Powell comments provide some temporary relief for the US dollar

USD/JPY: Powell comments provide support for the US dollar

The US dollar has continued to trade at stronger levels overnight following relatively hawkish comments from Fed Chair Powell yesterday afternoon. It has helped to lift USD/JPY to an intra-day high of 144.47 up from yesterday’s low of 141.65. US dollar gains have been more modest against other G10 currencies. The US dollar has been supported by the scaling back of market expectations for another larger 50bps rate cut from the Fed at their next FOMC meeting on 7th November. The US rate market has moved to price in less than a 50:50 probability of a 50bp cut in November (currently pricing around 35bps of cuts). It follows comments from Fed Chair Powell which reiterated the message from the last FOMC meeting that the Fed is planning to deliver 25bps cuts at the remaining policy meetings this year in November and December. Fed Chair Powell emphasized that the September dot plot suggests that the Fed is “not in a hurry to cut rates quickly”, and that while it often becomes stale over time it is generally still a good guide to the Fed’s thinking a few weeks later. The comments indicate that further evidence of US labour market weakness will be required to encourage the Fed to deliver further larger 50bps rate cuts. He added that the labour data “may give us a better real time picture” of the economy’s trajectory than GDP. It follows the recent upward revisions to GDP and GDI data that at the margin have helped to reduce downside risks for the labour market. The comments will place even more focus on the release of the latest nonfarm payrolls report on Friday.

The rebound for USD/JPY has seen the pair move back closer to levels that were trading prior to the LDP leadership election on Friday when it was trading just below the 145.00-level. While the LDP leadership election results triggered a bout of yen volatility resulting in USD/JPY subsequently hitting a high of 146.49 and a low of 141.65, now that the dust has settled there has been no lasting impact. New Prime Minister Ishiba’s decision to call a snap election on 27th October is unlikely to significantly alter the timing of the BoJ’s plans for monetary policy. Governor Ueda at the last policy meeting stated that the BoJ is not in a rush to raise rates again as soon as at the next meeting on 31st October. We are sticking to our forecast for the next hike in December but acknowledge that the stronger yen and unstable financial market conditions could delay the timing into early next year. A message that was evident in the release overnight of the minutes from the last BoJ policy meeting at which board members expressed more caution. One of the board members emphasized that “when conducting further policy interest rate hikes, the bank will need to communicate its policy stance and other factors to markets more carefully”. One other board member added “uncertainties regarding Japan’s economy have heightened with growing downside risks to the global economy”. On the plus side, the release overnight of the latest TANKAN survey revealed a further improvement in business confidence in Q3. At the same time the inflation outlook at all enterprises over all time horizons out to five years ahead remained above the 2% threshold. The survey is supportive for further BoJ policy normalization.

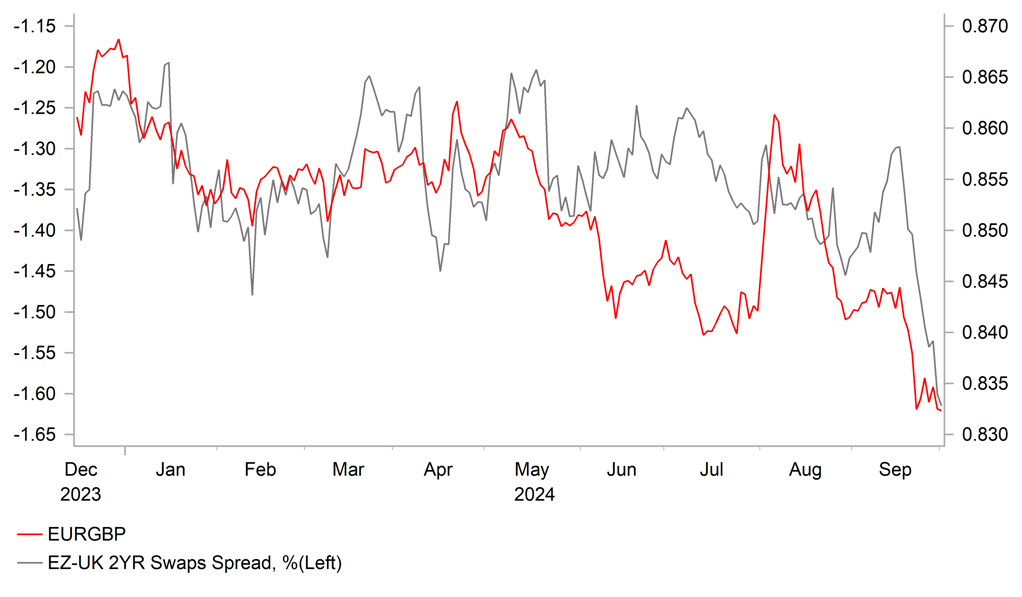

FASTER ECB RATE CUTS ARE ENCOURAGING LOWER EUR/GBP

Source: Bloomberg, Macrobond & MUFG GMR

EUR: President Lagarde provides green light for October rate cut

The euro has weakened ahead of the release this morning of the latest euro-zone CPI report for September. It has resulted in EUR/GBP moving to within touching distance of the 0.8300-level while EUR/USD has moved back closer to the 1.1100-level. The main driver of the euro specific weakness has been building expectations that the ECB will speed up the pace of rate cuts in response to the faster than expected slowdown in inflation. It follows the release of much weaker than expected inflation data from France and Spain. The release of the euro-zone CPI report this morning is expected to reveal that headline inflation fell below the ECB’s target to 1.8% in September. The national data revealed a step down in services inflation in France and Italy while it slowed only slightly in Germany.

The latest inflation data was welcomed by ECB President Lagarde who stated yesterday that “disinflation has accelerated in the last two months”. Importantly she added that it has given the ECB more confidence that their inflation goal will be met in a timely manner which they will take into the October policy meeting. We view the comments as giving a green light to market participants to more fully price in a back-to-back 25bps rate cut at the next policy meeting. While the ECB had previously indicated that they would like to wait to see more economic data for Q3 before cutting rates again, the scale of the downside inflation surprise in September appears to have provided justification to speed up their rate cut plans. We have brought forward our forecast for the next ECB rate cut to this month.

Faster ECB rate cuts provide an offset to the faster pace of Fed rate cuts and helps to dampen further upside for EUR/USD heading into year end. It is one reason why we expect the pair to consolidate within the current higher trading range between 1.1000 and 1.1500. On the other hand, China policy stimulus optimism is helping to prevent a bigger correction lower for EUR/USD. The bigger policy divergence is currently with the BoE who remain slower in cutting rates which is weighing on EUR/GBP.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

CPI (YoY) |

Sep |

1.8% |

2.2% |

!!! |

|

CA |

14:30 |

Manufacturing PMI |

Sep |

-- |

49.5 |

!! |

|

US |

14:45 |

Manufacturing PMI |

Sep |

47.0 |

47.9 |

!!! |

|

UK |

15:00 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Construction Spending (MoM) |

Aug |

0.2% |

-0.3% |

!! |

|

US |

15:00 |

ISM Manufacturing Employment |

Sep |

47.0 |

46.0 |

!! |

|

US |

15:00 |

JOLTS Job Openings |

Aug |

7.640M |

7.673M |

!!! |

|

US |

16:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

16:10 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

!! |

|

EC |

16:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

23:15 |

Fed Collins Speaks |

-- |

-- |

-- |

!! |

|

US |

23:15 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

23:15 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg