All eyes on NFP report & Gilt market fall out

USD: Did pick-up in US employment growth continue in October?

The major foreign exchange rates have remained stable during the Asian trading session ahead of the release later today of the latest nonfarm payrolls report for October. The US dollar has strengthened significantly since the last blowout payroll report was released in early October that revealed the US economy added 254k jobs in September and the unemployment rate declined by -0.1 percentage point to 4.1%. The unexpected strength of the US labour market has since contributed to the hawkish repricing of Fed rate cut expectations alongside the rising probability of Donald trump winning the US election and the Republicans taking control of Congress. The 2-year and 10-year US Treasury yields have since risen by around 40-45 bps from prior to the release of the September nonfarm payrolls on 4th October. The hawkish repricing that has already taken place over the past month creates a higher hurdle for US yields and the US dollar to strengthen further on the back of today’s nonfarm payrolls report especially given the close proximity of the US election. With the outcome of the US election pivotal for US dollar performance heading into year end, market participants are likely to be wary of adding to positioning based on the back of today’s nonfarm payrolls report unless there is big upside or downside surprise.

The consensus expectation going into today’s nonfarm payrolls report is for it to show employment growth slowed to 100k in October with the slowdown mainly driven by temporary disruption from strikes and Hurricane Milton. However, the latest ADP survey and initial claims reports have cast some doubt on the scale of the hit to employment growth. The ADP survey still estimated that private employment growth increased by 233k in October and the increase in initial claims in recent weeks was more modest than expected peaking at 260k. Looking beyond temporary distortions, the Fed will be trying to assess the underlying health of the labour market. Nonfarm employment growth has averaged around 200k/month over the last 9-12 months compared to 251/month in 2023. A bigger slowdown in employment growth has been more evident since Q1 at least until the unexpectedly strong pick-up in September. Today’s nonfarm payroll report could provide clearer evidence of whether the September pick-up was the start of a stronger period of employment growth or just a one-off. We are leaning more towards a one-off leaving the door open to further Fed rate cuts. Furthermore, the release yesterday of the latest US Employment Cost Index for Q3 provided encouragement for the Fed to keep lowering rates by highlighting that wage growth continues to slow. Wages and salaries increased by 0.8% in Q3 which was the weakest quarterly reading since Q2 2021.

MARKET REACTION FOLLOWING TRUSS MINI-BUDGET IN SEPTEMBER 2022

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Negative Gilt market reaction poses downside risk for pound

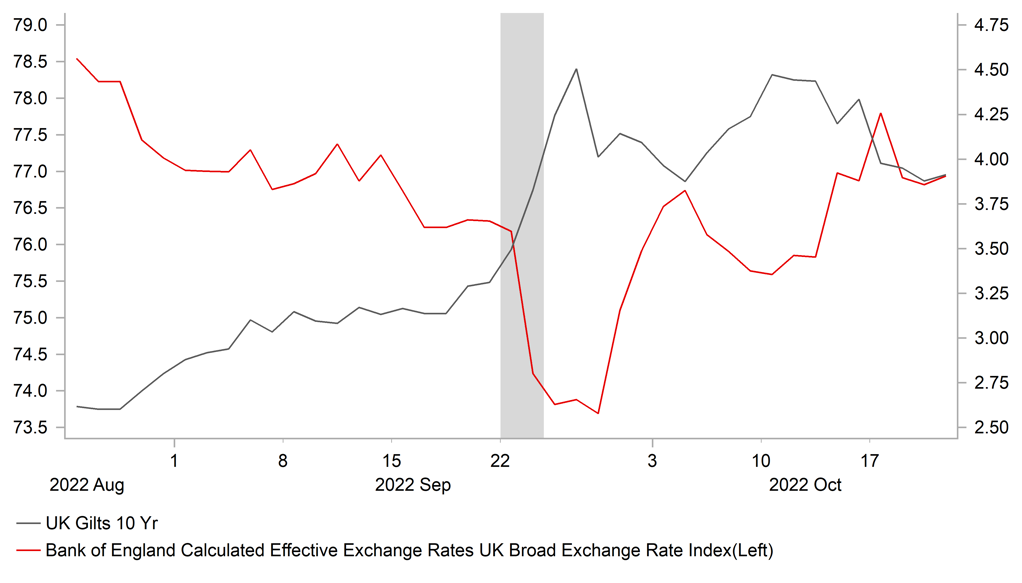

The pound has continued to trade at weaker levels overnight following yesterday’s sell-off. Cable has been trading close to the 1.2900-level and EUR/GBP has settled between 0.8400 and 0.8450. The negative market reaction to the details of the government’s Budget have triggered a modest weakening of the pound so far although it is still the best performing G10 currency this year. The pound has weakened by around -0.6% against the US dollar and by just over -1.0% against the euro since the details of the Budget were released on Wednesday. The bigger market reaction has been in the Gilt market where yields have risen sharply both at the short and long-end of the curve. The 2-year and 10-year Gilt yields have risen by around 25bps and 20bps respectively. The sell-off has drawn some comparisons to the negative market reaction following the September 2022 mini-Budget that brought down former Prime Minister Liz Truss. So far the negative market impact has been much more modest. On that occasion, the trade-weighted pound fell temporarily by around 3.5% while the 2-year and 10-year Gilt yields increased by 126bps and 120bps respectively. The Gilt sell-off would have to intensify further to trigger further weakness in the pound.

The negative market reaction to the Budget highlights that the Gilt market is uneasy over the need to absorb additional government borrowing. While the government stressed the need to fill a fiscal black hole of around GBP20 billion left by the previous government, the decision to raise sending by around GBP70 billion per year over the next five years which is only partially offset by tax rises of around GBP36 billion per year has raised doubts over their commitment to fiscal consolidation. The net result is that the government will now need to borrow around an additional GBP32 billion per year over the next five years. With around two thirds of the borrowing to cover day-to-day spending and only one third for capital investment. Upward pressure on Gilt yields also reflects the potential short-term boost to growth and inflation from additional front-loaded government spending. Market participants have become more wary over how much room the BoE will have to cut rates with the policy rate now expected to remain above 4.00% next year. We still expect the BoE to cut rates more than the market is expecting but the outlook for higher yields to remain in place for longer now could encourage a stronger pound when the Gilt market eventually settles down.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Manufacturing PMI |

Oct |

50.3 |

51.5 |

!!! |

|

US |

12:30 |

Average Hourly Earnings (MoM) |

Oct |

0.3% |

0.4% |

!!! |

|

US |

12:30 |

Nonfarm Payrolls |

Oct |

106K |

254K |

!!! |

|

US |

12:30 |

Unemployment Rate |

Oct |

4.1% |

4.1% |

!!! |

|

CA |

13:30 |

Manufacturing PMI |

Oct |

-- |

50.4 |

! |

|

US |

13:45 |

Manufacturing PMI |

Oct |

47.8 |

47.8 |

!!! |

|

US |

14:00 |

Construction Spending (MoM) |

Sep |

0.0% |

-0.1% |

!! |

|

US |

14:00 |

ISM Manufacturing PMI |

Oct |

47.6 |

47.2 |

!!! |

Source: Bloomberg