Summary

Please download PDF version above for the full report

Special focus: The VND weakened to new record lows against the USD following the SBV’s move to widen the trading band and raise the interbank USD/VND selling rate. USD strength, deteriorating trade and current account balances, and sluggish FDI flows are likely to keep the VND under pressure towards year-end. More in report.

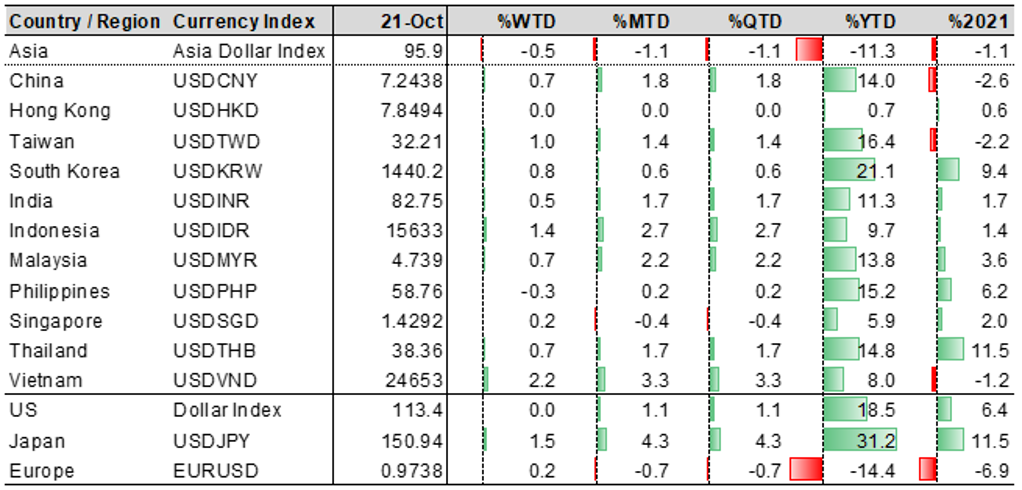

FX views: Asian currencies continued to be undermined by the USD heft with a few reaching fresh multi-year lows or record lows last week such as the VND and INR. We continue to see downside risks for Asian currencies the week ahead amid ongoing hawkish rhetoric by the Fed. Forecasts in report.

Week in review: Various Fed speakers continued to beat the hawkish drum. Trade data across a few Asian economies reflected a slowdown in export growth, namely South Korea, Taiwan, Malaysia and Indonesia. More in report.

Central bank monitor: Asian central banks continued to tighten monetary policy to combat inflation. BI raised the benchmark 7D reverse repo rate by 50bps to 4.75% as largely expected to curb inflationary pressures. More in report.

Week ahead: US core PCE numbers are likely to be the most scrutinised piece of data, particularly following the hot CPI print released two weeks ago which led markets to price in a terminal Fed funds rate slightly above 5%. Singapore and Malaysia will be releasing inflation data. Previews in report.

