Key Points

Please click on download PDF above for full report

- A mixed set of April key macro indicators. Industrial production outperformed investment in April, domestic consumption was still on the recovery track however expanding at a slow pace, judging by small sequential improvement of retail sales.

- Exports were good in April, continuing playing an important role in China's economic recovery. However, trade environment has been under pressure recently, adding uncertainty to exports in the second half of the year.

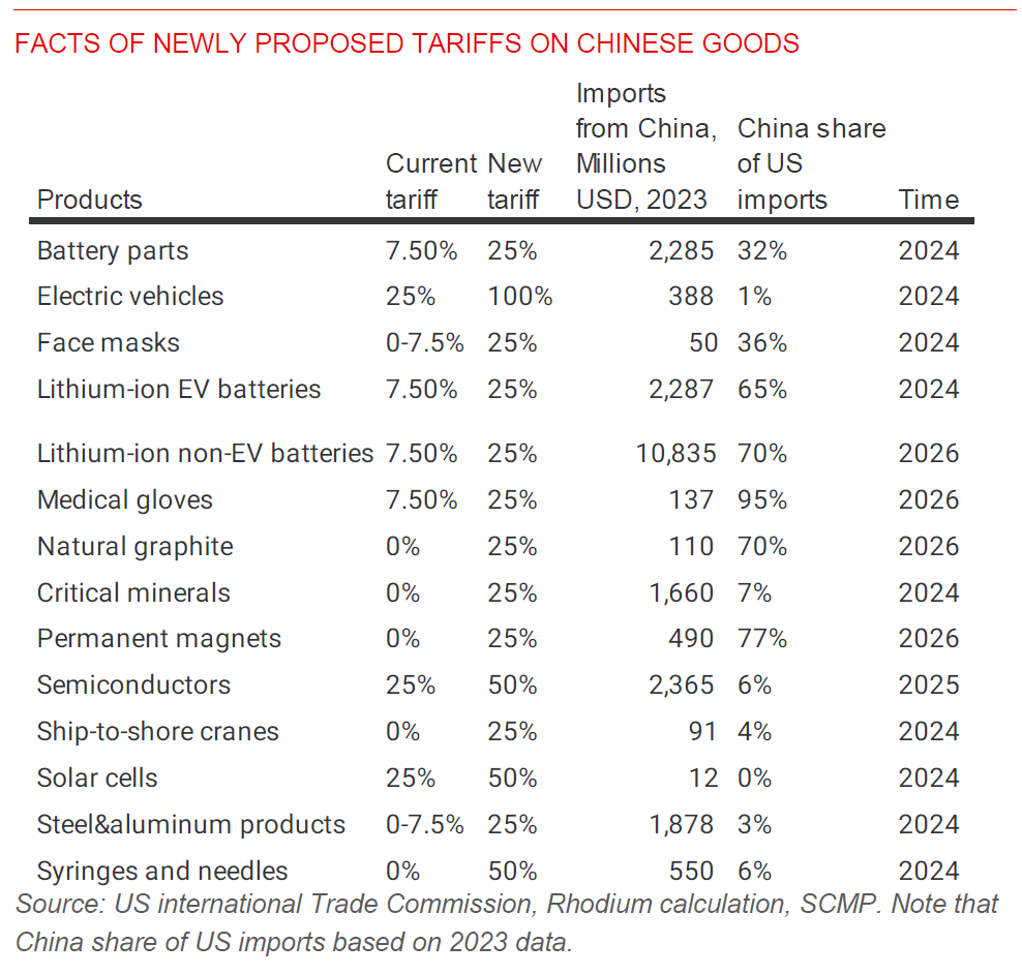

- We think that the overall impact of Biden’s tariff hikes on China’s exports is small, with varying impact for sectors:1) the USD18 billion US imports from China, on which higher tariffs are to be levied, only accounts for 4.2% of US’ total imports from China in 2023, and for about 0.53% of China’s total exports in 2023; 2) on a relative basis, China’s batteries and battery parts are to be impacted most, but, the phased implementation of tariff hikes indicates that the impact is to be fully felt in 2026, as the tariff hike on lithium-ion non EVs battery (USD10.84 billion) will happen in 2026; 3) the impact on China’s EV sector is minimal, despite the steep tariff hike from 25% to 100%, as US barely imports EVs from China. Having said it, with only half year to the US election in November, the risks of US politicians “de-China” campaign getting stronger are here, especially on China trade issues.

