In transition to an endogenous demand driven growth mode

Key Points

- China’s April economic data disappointed the market. The 18.4%yoy growth of retail sales and the 5.3%yoy of IP were largely due to the favourable base effect.

- Month-on-month changes of indicators depicted a more precise and downbeat picture of the Chinese economy, with both IP and FAI contracting, sales expanding by a milder pace than March, and sales/investment/floor space started of property sector activity all worse off in the month.

- Details of retail sales and services activities show that the economy still mainly benefited from the release of pent-up demand due to the relax of Covid-19 policies, and not yet driven by endogenous demand yet in this April.

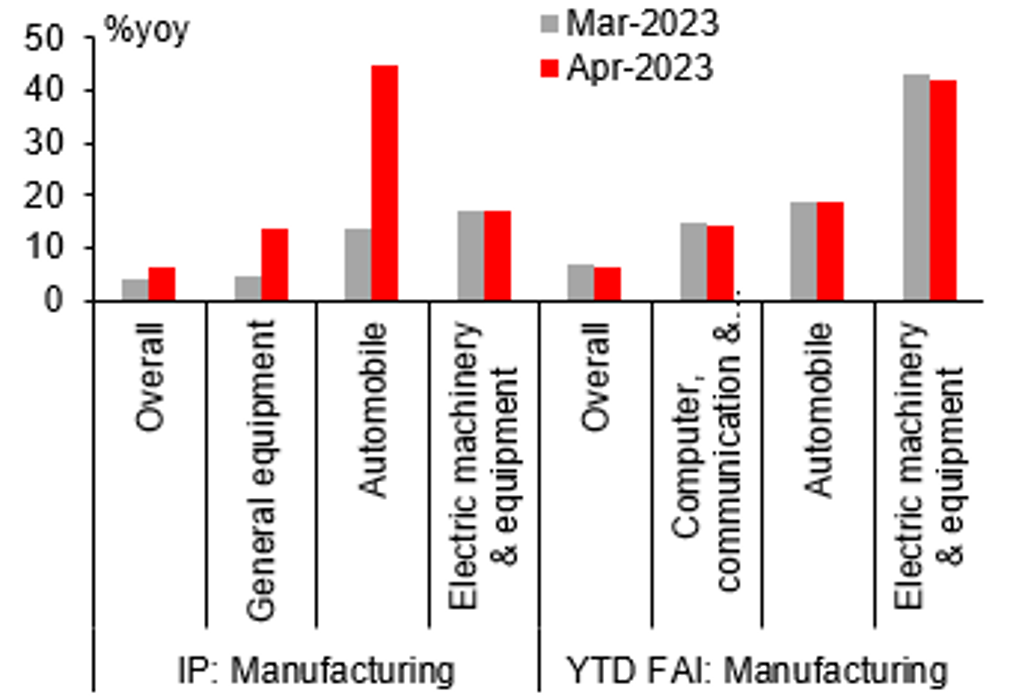

- Bright spots existed in April data: 1) the production and FAI of manufacturing remained resilient, particularly for automobile, general equipment, and electric machinery & equipment, due to structural opportunities implied by China’s 14th Five-Year Plan in maintaining a stable share of manufacturing industry; 2) medium to long-term loans to corporates were strong in March and April, implying stronger corporates investment ahead.

- With the youth unemployment rate at a record high 20.4%, and a near-zero 0.1%yoy headline CPI inflation, alarmed a risk of deflation due to weak demand. To cultivate endogenous growth drivers and promote a steady growth, further stimulus is needed, especially fiscal support.

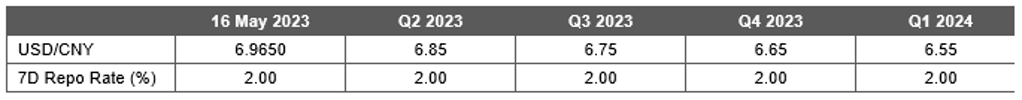

- We still see a faster GDP growth in H2, and expect a 5.5%yoy GDP growth for 2023. Although CNY may remain stressed in near-term, we still foresee a stronger CNY in 12-month horizon, albeit a bit more modest than previous forecasts, we expect USD/CNY to reach 6.85 by the end of Q2, 2023, 6.65 by the end of 2023.

YOUTH JOBLESS RATE HIT A RECORD HIGH OF 20.4% IN APRIL

Source: CEIC, MUFG GMR

PRODUCTION AND INVESTMENT OF A NUMBER OF MANUFACTURING SECTORS REMAINED STRONG

Source: CEIC, MUFG GMR

MUFG PERIOD-END FORECASTS

Source: Bloomberg, MUFG GMR