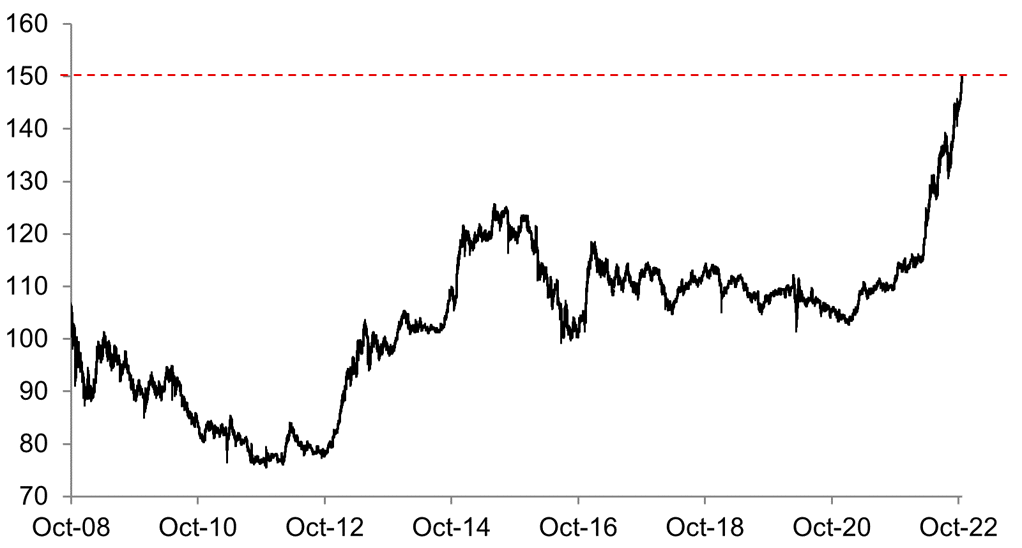

Chart of the week: USD/JPY has broken above the key 150.00 mark

Source: Bloomberg, MUFG GMR

FX View

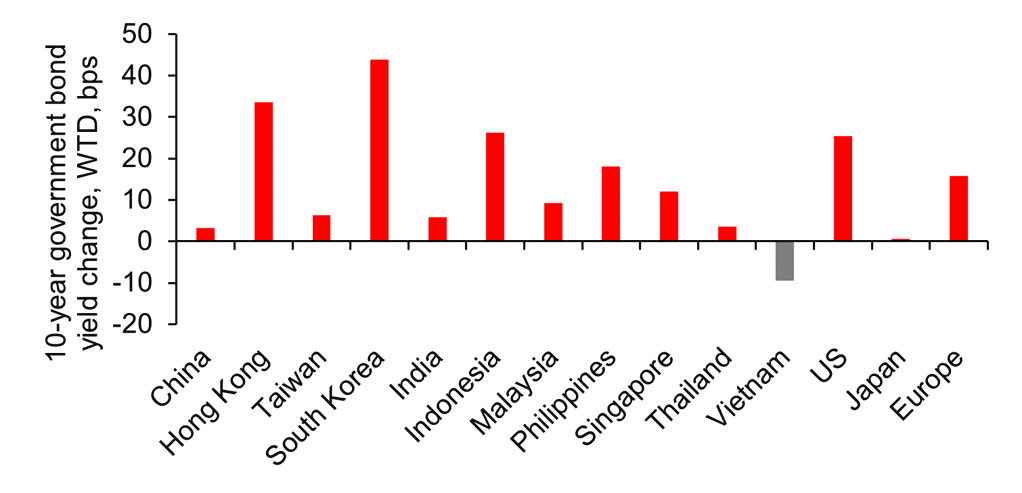

Most Asian currencies fell against the dollar last week amid a 0.3% rise in the USD Index. USD/JPY hit 150 on October 20 for the first time since 1990, keeping markets on high alert if Japanese authorities repeat last month's intervention in currency markets. VND (-2.2%) leading declines among its regional peers, as SBV on October 17 announced to widen the dong’s daily trading band to 5% on either side of the fixing rate from 3%, effective on the same day. The 1.4% depreciation of IDR was sustained by Indonesia’s falling real yields. TWD weakened 1% on a 2.4% decline in TAIEX index. Notably, CNY dropped 0.7% on larger equities outflows, as China’s delay on the release of Q3 GDP figures and a number of key economic indicators fuelled concern for the economy. This week, China’s Q3 GDP report and September IP, retail sales, FAI and property investment, as well as trade figures probably will be released, as well as data of production, trade and inflation for other Asian economies, i.e., Q3 GDP for Taiwan and South Korea, September IP for Taiwan and Singapore, September trade for Thailand, September inflation reports for Singapore, and Vietnam’s October economic data. The U.S. will release MBA mortgage applications and new home sales number for September, and GDP numbers and initial jobless claims, these may affect US rate hike expectations and US dollar movements

10-year government bond yields rose in general

Source: Bloomberg, MUFG GMR

FX Performance

Source: Bloomberg, MUFG GMR Note: Data retrieved at HKT5:30PM on 21 October 2022

|

LIN LI KARMAN LI |

USD/CNY: lockdowns in Xi’an and such, and development in Covid-19 policy remain the key for the near term movement

