Key Points

Please click on download PDF above for full report

- China’s October major macroeconomic data was mixed. While a stronger-than-expected retail sales growth was reported for October, growth deceleration happened for industrial production and property investment. Fixed asset investment (in YTD term) growth remained unchanged from prior month.

- The 1.6ppt acceleration in October’s retail sales growth reflects that government’s consumer goods trade-in program were taking effect. In fact growths of household electric & video appliance sales, automobiles, furniture all accelerated by 18.7ppts, 3.3ppts and 7.0ppts respectively in October. Such positive results could give government confidence in fiscal stimulus, and to further expand the size and scope of such programs in this remaining year and next year to boost domestic demand.

- The recovery of property sector wasn’t solidified in October. A sequential decline was seen in major housing activities indicators, including property investment (-18.8%mom), property sold (-12.9%mom), floor space started (-21.4%mom), floor space under construction (-28.3%mom). Floor space completed increased by 51.4%mom, probably due to marginally improving credit condition of developers and implementation of government’s ensuring home delivery requirement. Meanwhile, the decline in new home and secondary home prices in 70 cities continued in October though by a milder pace.

- October’s China macro data necessitates further forceful stimulus, especially on fiscal side. Government has been rolling out incremental policies. After last Friday’s approval of the “State council’s proposal of raising local government debt quota to replace existing hidden debts” (a new RMB 6tn quota for special LGBs over three years and etc., to reduce local governments’ hidden debt), this Wednesday, Ministry of Finance along with other two government agencies jointly announced new policies to support housing market. We expect more incremental policies to come.

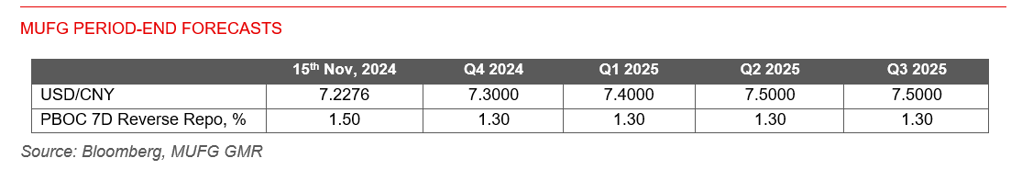

- In near term, USD/CNY will be driven by several factors, namely Trump trade, US Dollar and China’s further incremental fiscal & monetary & property policies, while for medium-term, US’s potential large tariff increase on China products would be a more impactful factor on the movement of the pair. Our forecasts price in a 20ppts increase of US’s average tariff on China products, from current 19% to 40% during next couple quarters. We expect the USD/CNY pair to grind higher and reach 7.30 by year-end and 7.50 by Q3 2025 (Link).