US inflation eases with FOMC focus now on jobs data

USD: Weak payrolls needed for FOMC to cut 50bps

The debate on whether the FOMC should cut by 25 or 50bps could well become clearer by the end of the week when we get the non-farm payrolls data for August. There are plenty of economic indicators that point to a weakening labour market and if that is confirmed by a lower than expected print on Friday, it will likely trigger another big rates and dollar move given the OIS market pricing is currently well short of pricing in a 50bps cut at the meeting on 18th September.

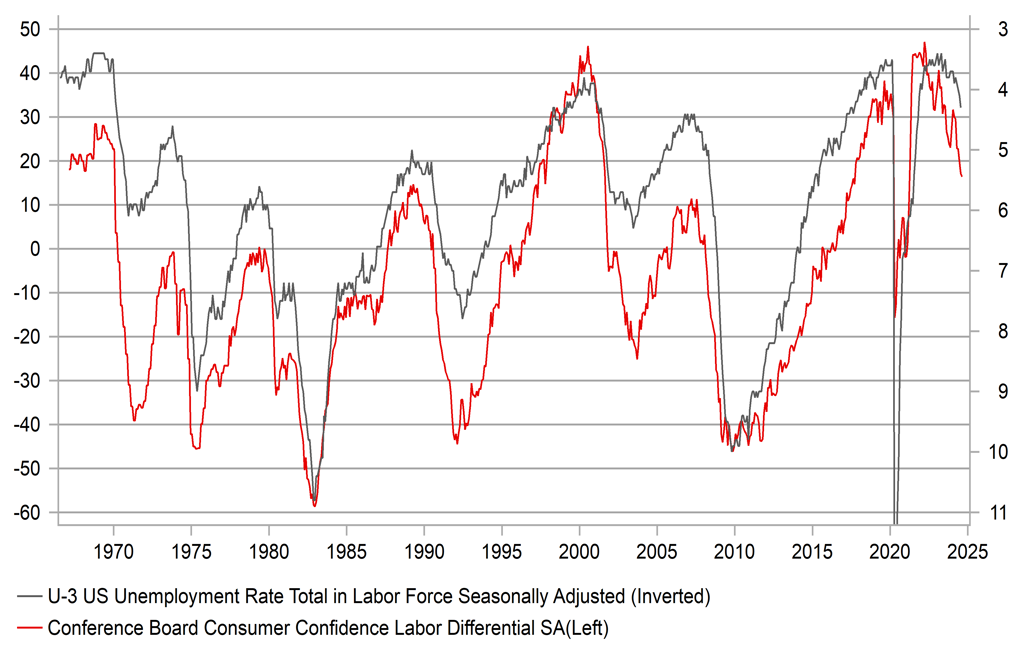

Last week the consumer confidence data revealed an upturn in confidence but despite this the jobs index worsened and further underlined the prospect of the unemployment rate continuing to drift higher. The Fed’s thinking on the labour market certainly seems to have shifted (based on the tone of Powell’s comments at Jackson Hole) following the benchmark revision of the NFP data that revealed a 818k downward revision to payrolls in the year to March 2024 – the second largest on record. That data may harden the Fed’s view on the unemployment rate rising and average hourly earnings growth slowing. Both of those indicators haven’t changed due to the NFP revision but will likely alter the Fed’s projections of labour market spare capacity that may shape the Summary of Economic Projections (SEP) to be released at the September meeting.

In the last SEP release in June, which would have been based in part on the non-farm payrolls data that we now know was over-stating employment growth by an average of 68k per month, the unemployment rate was forecast to be at 4.0% in Q4 2024 and the core PCE inflation at 2.8% which we can now see is overdone. The core PCE inflation on Friday for July came in at 2.7% while the unemployment rate is already at 4.3%. Average hourly earnings growth for July fell to 3.6% YoY, close to the 3.5% roughly consistent with price stability. So another weak print on Friday could see even bigger revisions to the SEPs on 18th September that could compel the FOMC to cut by 50bps. So the jobs report on Friday will be crucial in shaping those expectations.

Ahead of Friday we will get plenty of the other labour market indicators (ISM employment indices; JOLTS; Challenger; ADP) so those data points will shape expectations into the payrolls on Friday. If weaker than expected you would expect yields to drift lower to better price the risk of 50bps. Our bias this week is for the dollar to weaken back again given we see a bigger risk of a 50bp cut than currently implied by OIS pricing. Our payroll's forecasting model which uses the latest estimations of seasonal and trend components of the series, predicts surprise to the downside in the august payrolls report.

CONSUMER CONFIDENCE JOBS INDEX POINTS TO RISING UNEMPLOYMENT

Source: Macrobond & Bloomberg

EUR: Political weakness at the heart of Europe

As is happening in France with the extremes on the left and right of the political spectrum taking a larger proportion of votes in the parliamentary elections, this weekend saw a similar pattern in two regional elections in Germany yesterday. AfD is on course to win 32.8% in the state of Thuringia and marks the first win for a far-right party since World War II. The CDU/CSU was a second with 23.6% of the vote. It was the other way around in Saxony with the AfD falling short with 30.6% of the vote while the CDU/CSU won a slightly larger share with 31.9%. The SPD did appallingly bad winning just 6.1% in Thuringia, the worst result in postwar Germany while both the Greens and the FDP both fell below the 5% threshold required in order to be represented in the state parliament.