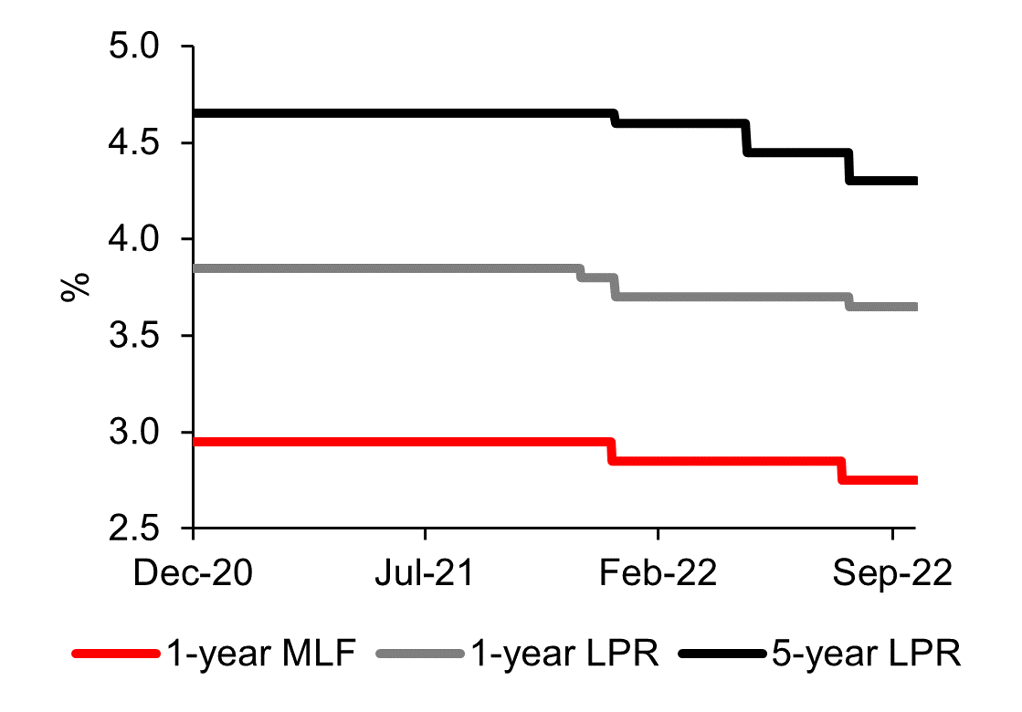

Chinese yuan extended its declines, rising 0.7% against US dollar despite steady CNY midpoint fixings last week, as market’s expectations for further more stimulus policies at the 20th national party congress weren’t fulfilled, and market got (negatively) surprised by the delay in the release of China’s Q3 GDP and September key economic indicators. China’s Shanghai Shenzhen CSI 300 Index declined by 2.6% in last week. Last week, CNY also weakened on government’s standby of the Covid-zero policy as indicated by president Xi’s work report, and some areas of Xi’an were locked down. Covid-19 situation made CNY’s rebound only a brief respite last Thursday, when the news said that China is considering a reduction in quarantine requirements for inbound travellers from “7+3” to “2+5” days. On October 17 and 20, PBOC kept its 1- & 5-year MLFs, 1- & 5-year LPRs unchanged respectively.

China’ Q3 and September’s key numbers, and Covid-19 control and policy are the focus this week

The current 7.25 level of USD/CNY is lowest value in past 15 years. In our view, no conclusion of a worsening overall economic fundamentals in September and this month, in fact, we see some improvement in credit structures suggested by the September bank loan numbers. And we still expect the continued introduction of more supportive policies, which will provide support for the CNY. There have been signs of thawing of travel control, with several China’s major airlines planning more international flights for the winter and spring seasons starting from end of this month. Government still wants to achieve a stable currency and it has tools in making so. Pan Gongsheng said that PBOC will continue to implement prudent monetary policy and keep Yuan’s exchange rates basically stable at a reasonable level.

