US yields weighed by geopolitics and data

USD: Risk aversion picks up with Middle East focus

The US dollar has rebounded with US Treasury bond yields declining and the yen and to a lesser degree the Swiss franc outperforming. This was your typical G10 FX performance reflecting increased risk aversion with the escalation of the conflict in the Middle East in focus. The intensification of Israel’s attacks in Lebanon and reported ground incursions prompted retaliation by Iran with around 200 missiles fired on Israel. This has obviously raised the risk of escalation in the region with Israel promising retaliation. The question now is will this be something like a repeat of what happened in April with the firing of missiles by Iran a one-off, face-saving symbolic act rather than the start of something more sustained. How Israel responds against Iran will be possibly important in determining that. Our research team in the Middle East remain of the view that there is very little appetite on the part of Iran to seriously escalate any conflict. Of much greater strategic importance for Iran is advancing its nuclear program as the best option to safeguard the survival of the current regime. So we remain sceptical of there being any serious further escalation to the conflict that turns this into a wider Middle East war. Crude oil market participants have understandably built in some risk premium related to these unfolding events with Brent crude oil jumping over 5% from the intra-day low yesterday before the concerns over Iran escalating the conflict emerged. It is important to remember that for Iran the primary goal is the survival of the regime and hence ballistic missile attacks from Iran are unlikely to deter Israel’s goals in Lebanon and Gaza. Also, while Iran’s crude oil production is not insignificant, it is relatively small on a global scale with production of around 3mn b/day in contrast to the global supply of about 100mn b/day.

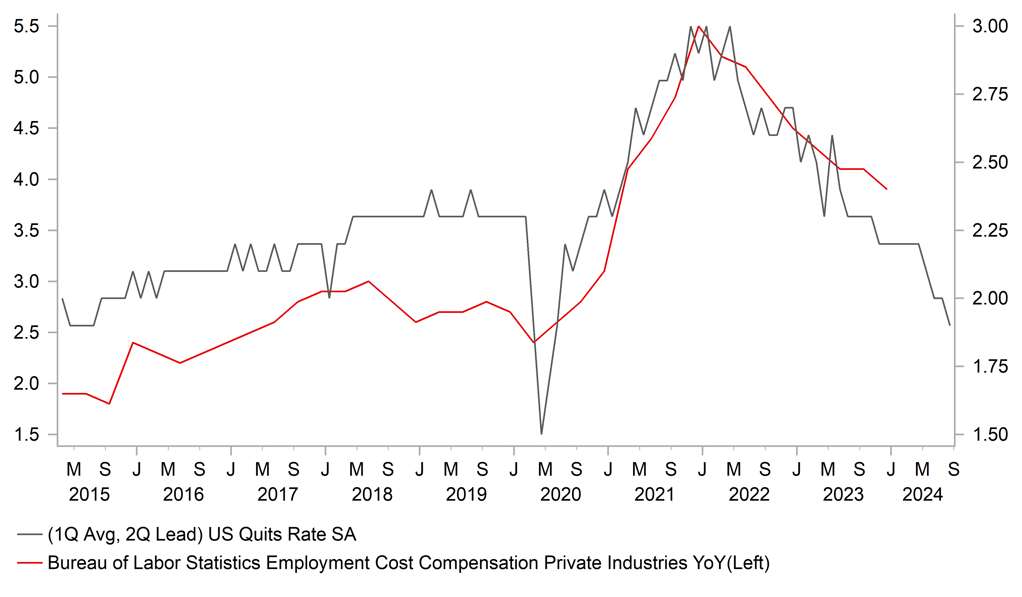

US Treasury bond yields were also pressured lower by the incoming economic data which overall was on the weaker side. The JOLTS data revealed a pick-up in job opening from 7711k in July to 8040k in August. Job openings have stabilised around the 8000k level, which is a little higher than the pre-covid peak. But the key Quits Rate declined once again to 1.9%, a new post-covid low and the lowest level since July 2015 when the covid-period is ignored. That’s compelling evidence of the direction of wage growth going forward, as can be seen in the chart. Coupled with the ISM Prices Paid Index falling sharply from 54.0 to 48.3 in September the data certainly will further ease concerns over inflation risks amongst FOMC members.

We released our monthly Foreign Exchange Outlook yesterday (here) and we show limited further US dollar weakness through the remainder of the year. Geopolitical risks escalating (like now) along with risks of US hard landing fears, global growth uncertainties and monetary easing outside the US will all act to limit the appetite for further dollar selling. Our DXY-related forecasts imply just a 1.0% drop in DXY by year-end.

