Key Points

Please click on download PDF above for full report

- On June 17, the National Bureau of Statistics released economic data for May. The year-on-year growth rates of fixed asset investment, industrial production and property investment decelerated in May, particularly, the downward trend of real estate activities remained in May, and the decline in housing prices continued as well. Retail sales growth improved to 3.7%yoy, however, it was mainly driven by the May Labour Day holiday and the advancement of the 618 promotion, and it was still low compared to pre-Covid values.

- Chinese economy still showed a persisting insufficient demand in May, consistent with the weak household and corporate loan demand, and the still near-zero 0.3%yoy CPI inflation and negative PPI inflation in the same period.

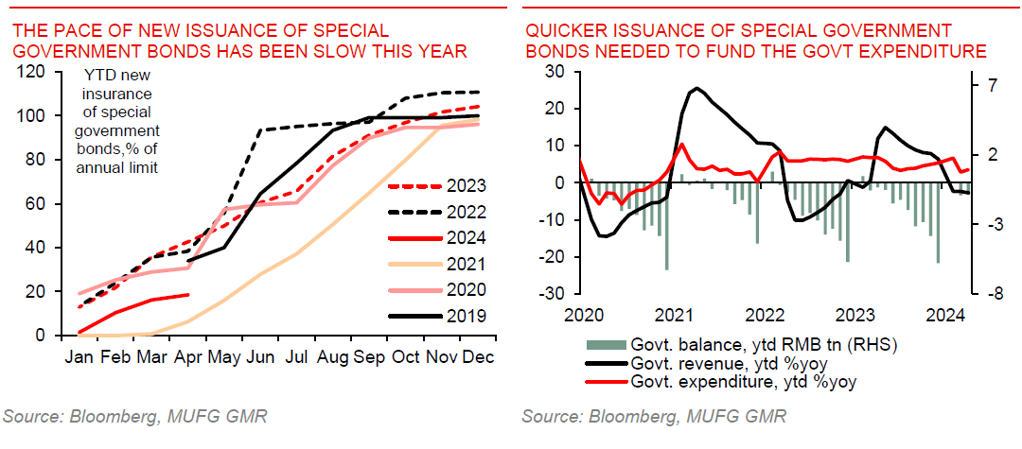

- Having said the above, we see a strong pick-up of government bond issuance in May, a big contrast to the slow issuance in first four months of the year. Looking forward, to reverse the downward pressure on the economy, economic policy must rely on fiscal policy. This pickup of government issuance in May and potential continued faster pace of issuance in the remaining part of the year likely help support economic growth through supporting the strategic projects/industry, social and infrastructure investment.

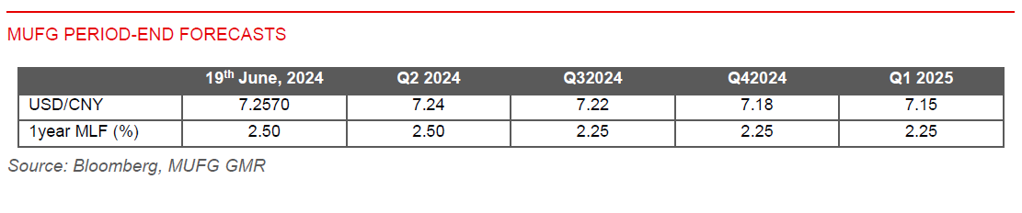

- Recent mild CNY’s weakness happened amid a gradual upward revision of the USD/CNY fixing from 7.1042 to 7.1148, the stronger US dollar and resilient US economy, and China’s weak economic development. Looking forward, on the US dollar front, as soft May US retail sales data adds to signs that consumers are beginning to struggle. The fact that services consumption growth and University of Michigan consumer confidence slowed in recent months, suggests high interest rates are having a more material impact on households, and the change or even the marginal change of consumption pattern may make Fed in favor of a rate cut in September and weighting on the dollar. On the Chinese domestic factor front, with further more policy stimulus and a more stable economic recovery in upcoming months. Net, CNY likely receives some support towards the end of Q3.