On 5th March, Premier Li Qiang, on behalf of the State Council, delivered a government work report to the Second Session of the 14th National People’s Congress (NPC), for their review and approval. Premier Li reviewed government’s work in 2023, recognized the difficulties and challenges the economy faces, and announced the goals, tasks and policy priorities of the economic and social developments in year 2024. Premier Li said that the trend of economic recovery and long-term improvement have not changed and will not change. While calling for enhancing confidence, Premier Li, at the same time, said that “must adhere to bottom-line thinking and be fully prepared to deal with various risks and challenges”. Below, 9 key takeaways are summarised.

9 Key takeaways of 2024 NPC work report:

#1. An “around 5%” target is set for 2024 GDP growth, same as 2023’s growth target.

This growth target reflects government’s intention to boost confidence, and in line with our expectation. This relatively strong growth target is consistent with government’s targets of promoting employment and income.

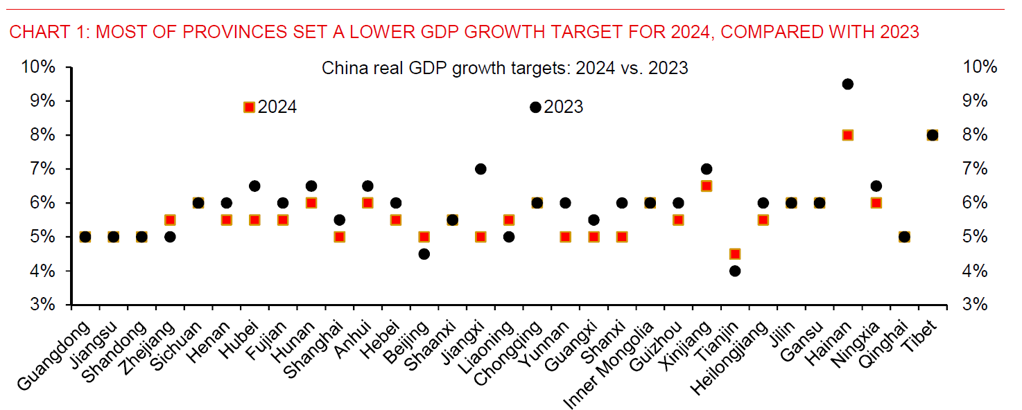

Having said it, “around 5%” is a bit inconsistent from the broad-based downward revisions of growth targets by the local governments in prior local NPCs. Chart 1 shows that many provinces set a lower growth target for 2024, compared with 2023. In fact, the bottom-up national GDP growth target, based on GDP-weighted individual province’s GDP growth target, is about 5.35% for 2024, lower than last year’s 5.6%. Historically, the bottom-up national GDP target numbers often were 0.6ppts higher than the official national GDP growth target.

#2. China’s fiscal policy stance remains proactive for 2024, but the numerical targets announced slightly disappoint the market.

The budgeted deficit-to-GDP ratio is set at 3% for 2024, same as the original budgeted deficit-to-GDP ratio for 2023. Starting from this year, government plans to issue ultra-long-term special treasury bonds for several consecutive years, specifically for the implementation of major national strategies and the construction of security capabilities in key areas, and 1 trillion yuan will be issued this year. This year, government budgets a RMB3.9 trillion quota for special bonds for local governments, RMB0.1 trillion higher than 2023’s quota of RMB3.8 trillion.

Considering the approved additional RMB1trillion government bonds in late 2023 (which pushed the budged government deficit-to-GDP ratio to 3.8% for 2023), the announced numerical fiscal numbers today do not seem to be offering something extra, compared with those for 2023.

However, with reasons including government’s restrained fiscal stimulus last year, government’s assessment that Chinese economy’s “continued economic recovery not yet solid, with insufficient effective demand, overcapacity in some industries and weak social expectations”, and fiscal challenges local governments generally face, an idea of big bang fiscal stimulus for this year maybe shouldn’t be entertained at first place, in a hindsight.

We expect additional policies to ensure a close 5% growth this year, due to that housing sector is still finding a bottom. The happening of extra 1trillion RMB government bond also gives some hope for that.

Please read more in the full report by downloading the PDF.