Key Points

Please click on download PDF above for full report

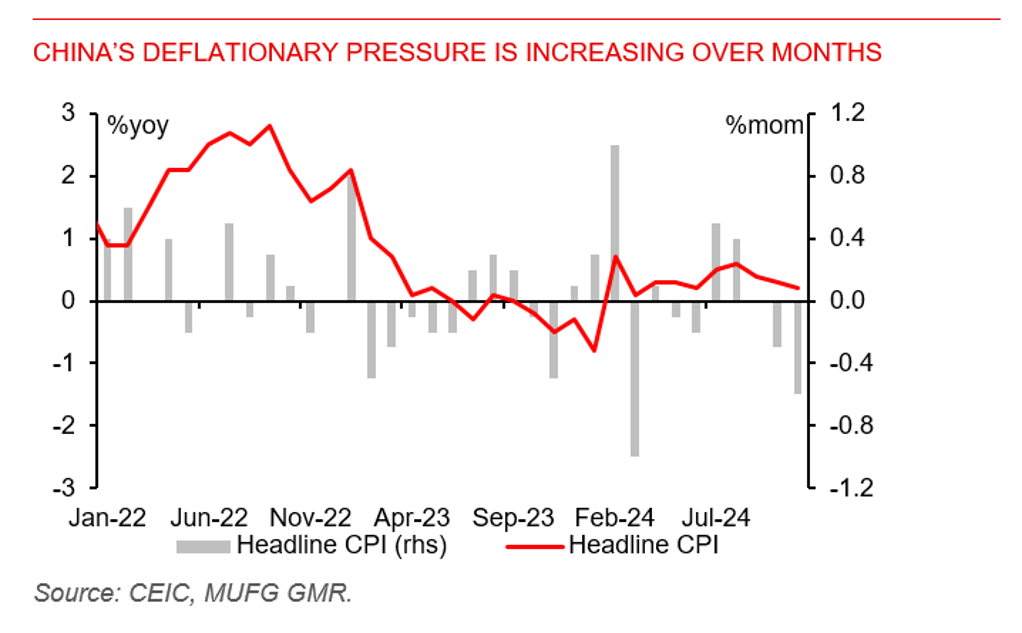

- China’s November major macroeconomic data offered a set of weak and weaker-than-expected numbers. With growths of retail sales, FAI and property investment YTD decelerating and CPI index contracting (-0.6%mom) in November, there is clear urgency for government officials to ramp up support for the economy. This urgency is also amplified by expectations of incoming tariffs.

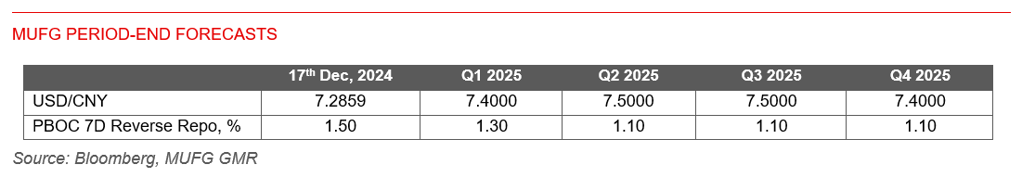

- In last week’s Politburo meeting and Central Economic Work Conference, the government sent a strong pledge to stimulate growth. This set of weak numbers would push government to front load the issuance of bonds scheduled for next year and PBoC to cut policy rates soon. We expect additional 40bps cut on PBOC’s 7-day reverse repo rate, instead of previous estimation of 20bps cut for 2025.

- November retail sales brought negative surprise, after the positive surprise it delivered for October. If adjusted for the one-off factors, November retail sales growth can be read as at its “normal” and subdued level.

- For USD/CNY, risks remain on both sides in near term. One key focus in near term would be Chinese government’s policy stimulus, it would provide tailwinds for the currency. Conversely, worsening yield spread, and the expectation of an incoming phased US’s tariffs increase on China’s products would bring headwinds to the currency, as we are approaching the inauguration date of Trump. Net, we expect USD/CNY to reach 7.40 by 1Q2025. (link)

Headline CPI inflation edged lower again in November