Please download PDF using the link above for the full report

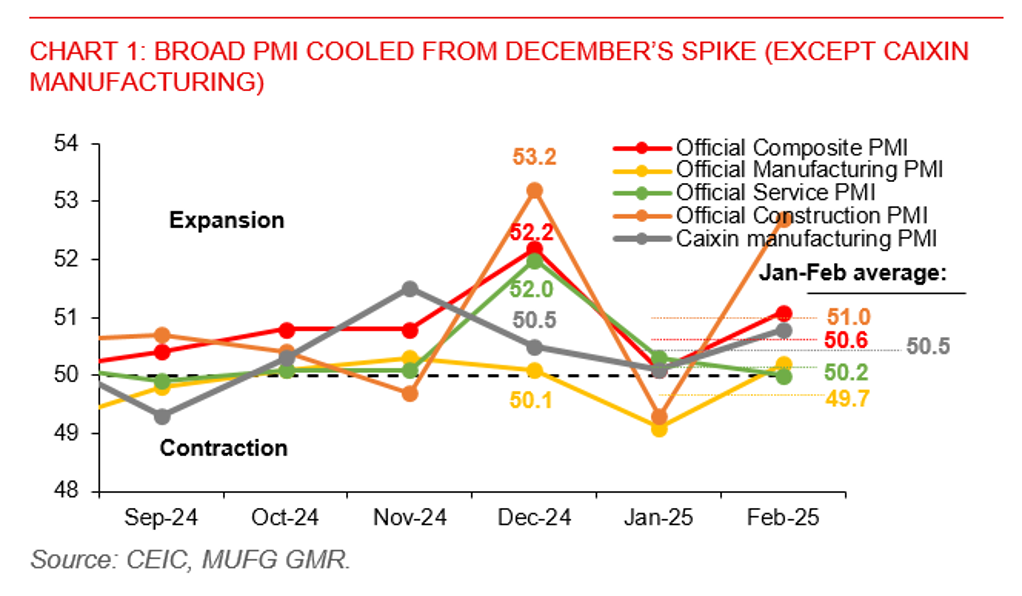

- February official manufacturing PMI increased by 1.1ppts to 50.2. The manufacturing sector returned back to the expansionary territory after January’s contraction. Overall composite PMI improved from 50.1 to 51.1, with non-manufacturing business activities improving slightly from 50.2 to 50.4.

- To remove the distortion that lunar-year seasonality has on monthly data, we focus more on the Jan-Feb average PMI numbers. The average PMIs imply a slowdown in economic recovery momentum in Jan and Feb compared with last Q4, across manufacturing, service and construction sectors. Particularly, the Jan-Feb average manufacturing PMI was 49.7, lower than Q4’s 50.2.Caixin manufacturing PMIs showed similar pattern.

- The service PMI, small and medium enterprises manufacturing PMIs further declined in February, despite the support of seasonal factors. The large enterprise manufacturing PMI increased by 2.6ppts to 52.5% in February, but the Jan-Feb average number only improved slightly by 0.2ppt from Q4’s 51.

- The bright spot was the improvement of the PMI sub-index of manufacturing production and business expectation, with the Jan-February numbers averaging at 54.9, higher than Q4’s 54.0.

- However, the PMI sub-index of construction business expectation decreased by 0.4ppt to 55.6% in Jan-Feb, signalling some uncertain sentiment towards the property sector. And for both manufacturing and non-manufacturing sectors, for both input and sales prices, the Jan-Feb average index values were lower than respective Q4’s.

- This set of PMIs still indicated the existence of imbalances between supply-side and demand-side of the economy, with supply-side performing better than the demand-side. And the positive effect of previously announced policies on the overall economy has been losing some steam in stimulating growth.

- The near-term focus for China economy is on tomorrow’s China NPC, US’s tariffs on China and other countries, China’s tariffs retaliation, US-China relations, as well as the development of China property sector. Net, we expect a weaker sequential GDP growth in Q1 (from 1.6%qoq in Q4).

Broad PMI cooled from December's spike (except Caixin manufacturing)