Key Points

Please click on download PDF above for full report

- A mixed set of Jan-Feb macro numbers was released today for China, with an accelerated growth seen in industrial production, retail sales and FAI, and worsened activities in property sector and weak loan demand by both households and corporates. A higher jobless rate was recorded too for Feb.

- We see a postponed bottom-up of the property sector. Despite various policy easing measures for the sector in recent months, China’s property prices fell by a faster pace in February, after several months’ price decline narrowing since last September when government began to step up the stimulus. Major activity indicators, including property investment, sales and floor-space-started, posted even worse negative growths in Jan-Feb, compared with last December.

- Silver lining was that details of Jan-Feb data showed that Chinese economy still was reactive to policy stimulus. The high-tech industry was performing relatively better, FAI for equipment purchase was growing at rate of 18.0%yoy, and recent improvement of retail sales growth was partly due to government’s trade-in programs.

- With the stress in domestic economy, and challenging external environment, more government stimulus is needed to stabilize the economy. Recently announced “Special Action Plan to Boost Consumption” offering a comprehensive package of policies for boosting consumer spending and tackling a set of underlying issues, including low wages, real estate crisis, childcare, AI funding and stock and household wealth, is likely to help. Having said it, balancing the potential magnitude pf the stimulus, size of tariffs and delayed bottom-out of the property sector, we revised China 2025 GDP growth marginally up to 4.6% from 4.5%.

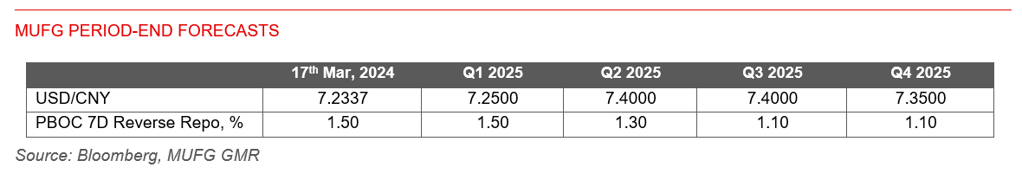

- For USD/CNY, we see a more moderate upside for the pair, due to the recent un-expected weakening of the US dollar, the downward revision on the growth outlook for the US economy, as well as the stepped-up China policy stimulus. We revise the pair lower to 7.25 by Q1, 7.40 by Q2, 7.40 by Q3, 7.35 by Q4.