KRW weakened last week amid broad risk aversion

USD/KRW: subject to risk sentiments and domestic data announcement

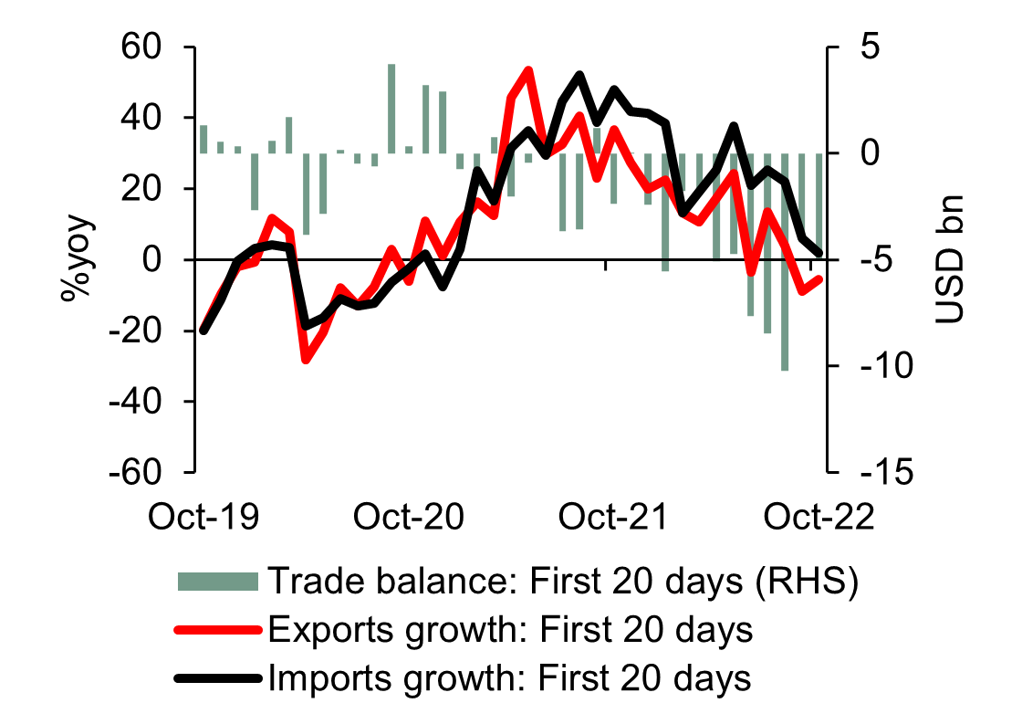

Despite a zero net change of US dollar and KOSPI index, Korean won weakened 0.8% last week as the postponement of China’s key figures release last week. The weakness of the Japanese yen which hit a 32-year low in the week has a negative spill-over effect on KRW. Newly released trade data accentuated concerns over the export outlook for South Korea. In the first 20 days of October, South Korea’s exports fell 5.5%yoy after an 8.7% contraction in August, with chip exports growth sliding to -12.8%yoy from prior’s 3.4%yoy. By destination, exports to China fell 16.3%yoy, marking the fifth consecutive month of contraction. Notably, there was news saying South Korea is considering temporarily banning short selling of shares and activating a stock market stabilization fund if there is a risk that the benchmark stock index will fall below 2,000 level. Look ahead, the rise in US Treasury yields could continue to weigh on the KRW, but potential smoothing operations by authorities may help limit the degree of the currency’s depreciation. Q3 data will be released this week.

