Week Ahead FX outlook:

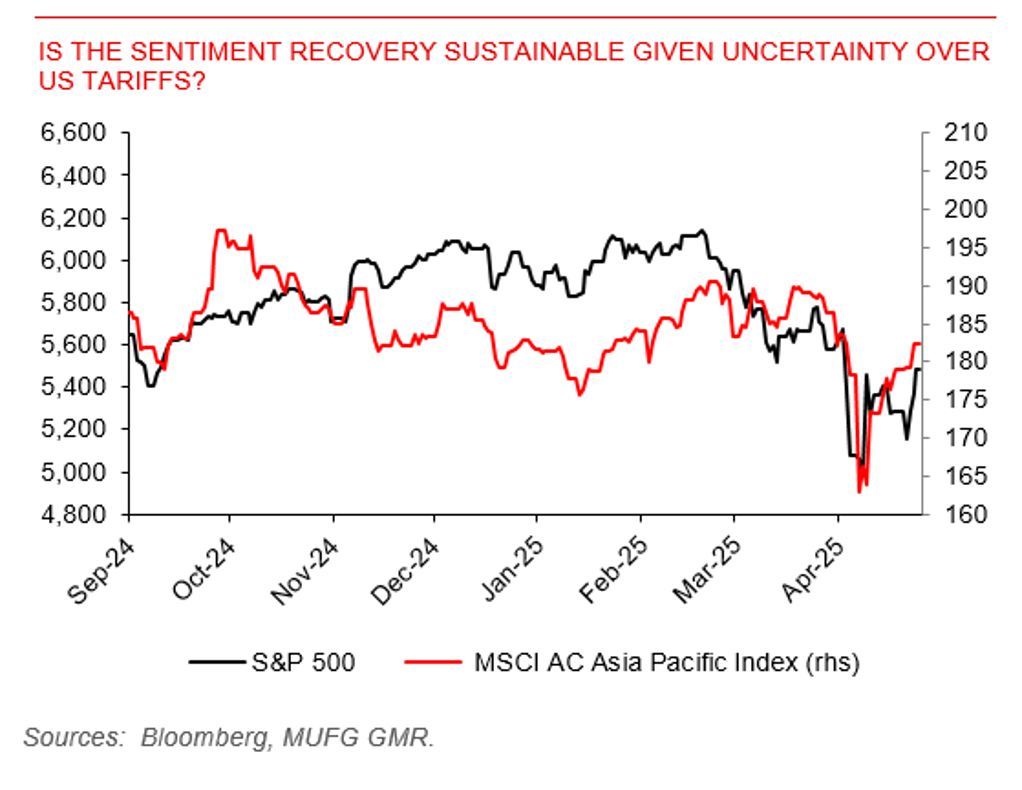

This week, headlines on tariff reductions and Fed’s independence ease some market concerns, both US dollar and US equities gaining some lost grounds, and some relief is seen on some Asian currencies. MYR and PHP recovered most by about 0.9% against the Dollar, while KRW depreciated most by 0.9% this week. KRW’s lag behind Asian peers was due to the surprise contraction of its Q1 GDP growth (-0.2%qoq in Q1 vs consensus expectation of 0.1%) and continued net sale of equities by foreign investors. The fact that this week’s relief rally is largely based on the US administration’s assuaging remarks would imply some doubts on the durability of this rally, given Trump’s volatile rhetoric in recent months.

Next week, developments on tariffs talks remain a focal point of the market. While an “agreement of understanding” on trade between the US and South Korea could reach as soon as next week, it may still be unlikely that China agrees to senior level negotiations soon, as Chinese foreign policy apparatus often means initial discussions start at a lower level before moving up to senior officials, and Chinese official denied claims this Thursday that tariffs negotiations with the US were under way. Factors matters for Asia FXs include Bank of Thailand policy rate decision, South Korea’s trade, inflation, and industrial production data, manufacturing PMI for several Asian economies, and Singapore’s general election on 3 May. In Asia, as the balance of risks for central banks have shifted towards supporting growth, we expect a 25bps cut by the Bank of Thailand. As of G10 factors, the key focus will be US April labour market data and core PCE inflation for March, and etc.

Is the sentiment recovery sustainable?