The evidence of disaffection was highlighted by the surge in popularity on the left as well with a new far-left party BSW winning 15.8% of the vote in Thuringia and 11.8% in Saxony. Given the performance of the two extreme parties it is clear that Germany is heading slowly toward the very same political outcome as in France – political gridlock. AfD will not be in a position to govern in Thuringia given all other parties have stated they would not enter a coalition with AfD which mean the CDU/CSU would be required to consider governing with other parties including the far-left party BSW. BSW are more supportive of Russia and are calling for a change in policy on Ukraine.

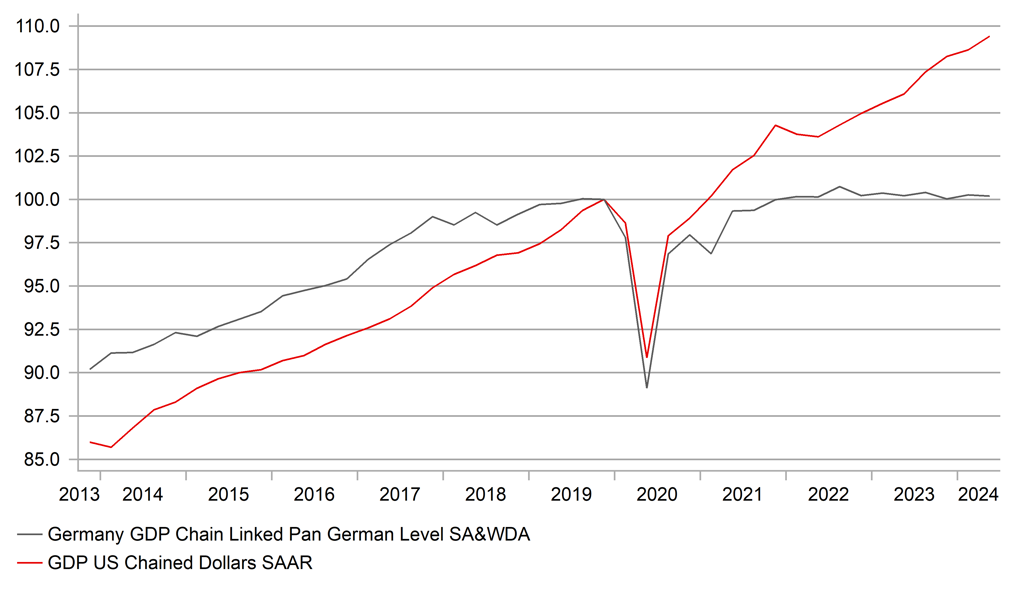

The next general election is scheduled for autumn 2025 and based on these results it seems difficult to see a strong government emerging. Given the similar scenario in France, the political backdrop in the euro-zone has never been as bad since the single currency emerged. Weak GDP growth in Germany for a sustained period is at the heart of voter anger. Five of the last ten quarters for GDP growth has seen a contraction. Incredibly, Germany’s economy is a mere 0.2% larger than in Q4 2019 ahead of the covid pandemic. In the US, real GDP is 9.4% larger over the same period.

We will be releasing our monthly Foreign Exchange Outlook this afternoon and we will be showing a weaker US dollar forecast profile but the mixed global economic backdrop – commodity prices are down 10% since May, the elevated geopolitical risks and the complete political gridlock at the heart of the euro-zone all point to reasons to remain cautious over the extent to which the dollar will weaken going forward.

US VERSUS GERMAN REAL GDP – REBASED Q4 2019

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

KOF Leading Indicators |

Aug |

100.6 |

101.0 |

!! |

|

EC |

08:05 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

EC |

08:35 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

! |

|

GE |

08:55 |

German Unemployment Change |

Aug |

17K |

18K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Aug |

6.0% |

6.0% |

!! |

|

NO |

09:00 |

Unemployment Change |

Aug |

-- |

76.57K |

! |

|

UK |

09:30 |

BoE Consumer Credit |

Jul |

1.300B |

1.162B |

! |

|

UK |

09:30 |

M4 Money Supply (MoM) |

Jul |

0.5% |

0.5% |

! |

|

UK |

09:30 |

Mortgage Approvals |

Jul |

61.00K |

59.98K |

! |

|

IT |

10:00 |

Italian HICP (MoM) |

Aug |

0.0% |

-0.9% |

!! |

|

IT |

10:00 |

Italian HICP (YoY) |

Aug |

1.3% |

1.6% |

!! |

|

EC |

10:00 |

Core CPI (YoY) |

Aug |

2.8% |

2.9% |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Aug |

2.2% |

2.6% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

Aug |

-- |

0.0% |

!!! |

|

EC |

10:00 |

Unemployment Rate |

Jul |

6.5% |

6.5% |

! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Jul |

2.7% |

2.6% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Jul |

0.2% |

0.2% |

!!!! |

|

US |

13:30 |

Personal Spending (MoM) |

Jul |

0.5% |

0.3% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Jun |

0.1% |

0.2% |

!! |

|

CA |

13:30 |

GDP Annualized (QoQ) |

Q2 |

1.6% |

1.7% |

!! |

|

US |

14:45 |

Chicago PMI |

Aug |

45.0 |

45.3 |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Aug |

2.9% |

2.9% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Aug |

3.0% |

3.0% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Aug |

67.8 |

66.4 |

!! |

Source: Bloomberg