Key points

President Trump announced “reciprocal” tariffs of at least 10% for all countries, and much higher tariffs for 60 countries deemed the worst offenders on 2 April.

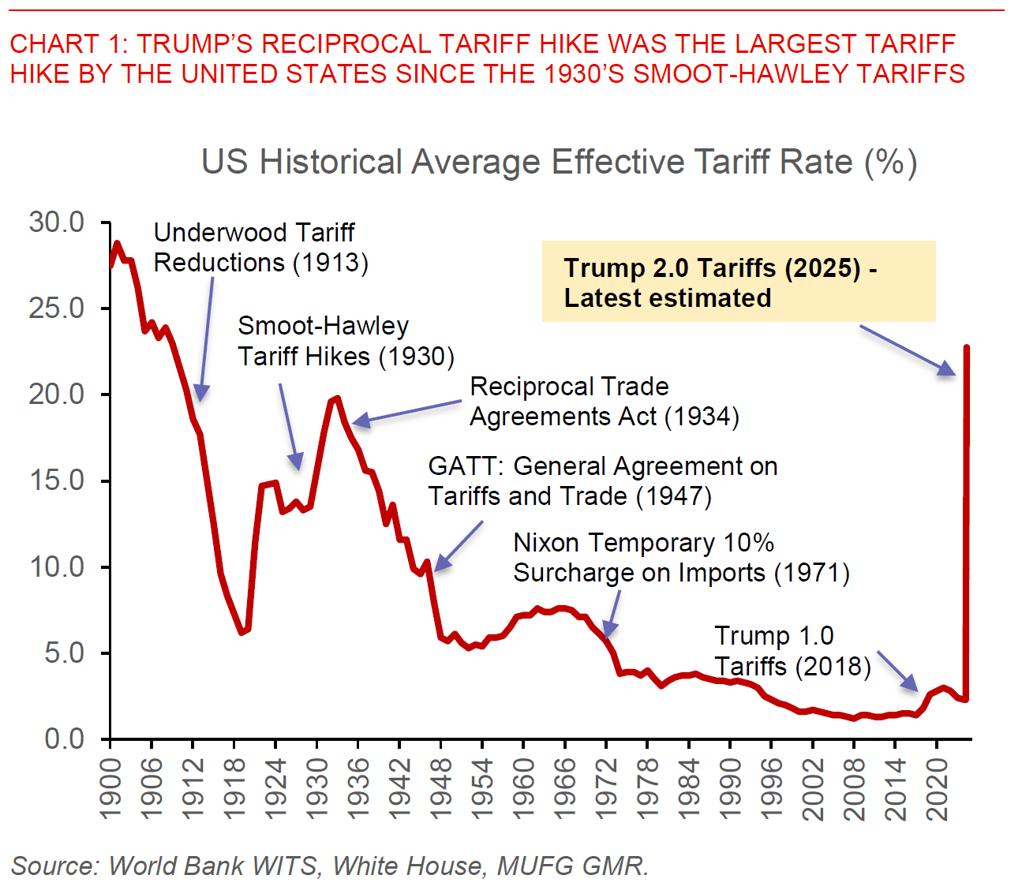

- A 25.1% average US tariffs on its imports is implied by these reciprocal tariffs, the highest tariffs rate since Smoot Hawley Act of 1930.

- Our calculation shows that the US weighted average tariff on Asia has risen sharply to around 40%, from prior 12%. A 34% tariff was announced for China, on top of the earlier 20% tariff increase. Significant tariffs were also imposed on other Asian countries, e.g., Vietnam (46%), Thailand (36%), Indonesia (32%), South Korea (25%), Taiwan (32%), India (26%), and etc.

- The announced tariffs seem have nothing to do with “reciprocal” and are far higher than the tariffs that other countries impose on the US. The Trump administration instead used a simple calculation of dividing a country’s trade surplus with the US by its exports into the US and multiplying by 0.5 - this may ultimately reflect the Trump administration’s intention of using the tariffs as a tool to exert pressure on countries to achieve both trade balance and manufacturing reshoring.

- We expect negotiations ahead but think that higher US tariffs in Trump 2.0 would result with high probability. Apart from China’s retaliation with a 34% tariff on all US imports, major Asian economies have chosen to refrain from direct retaliation. Asian economy’s negotiation with the US may not yield desired results, especially for countries running large trade surplus with the US, such as Vietnam. China’s retaliation actually complicates Vietnam’s and others’ negotiation with US, due to US’s worries on Chinese firms exploiting them as a backdoor to dodge tariffs.

