Will BoE follow ECB & Fed by signaling close to end of hiking cycle?

JPY: US downgrade hasn’t prevented USD/JPY from continuing to rebound

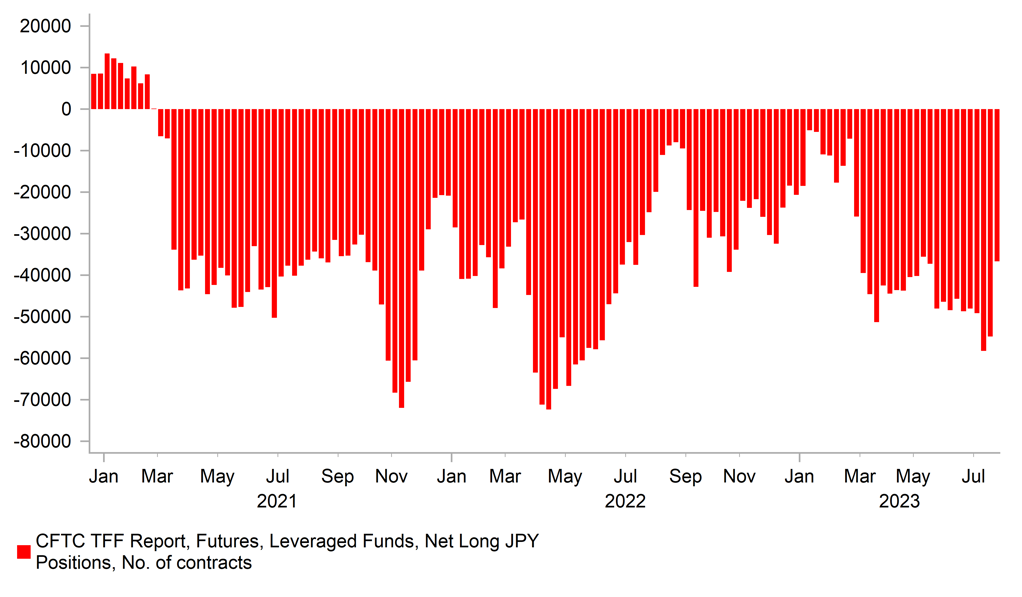

The yen weakened further overnight resulting in USD/JPY rising up closer to the 144.00-level. The yen sell-off was reinforced overnight by the announcement from the BoJ that it has intervened in the JGB market for the second time this week to dampen the pace of the move higher in yields. The BoJ announced an unscheduled operation to purchase JPY400 billion of JGBs across various maturities after the yield on the 10-year JGB hit a fresh high overnight at 0.66%. When the BoJ announced the shift to more flexible yield curve control (YCC) policy settings, the updated guidance did signal that the BoJ would “nimbly” conduct market operations when the 10-year JGB was trading between 0.5% and the new hard cap at 1.0%. In this respect the decision by the BoJ to step back into the JGB market should not be a surprise although market participants were likely anticipating that the BoJ would not step back in so soon having already done so on two occasions this week as yields have moved higher beyond 0.5%. The BoJ’s actions this week alongside the dovish commitment last week to maintain low rates until they are more confident that inflation can be sustained at their 2.0% target has encouraged market participants to rebuild short yen positions in the near-term after they were scaled back towards the end of last month.

The move higher in USD/JPY is also being supported by the broad-based rebound in the US dollar. The dollar index has extended its recent rebound overnight moving back closer to the 103.00-level. It has now rebounded by just over 3% since hitting a year to date low in the middle of July. The US dollar is deriving more support in the near-term from the move higher in long-term US yields. The 10-year US Treasury yield has continued to move higher alongside 10-year JGB yields after the BoJ made YCC policy settings more flexible, and hit a fresh high overnight at 4.14%. Fitch’s decision to downgrade the US sovereign credit rating did trigger more risk-off trading conditions yesterday with global equity markets falling by between 1.0 and 2.0%, but it failed to prevent long-term US Treasury yields from continuing to move higher. It was the high beta currencies such as the G10 commodity currencies that were hit hardest by the deterioration in global investor risk sentiment. The main economic data release yesterday was the ADP survey that has raised expectations for another strong US employment report on Friday supporting US yields and the US dollar. The ADP survey estimated that private employment likely increased by 324k in July. While we acknowledge upside risks, we still expect to see more evidence that employment growth has slowed this year in tomorrow’s NFP report.

YEN SHORTS HAD BEEN CUT BACK IN LATE JULY

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Will BoE disappoint expectations for more aggressive rate hikes?

The main event today will be the BoE’s latest policy update. The pound has come under some modest selling pressure ahead of today’s MPC meeting undermined in part by the deterioration in global investor risk sentiment triggered by the US credit rating downgrade and ongoing move higher in long-term yields. It has resulted in cable falling to an intra-day low yesterday of 1.2681 while EUR/GBP has risen back above the 0.8600-level. The bigger move in cable is mainly driven though by the stronger US dollar leg rather by pound specific weakness.

The pound has lost some upward momentum in recent weeks as well after the release of the weaker UK CPI report for June and latest UK labour market report that have helped to dampen expectations for more aggressive BoE rate hikes going forward. UK rate market expectations for the terminal rate in the tightening cycle have dropped back sharply from around 6.50% in early July to around 5.75% at present. It has made market participants less confident that the BoE will deliver back to back 50bps hikes at today’s policy meeting. The UK rate market is currently pricing in around 34bps of hikes for today’s meeting. We are expecting he BoE to revert back to delivering a more normal 25bps today although acknowledge that another larger 50bps hike can’t be ruled out depending on the updated MPR forecasts. If the BoE raises rates by 25bps as we expect today then it will trigger some initial disappointment and pound selling. The initial sell-off could be dampened by the BoE continuing to send a hawkish signal that it is prepared to hike rates further in response to fears over more persistent inflation in the UK. The BoE’s forecasts for wage growth are expected to be revised materially higher in today’s Monetary Policy Report. Unlike the ECB and Fed we do not expect the BoE to signal that they are close to the end of their cycle.

At the same time, there is some speculation that the BoE will announce updated plans for quantitative tightening at today’s policy meeting. The BoE halted reinvestments of its maturing gilts and has been actively selling gilts since September targeting a GBP80 billion annual reduction in their QE portfolio. Of which around GBP40 billion is due to maturing bonds rolling off and GBP40 billion are active sales. The BoE is expected to announce a higher target for the next twelve months from October 2023 to September 2024 as more gilts totalling GBP50 billion are set to mature in the next twelve months. It could offer some modest support for the pound if the BoE steps up active sales as well.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Services PMI |

Jul |

51.1 |

52.0 |

!! |

|

UK |

09:30 |

Services PMI |

Jul |

51.5 |

53.7 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Jun |

-3.1% |

-1.5% |

! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Aug |

5.25% |

5.00% |

!!! |

|

UK |

12:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:30 |

Challenger Job Cuts |

Jul |

-- |

40.709K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

227K |

221K |

!!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q2 |

2.6% |

4.2% |

!! |

|

UK |

14:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:45 |

Services PMI |

Jul |

52.4 |

54.4 |

!!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Jul |

57.2 |

59.2 |

! |

Source: Bloomberg