Key Points

Please click on download PDF above for full report

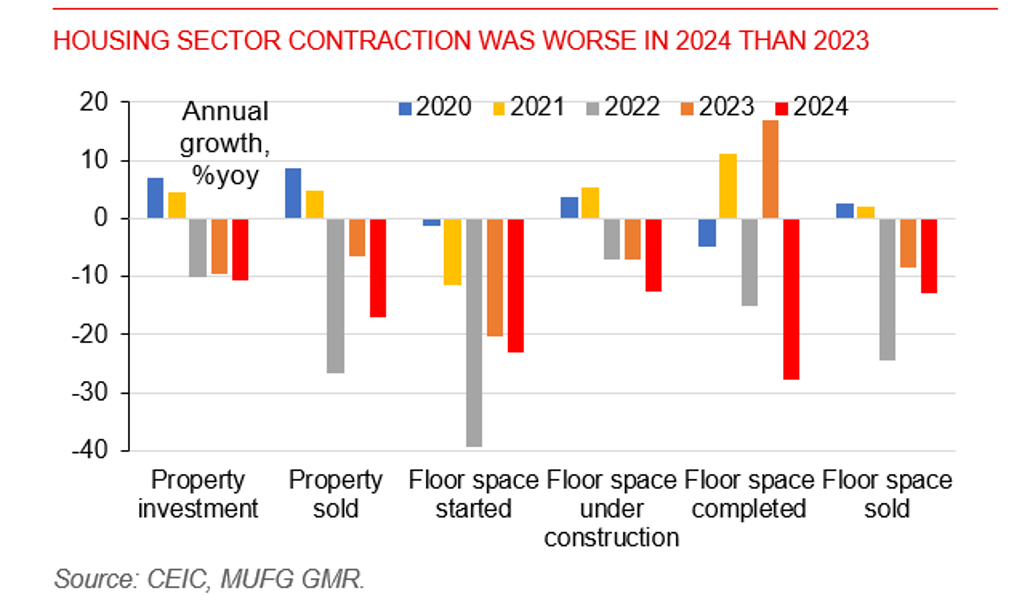

- It was a positive surprise that China real GDP grew by 5.4%yoy in Q4, and China’s 2024 economic growth met the 5.0% growth target set in last March. 2024 overall was a year with insufficient domestic demand, dragged by larger contraction of property sector activities, negative wealth effect and employment conditions.

- December monthly data showed that Chinese economy benefited from strong exports, and that front-loading exports helped IP/manufacturing activity. The accelerated year-over-year retail sales growth was another bright spot, however, slower pace of sequential retail sales expansion in December means a moderation of the impact of various trade-in programs. For property sector, investment declined 9.3%mom despite sequential improvement of other main activity indicators. Both new and used home prices continued to decline in the month.

- For 2025, with the strong headwinds like tariffs and potential decline of external demand, stimulating consumption will be an important lever for policy easing. Government will remain supportive for investment, but the statements of "moderately increasing investment within the central budget" and "improving investment efficiency" signal some cautiousness. This with the high base of consumption support likely delivers a lower growth rate of 4.5% for 2025. We expect the property sector to bottom out in H1.

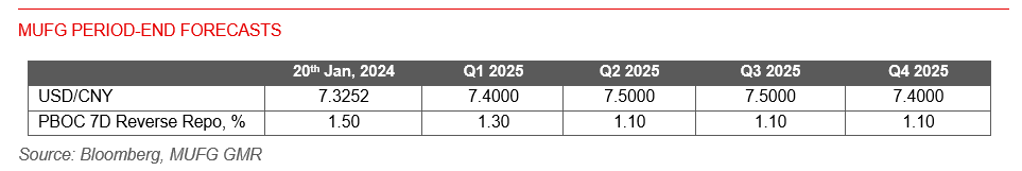

- For USD/CNY, while PBoC will continue to manage the volatility of the pair, PBOC likely allows some further weakening of RMB in 2025 amid the strong headwinds, so as to reduce some pressure on exports and support the economy. We maintain our expectation of USD/CNY to reach 7.50 by end of Q2 2025 and reach 7.40 by end of Q4 as Dollar strength likely to moderate in 2H given Fed’s easing. (link)

Housing sector contraction was worse in 2024 than 2023