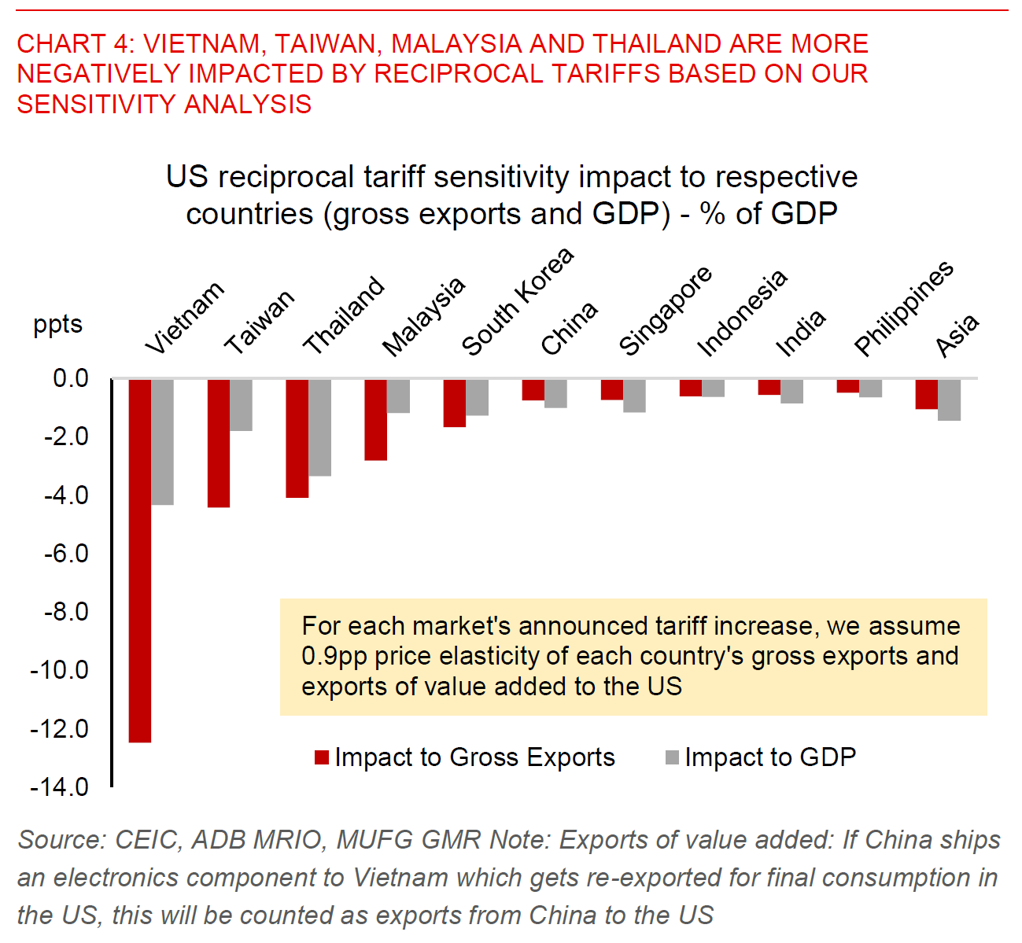

- Vietnam, Taiwan, Thailand, Malaysia and Singapore are likely more vulnerable from reciprocal tariffs, while India and the Philippines are relatively more insulated. For example, Vietnam could see a very sharp 12pp reduction in gross exports to the US as a share of its GDP, and potentially up to 4pp reduction in its GDP.

- Negative impact to Singapore could be significant despite a 10% rate. It’s reliance on trade servicing make it vulnerable to global trade slowdown.

- Impact on China: PIIE's estimate in September 2024 indicated that a 60% tariff on China and a 10% blanket tariff on the world will have an impact of 0.8-1.1 percentage points on China's real GDP in 2025. Government likely step-ups both monetary and fiscal policies.

We think that current levels of Asia FX not reflective the tariffs impact yet. VND, TWD, THB, SGD and to a smaller extent IDR and KRW look more vulnerable, while INR and PHP are more insulated. We maintain a moderate CNY weakness to 7.4 (helped by a potential weaker US dollar outlook than before).