit cycle, coupled with our expectation for a less interventionist central bank. Nonetheless, the macro data over the past week has admittedly been better than we anticipated, with a smaller trade deficit, higher services exports coupled with lower inflation all helping to boost rate cut expectations and hence also capital inflows. We do however think that USD/INR markets are right now underpricing the risk from Trump’s reciprocal tariffs for India, and think the risk-reward may be tilted towards weaker INR from here.

Meanwhile, the Indonesian Rupiah was an exercise in sharp contrast, again driven by local rather than global factors. Policy uncertainty in Indonesia has already been rising due to the Prabowo’s administration priorities to focus on its school lunch program to reduce the country’s structural issues on malnutrition and stunting. Nonetheless, the adage that there is no free lunch perhaps rings true in macro markets as well as in life. The government had to find fiscal space to fund this new program, while moves to set up a new sovereign wealth fund in Danatara coupled with lack of clarity around Bank Indonesia’s plan to buy bonds to support the government’s affordable housing program have pushed IDR weaker. We continue to think that IDR can weaker further moving into next quarter.

Local factors resulted in divergence between INR and IDR this week