PBOC kept key policy rates unchanged in October

Source: Bloomberg, MUFG GMR

South Korea’s early export contracted for the second straight month in October

Source: CEIC, MUFG GMR

|

JEFF NG |

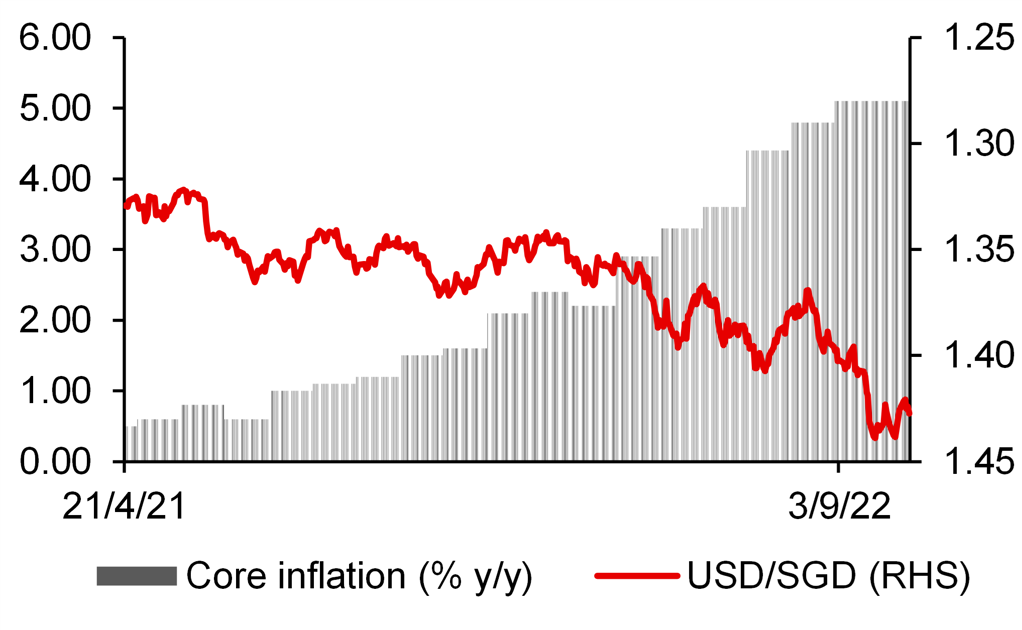

USD/SGD: Resilience

USD/SGD stayed fairly range bound even as other currencies weakened against the USD. After MAS tightening monetary policy last Friday, the SGD NEER has gained by almost 2% since last Thursday. Currently, we see the SGD NEER trading about 1% above the mid-point of the revised policy band. In the meantime, USD/SGD has been stuck in a range around 1.42 the past week.

This comes despite weakness in trade data. Singapore’s non-oil domestic exports increased by 3.1% y/y in September, lower than the 11.4% increase a month ago. This was dragged by electronics exports which decreased by 10.6% y/y.

For the week ahead, we anticipate this stability to persist. The pair may persist within a range of 1.4180 to 1.4310. Singapore’s inflation may continue to be high. We forecast a 7.7% y/y increase compared to the 7.5% print a month ago. Core inflation is also expected to increase 5.3% y/y from 5.1% a month ago. Recent inflation has been the highest in transport, clothing and footwear, as well as from food and recreation/culture. We see headline inflation peaking close to 8+% y/y at the start of 2023 before easing below 4% by the end of next year. Core inflation may also reach 6+% y/y in early 2023 before easing below 3% by the end of the year.

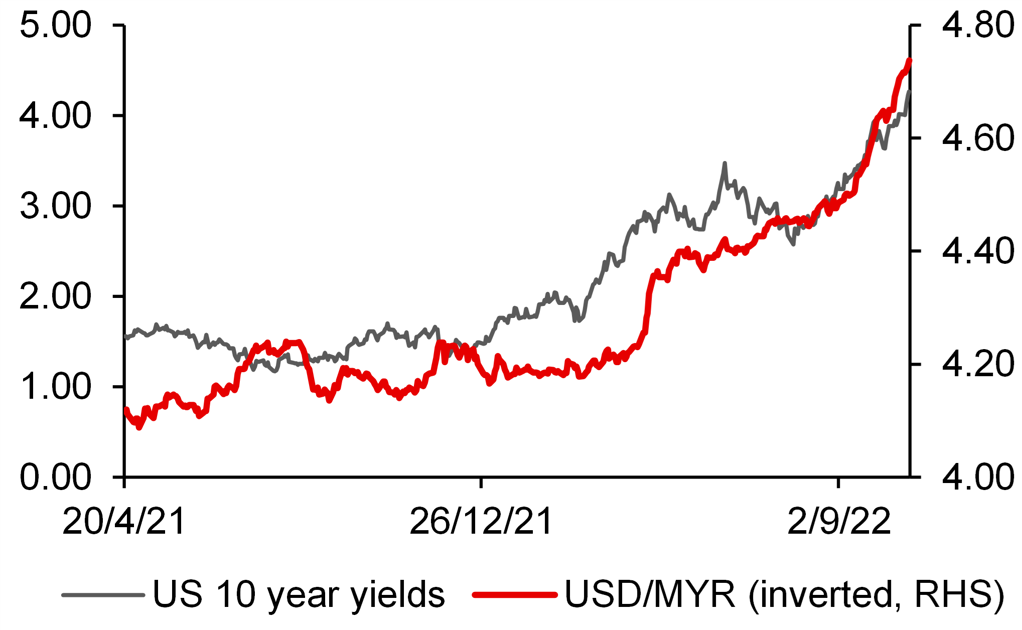

USD/MYR: USD strength pushed pair higher

USD/MYR continued to move in a bid tone over the past week. The pair broke 4.73 on Friday’s session and attention is now shifting to 4.75. This comes despite an increase in Brent prices earlier the week, although the rise has partly reversed by Thursday. Crude palm oil prices also rebounded amid concerns on flood risks. USD strength from hawkish Fed rate hikes continues, pushing MYR weaker alongside other currencies. We expect a pause in BNM monetary policy on 3 November. This comes as inflation eased to 4.5% y/y in September from 4.7% a month ago. This was helped by lower food inflation. Core inflation headed to 4% y/y from 3.8% a month ago. For the week ahead, 4.75 is the immediate resistance before 4.7850 next.

