Week Ahead FX outlook:

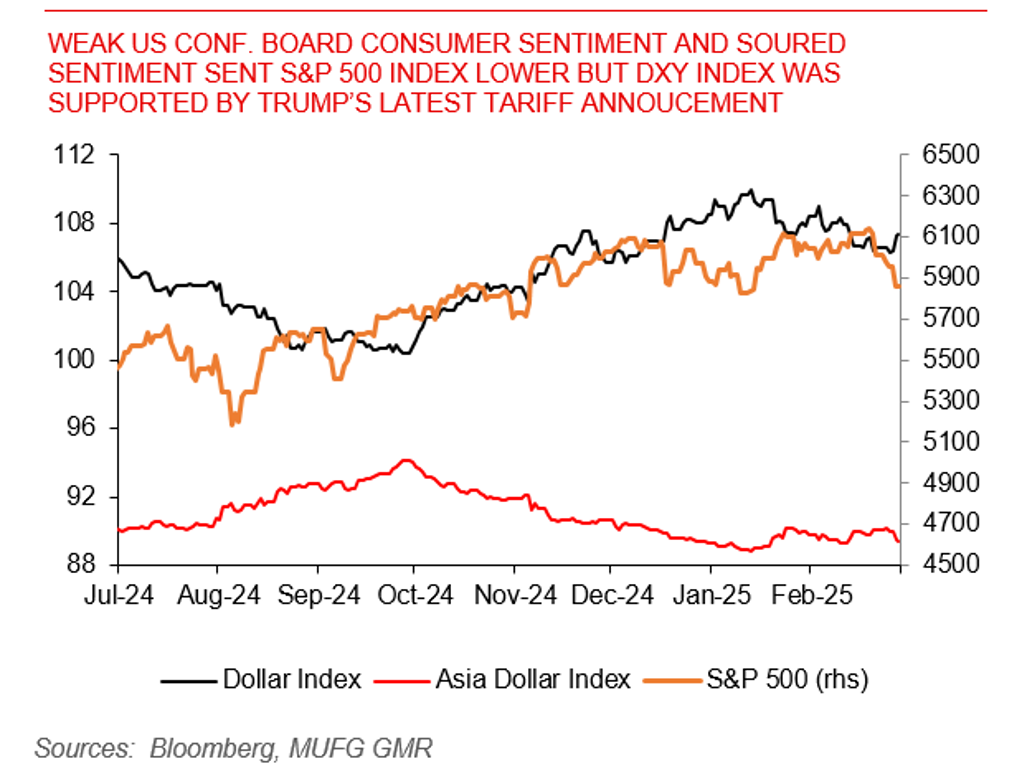

The US dollar index (DXY) strengthened moderately this week, affected by President Trump’s tariff threats and stocks linked to cryptocurrencies falling. The Asia dollar had a mirror depreciation of 0.74% this week, so did JPY. Tokyo CPI inflation declined to 2.9%yoy in February from January’s 3.4%, and latest larger-than-expected contraction of housing starts data helped justify JPY’s weakness.

The key highlights next week remain on tariffs, with Trump’s 25% tariffs on Canada and Mexico will take effect on March, and an additional 10% tariff on China goods. Another major event is China’s NPC meeting, which will commence on March 5th. Market is keen to see China government’s plan for year 2025 and details of stimulus. We expect a growth target of around 5%, a budget deficit ratio of 4~4.8% to GDP, with an increase in ultra-long special CGBs and special LGBs. Measures in stimulating demand such as increasing the size of consumer goods program, increasing pension pay-out or subsidies to special groups and others flagged in December CEWC meeting are worth paying attention to.

Next week will publish inflation data from Indonesia, Thailand, and South Korea, as well as manufacturing PMI data for several Asian economies. Indonesia’s inflation will likely be subdued in February, mainly due to the government’s electricity discount. However, recent rupiah weakness stemming from fiscal uncertainty and corporate governance concerns over the newly created Danantara – a second sovereign wealth fund – will likely lead Bank Indonesia to keep its policy rate on hold at 5.75% at the March meeting. Meanwhile, Bloomberg consensus is for South Korea’s inflation to hover around 2.1%yoy in February. With inflation no longer posing a major problem, along with the domestic economy struggling, the Bank of Korea will maintain its policy rate cutting cycle this year.

Investor sentiment turned weaker and the US dollar was supported by Trump's latest tariff announcement