Key Points

Please click on download PDF above for full report

- China’s GDP growth slowed by 0.1ppts to a 4.6%yoy in Q3, making an overall 4.8%yoy GDP growth for Q1-Q3 this year. The main drag on growth in Q3 was the weak household consumption expenditure caused by the soft job market recovery and lack of willingness to consume. In Q3, the economy remained in a deflationary status with a -0.6%yoy GDP deflator. The positive part is that the sequential expansion of GDP expedited to 0.9%qoq in Q3, up from Q2’s 0.5%qoq.

- September data shows that growth rates of major economic indicators improved, including IP, retail sales and FAI. Consumption recovery in September, implied by the 1.1ppts increase in retail sales growth in the month, was helped by the trade-in policy. Both growths of IP and services production accelerated by 0.9ppts and 0.5ppts. The effects of the new round of incremental macro policies have already begun to show.

- A series of policies were announced lately by the Political Bureau meeting of the Central Committee on September 26, and the high-level meetings done by PBOC, NDRC, Ministry of Finance, Ministry of Housing and Urban-Rural Development and other ministries and commissions. Two specific policies for property sector were announced on October 17, one is to implement an additional 1 million units of urban village renovation through monetary settlement and other methods; the second is to increase the credit scale of "whitelist" projects to 4 trillion yuan before the end of the year to meet reasonable financing needs of developers. Such policies may help accelerate the release of housing demand and further alleviate housing delivery risks. And more incremental measures for property sector and overall economy are likely.

- These meetings clearly signal a shift in government’s policy stance and its strong intention to stabilize the economy and the property market. We expect the rebound in September date to sustain into Q4 and help to deliver a close to 5% growth.

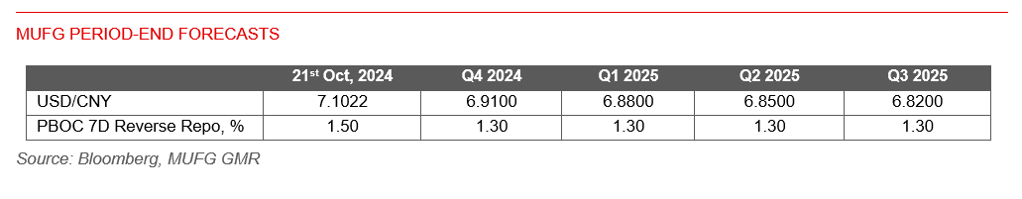

- In near term, USD/CNY likely continues to be affected by the levels of “Trump trade” and the China’s stimulus packages. Further intensified Trump trade could push the pair higher, while positive Chinese policies would lower the pair. For the medium term, Fed’s policy rate cut cycle, soft-landing US economy, the potential better growth of China relative to US would still help justify a lower USD/CNY. Having said it, the biggest risk to our call is US tariff policy.