Relatively modest market reaction so far to US credit rating downgrade

JPY: Digesting the fallout from the BoJ’s YCC policy tweak

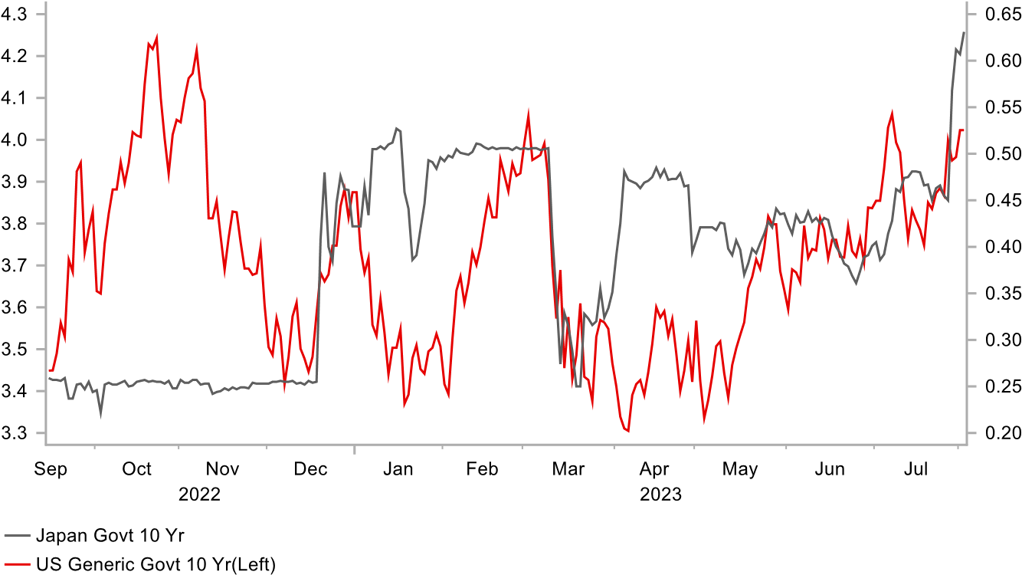

The yen has continued to re-weaken at the start of this week resulting in USD/JPY hitting an intra-day high yesterday at 143.55 as it moves further below above the low late last week at just above the 138.00-level set in the immediate aftermath the BoJ announcement that it was making YCC policy settings more flexible. The move higher in USD/JPY has been supported by the broad-based rebound for the US dollar. The dollar index has climbed back above the 102.00-level after threatening to break below the 100.00-level earlier this month. The rebound for US dollar has coincided with a move higher in long-term US yields with the 10-year Treasury yield currently attempting to break above 4.0%. The BoJ’s decision to allow the 10-year JGB yield to move above 0.5% and up towards 1.0% appears to have contributed towards some additional selling pressure at the long end of the US yield curve a well, while Fed policy expectations have remained more stable at the short end of the curve. The 10-year US Treasury yield has increased by around 20bps since speculation intensified over a shift in the BoJ’s policy settings late last week. A similar amount to the change in the 10-year JGB yield that hit a fresh high overnight at 0.63%.

Market participants are still digesting the change to the BoJ’s policy stance. Overnight Deputy Governor Shinichi Uchida commented on the BoJ’s recent actions when speaking to business leaders in the Chiba prefecture. He stated that the YCC policy tweak wasn’t a step toward an exit from the current loose policy stance. The YCC adjustment was to make it more flexible was made so the BoJ could continue with monetary easing. He emphasized that the BoJ was still a long way off from an exit strategy. In the interim he reiterated that the BoJ will contain excessive surge in the 10-year JGB yield via various market operation tools. In light of recent developments, our analysts in Tokyo now believe that the BoJ have started the process of removing YCC by first allowing greater flexibility for the 10-year JGB yield to move above 0.5%. A full removal of yield curve control could be phased in through the remainder of this year if 10-year JGB yield begins to stabilize below the new hard cap at 1.0%. The next step would then be for the BoJ to begin raising interest rates out of negative territory. Our Tokyo analysts are now forecasting the first rate hike from the BoJ in the 1H of next year (click here). The shift toward tighter BoJ policy supports our outlook for the yen to strengthen in the year ahead, although the recent YCC policy tweak has not been sufficient on its own to trigger a reversal of yen weakness in the near-term.

SPILLOVERS FROM BOJ YCC ADJUSTMENT INTO OTHER BOND MARKETS?

Source: Bloomberg, Macrobond & MUFG GMR

USD: US credit rating outlook sheds light on health of US public finances

The main event overnight was the decision by Fitch to downgrade the US sovereign credit rating that triggered a brief sell-off for the US dollar. The dollar index briefly dipped to an intra-day of 101.96 but the decline was quickly reversed. Fitch announced that it has lowered the US sovereign credit rating by one notch to AA+ from AAA repeating a similar move by S&P more than a decade ago. It now leaves only Moody’s that still rates the US as a top rated AAA credit that could raise a problem for any funds or index trackers with a AAA only mandate. US Treasury Secretary Yellen was quick to downplay the announcement stating that it was “arbitrary” and “outdated”…and ”does not change what Americans, investors, and people all around the world already know: that Treasury securities remain the world’s preeminent safe and liquid asset, and that the American economy is fundamentally strong”.

When S&P downgraded the US credit rating in August 2011 it triggered a sharp selloff in risk assets and boosted safe haven demand for US Treasuries. The US dollar reaction was more muted. On this occasion we are expecting the immediate market reaction to be relatively more modest. The timing of the downgrade was somewhat surprising although Fitch did warn back in May that they were weighing up lowering the credit rating. The announcement sheds more light on the health of the US public finances which we have already highlighted as a negative structural factor for US dollar performance over the medium to long-term. The US Treasury just announced on Monday that it has increased the net borrowing estimate for Q3 to USD1 trillion which is well above the USD733 billion it had predicted back in May. The Treasury is due to preview its quarterly financing plans later today.

In the accompanying policy statement, Fitch outlined that it had decided to lower the US credit rating to reflect “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘A’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit stand offs and last-minute resolutions”. Fitch expects the general government deficit to rise to 6.3% of GDP in 2023 from 3.7% in 2022. State and local governments are also expected to run a deficit of 0.6% of GDP this year. It then expects the general government deficit to remain elevated at 6.6% of GDP ahead of next year’s Presidential elections. As a result the general government debt ratio is expected to raise from 112.9% of GDP this year up to 118.4% by 2025.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

SECO Consumer Climate |

Q3 |

-- |

-13 |

!! |

|

SZ |

08:30 |

procure.ch PMI |

Jul |

44.0 |

44.9 |

!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Jul |

189K |

497K |

!!! |

Source: Bloomberg