USD/THB: Stronger dollar still the pushing baht

USD/THB headed higher over the past week, from dollar strength. Pair touched a high of 38.465 on 20 October and stayed close to these levels by Friday. Yield differentials and expectations of more Fed rate hikes versus the BOT remained supportive of the dollar versus the baht. However, there was slight support from a potential loosening of travel restrictions from China, which may support Thailand tourism. For the week ahead, focus may shift towards customs trade numbers for September, after a high trade deficit in August due to stronger import growth compared to export growth.

Some stability in USD/SGD after MAS

Source: Bloomberg, MUFG GMR

USD/MYR headed higher as US yields climbed

Source: Bloomberg, MUFG GMR

|

SOPHIA NG |

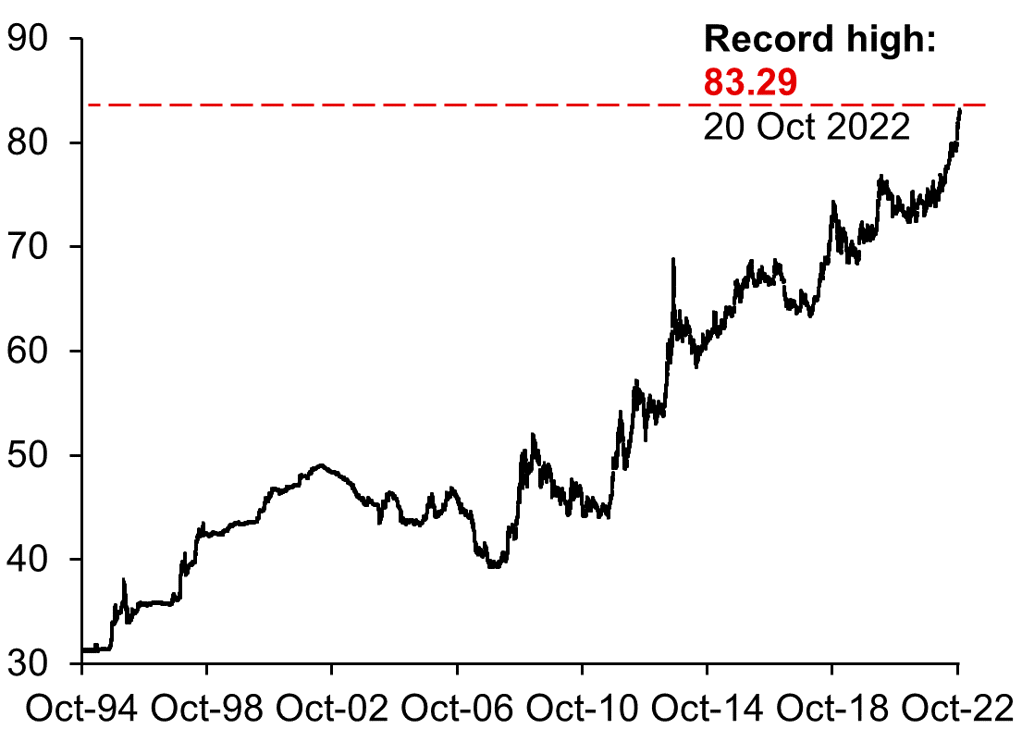

USD/INR: 83.00 mark breached

USD/INR volatility picked up last week after it rose to a record high of 83.29 versus its Mumbai close at 82.35 on 14 October. The INR’s depreciation to new record lows against the USD last week was mainly driven by stronger USD demand by oil importers. According to newswires, the RBI may have sold off USD1 bn last Thursday to bring USD/INR back below 83.00. We maintain our view that the sharp decline in foreign reserves by around USD101 bn so far this year limits the scope for aggressive RBI intervention in the near term, with future rounds of intervention to be done sporadically. This puts more upside risks to USD/INR particularly during bouts of USD strength (click here). We are maintaining our year-end USD/INR forecast at 84.00. For the week ahead. 83.00 is likely to be the first level of topside resistance for USD/INR, followed by 83.50.