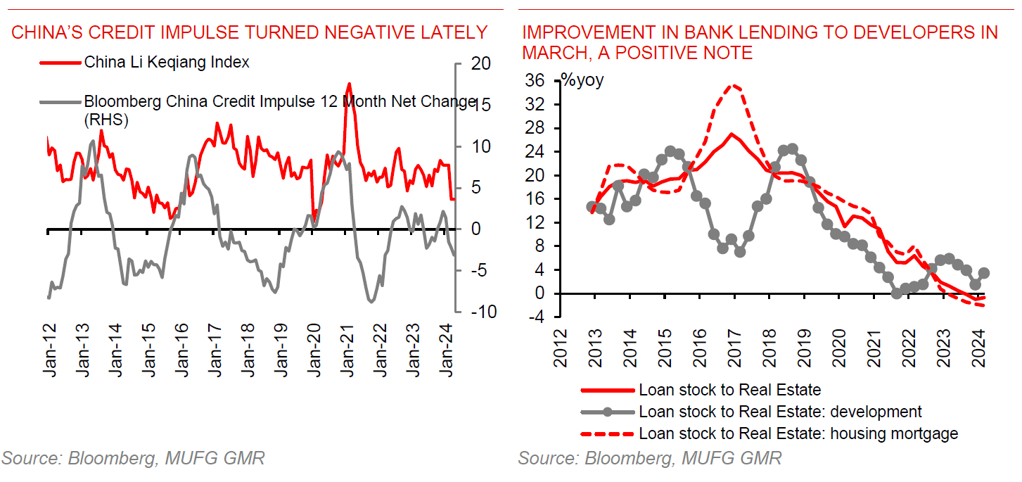

- Property market still not yet stabilized with a sequential contraction and large year-over-year decline in sector’s major activity indicators in April. Growth of year-to-date property investment decelerated to -9.8%yoy, and growth of year-to-date property sales decelerated to -28.3%yoy in April, while growth of year-to-date floor-space-started was -24.6%yoy. China’s home price continued to decline in April for both new home and used home prices. The area of real estate for sale nationwide reached 746 million square meters.

- Positive real estate policies were rolled out lately, in three main aspects: 1) promote "housing delivery"; 2) promote "destocking"; 3) introduce measures to properly dispose and revitalize of idle land. The minimum down payment for first home is reduced to 15% and to 25% for second home. No minimum requirement for mortgage rates for first- and second home. PBOC proposed to set up RMB300 billion fund to support local state-owned enterprises to acquire completed but unsold commercial housing at a reasonable price and use them as for affordable housing. Government allows buyback and transferring idle land to help alleviate developers’ difficulties and debt.

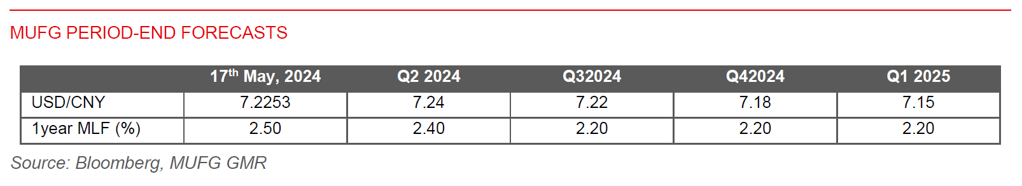

- While still debates on the necessary size of capital for destocking and details for achieving desirable outcomes, recent comprehensive property policies show government’s strong aim to revitalize the economy. With also stronger fiscal support in Q3 and onward, China likely delivers a GDP growth of 4.8% for 2024, which likely provides support for the currency. Considering the potential further tension between US and China, especially on trade side, we expect only a modest appreciation of CNY against the US dollar by the end of this year (7.18 for USD/CNY).