USD to strengthen further at start of Trump’s 2nd term as president

USD: Room to strengthen further during 1H of this year

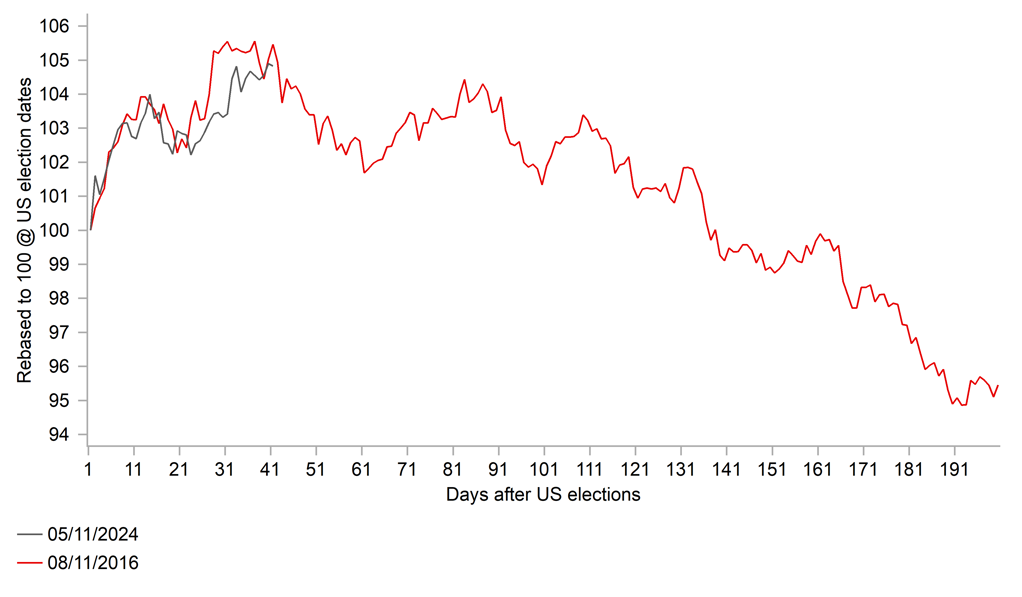

The US dollar continues to trade on a stronger footing at the start of the new calendar year in anticipation that policies implemented at the start of Trump’s second term as president will be supportive for a stronger US dollar. The inauguration of Donald Trump as the 47th president of the United States will take place on 20th January. The dollar index has already strengthened sharply by almost 5% since the US election on 5th November. US dollar gains have been broad-based since the US election. The worst performing G10 currencies have been the Australian and New Zealand dollars, and the worst performing emerging market currencies have been the Russian rouble, South African rand, and Brazilian real. The price action for the dollar index has been similar so far to following the first US election victory for Donald Trump at the end of 2016 when it also increased by just over 5%. On that occasion the dollar index peaked right at the start of Trump’s first year in power on 3rd January 2017 before trending lower throughout the first nine months of the year. However, we do not expect history to repeat at the start of Trump’s second term as president. The weaker US dollar at the start of Trump’s first term as president was encouraged by stronger global growth. According to the IMF, World GDP picked up to 3.8% in 2017 from 3.3% in 2016. In contrast, World GDP growth is expected remain weaker in the year ahead expanding at a similar pace to in recent years at around 3.2%. Another major difference at the start of Trump’s second term as president is that he has already indicated that he will take action sooner to implement tariffs against major trading partners having already threatened to impose higher tariffs on China, Canada and Mexico at the start of this year unless they take action to tighten border controls to restrict the access of illegal immigrants and drugs into the US. While we don’t expect 25% tariffs to imposed on all goods imported from Canada and Mexico, it is likely that tariffs will be hiked by a further 10% on imports from China. More front-loaded tariff hikes support our forecast for the US dollar to strengthen further during the first half of this year (click here).

The recent hawkish policy shift from the Fed provides another tailwind for US dollar strength at the start of this year. At the last FOMC meeting in December, the Fed sent a clear signal that they will be a lot more cautious over delivering further rate cuts this year even as there was encouraging evidence that underlying inflation pressures eased in November when the core PCE deflator increased by just 0.1%M/M. The Fed is now planning only 2 further rate cuts this year which highlights that FOMC participants are already taking into consideration that Trump’s plans for higher tariffs, tighter immigration and maintaining loose fiscal policy pose upside risks to the US inflation outlook. The Fed is likely to leave rates on hold at the next FOMC meeting in January, and there is a risk that the Fed could keep rates on hold for longer beyond March. In contrast, the other major central banks of the ECB, BoE and PBoC are all expected to keep cutting rates potentially creating a wider policy divergence in the near-term that is encouraging an even stronger US dollar.

USD PERFORMANCE (DXY) HAS BEEN FOLLOWING 2016 ELECTION IMPACT

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Upward momentum for USD/JPY slows as moves closer to 160.00-level

The yen has been recovering some lost ground at the start of the new calendar year resulting in USD/JPY dropping back towards 156.50 overnight after hitting a high of 158.08 on 26th December. The pair has struggled to break above resistance at the 158.00-level in recent weeks. The price action also coincides with US yields losing some upward momentum. The 2-year US Treasury yield failed to break above resistance from the 200-day moving average that comes in at around 4.35% and has dropped back towards 4.20%, while the 10-year US Treasury yield has run into resistance at around 4.60%.

Japanese officials will welcome the loss of upward momentum for USD/JPY after expressing more concern over yen weakness over the holiday period as the pair moves back closer to last year’s highs at just above the 160.00-level. While verbal intervention is never likely to reverse the yen weakening trend on its own, it has helped to at least temporarily slow the pace of the yen’s decline. If the yen continues to weaken it could also increase pressure on the BoJ to hike rates sooner this year in January rather than wait until March as indicated by Governor Ueda at last month’s policy meeting. The Japan Times is running a report today stating that the BoJ is expected to raise rates two or three times this year possibly taking the policy rate up to 1.00% for the first time in three decades according to economists in Japan. A Market News report released at the end of last year raised some doubts on the willingness of the BoJ to hike rates as far as 1.00%. MNI reported that officials at the BoJ fear that the real neutral rate of interest could be even lower than the previously-estimated range of -1.00% to +0.5%. The report states that the BoJ’s former estimate of the neutral rate was only based on data until the first quarter of 2023. Overall, the BoJ’s continued caution over raising rates further will continue to encourage speculative selling of the yen especially while the Fed has become more reluctant over cutting rates further.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Nov |

3.5% |

3.4% |

! |

|

EC |

09:00 |

Manufacturing PMI |

Dec |

45.2 |

45.2 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Dec |

47.3 |

48.0 |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

222K |

219K |

!!! |

|

CA |

14:30 |

Manufacturing PMI |

Dec |

51.9 |

52.0 |

! |

|

US |

14:45 |

Manufacturing PMI |

Dec |

48.3 |

49.7 |

!!! |

Source: Bloomberg