Risks of USD/PHP crossing above 60.00 have yet to abate

USD/PHP: Diokno vowed to prevent USD/PHP from breaching 60.00

The PHP was the only AXJ currency that strengthened against the USD last Friday with the size of its gain at 0.3%. This was mainly due to Finance Secretary Diokno’s strongly worded vow to prevent USD/PHP from breaching 60.00 and his promise to President Marcos to make USD/PHP return to 55.00 “eventually”. In addition, he said that the authorities are ready to use an additional USD10 bn to defend the PHP. This follows latest available data showing a USD4.4 bn decline in foreign reserves to USD93.0 bn in September. This brings the total decline in foreign reserves so far this year by USD15.8 bn. A drawdown of another USD10 bn in foreign reserves will bring the import cover by a month lower versus the current 7.6 months. This is still higher than the IMF’s recommendation of a minimum import cover of three months, but we think the BSP is likely to maintain a higher buffer to save for a rainy day.

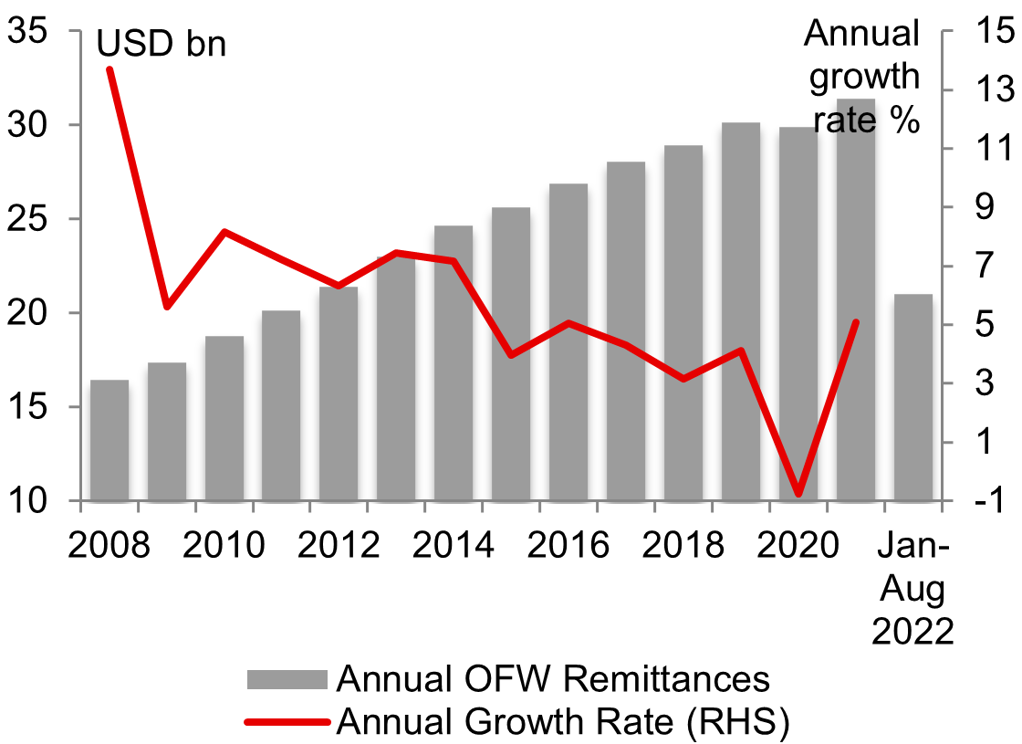

Diokno’s vow to prevent USD/PHP from breaching 60.00 is a strong signal of that level being the line in the sand for authorities. USD inflows from the seasonal increase in remittances in the coming months with the peak expected in December amid the Christmas holidays may help alleviate the pressure for aggressive intervention. But whether this can help USD/PHP stave off 60.00 remains unlikely, particularly in view of USD strength amid rising market expectations of aggressive Fed policy tightening, and no change in the fundamental factors, namely widening trade and current account deficits, that will drive the PHP weaker. We continue to expect the trade deficit to continue to widen in the coming months as external demand wanes amid slower growth in the US, China and Japan, which are the Philippines’ top three export destinations. Further, import costs are likely to remain elevated, on top of higher demand for capital goods as the Marcos administration pushes its massive infrastructure spending programme. We are keeping our end-2022 USD/PHP forecast at 61.00.

USD/INR hit a record high

Source: Bloomberg, MUFG GMR

Overseas Filipino workers’ remittances

Source: Bloomberg, MUFG GMR