US QUITS RATE FALLS TO NEW POST-COVID LOW POINTING TO A FURTHER EASING IN GROWTH OF WAGES

Source: Macrobond & Bloomberg

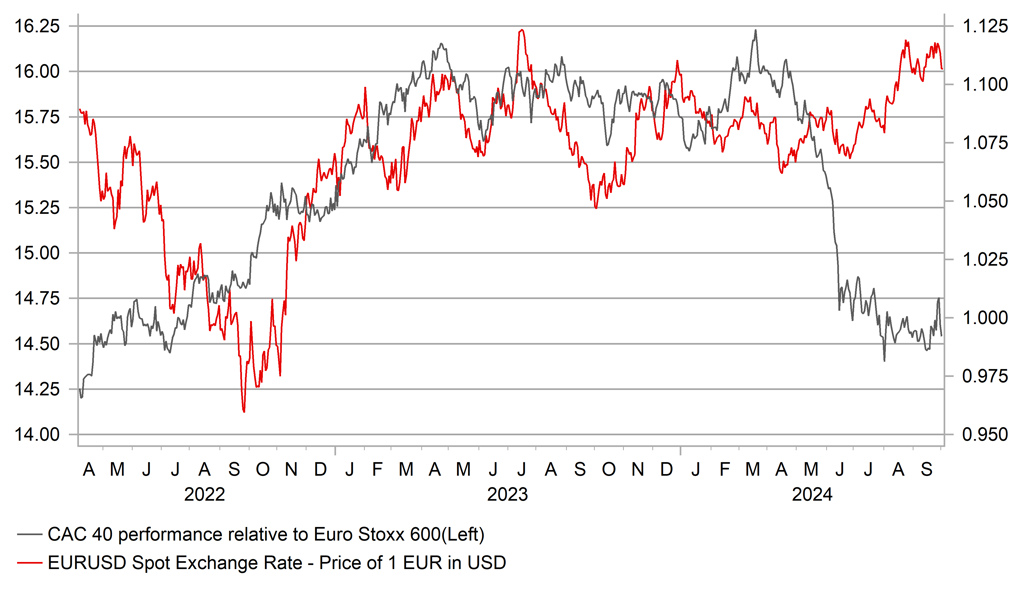

EUR: Imminent risk from France has receded

The euro weakened yesterday mainly due to the broader US dollar rally due to the increased risk aversion on Middle East risks but we did have a much-anticipated 90-minute speech from Prime Minister Michel Barnier in France which provided the markets with some initial detail over the plans for bringing the French budget back under control and the government’s general plans for the parliament. Barnier announced a two-year extension to getting the deficit back to the 3.0% EU limit from 2027 to 2029. This will allow for Barnier to present a budget that is not as aggressive in cutting the budget deficit and will therefore be more likely to get passed through parliament. The projection now is to reduce the budget deficit from over 6% this year to 5% next year. Two-thirds of this decline will come from spending cuts and the rest from tax increases on wealthy individuals and companies recording “significant profits”.

The mix of ways to get the budget down, skewed toward spending cuts, will anger the left but will be more palatable for the right and for RN specifically. RN is the largest single party in parliament and therefore it makes sense to lean more toward garnering its support. The left is likely to oppose the budget and attempt to bring down the government but Marine Le Pen has suggested her party would not support such a motion providing scope for the government to get a budget approved. This makes sense and RN’s ultimate goal is likely to show the country that the parliament of France can function without collapse when RN is the largest single political party. The biggest prize of all is the presidency in 2027 and that involves strengthening the credibility of RN which gives the chance of progress with a budget. Marine Le Pen thanked PM Barnier for the “respect” shown and promised time for the government to function. Barnier in his speech also promised to tighten immigration controls.

The full details of the budget will be revealed next week but the prospects of getting something approved look a little better than before the Barnier speech and this is reflected in the modest narrowing of the OAT/Bund spread from 80bps to 78bps. If the spread does remain contained through the budget process next week it will remove one near-term downside risk for euro.

CAC 40 HAS NOTABLY UNDERPERFORMED THE WIDER EURO STOXX MARKET ON ELEVATED POLITICAL UNCERTAINTY

Source: Bloomberg & MUFG Research

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

IT |

09:00 |

Italian Monthly Unemployment Rate |

Aug |

6.5% |

6.5% |

! |

|

EC |

10:00 |

Unemployment Rate |

Aug |

6.4% |

6.4% |

! |

|

UK |

10:30 |

BoE FPC Meeting Minutes |

-- |

-- |

-- |

! |

|

EC |

10:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

12:00 |

Dallas Fed PCE |

Aug |

-- |

1.70% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

11.0% |

! |

|

EC |

12:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Sep |

124K |

99K |

!!!! |

|

SZ |

14:00 |

SNB Quarterly Bulletin |

-- |

-- |

-- |

! |

|

UK |

15:00 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

US |

16:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:15 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

EC |

17:45 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg