GBP & EUR suffer at the start of the new year

GBP: Growth concerns sees pound underperform

The pound was the worst performing G10 currency on the opening day of 2025, falling by 1.25% at one stage with fears over growth in Europe remaining a key focus for investors. Those fears were reinforced by the UK PMI manufacturing index which dropped more than estimated in the advance reading, to 47.0 – the lowest level since January last year. It was the fourth consecutive month of decline with the cumulative drop the largest since the decline in 2022 due to the energy price shock following Russia’s invasion of Ukraine.

The theme of energy price rises is again in focus and there has been another sharp rise in natural gas prices following the end of gas supplies running through Ukraine with Ukraine refusing to renew a transit contract with Russia that helps lift Russia’s revenues from energy sales. In addition to this, a natural gas plant in Norway (Hammerfest) halted operations due to a failure that will see operations halted until 9th January. Coming at the same time as the transit deal expiring and due to expected colder weather, natural gas prices have jumped. A weather forecaster in the UK predicted a colder than usual January for the UK, France, Germany and the Nordics combined with possible weaker winds which will mean increased demand for natural gas. Storage levels have dropped more quickly than in recent years and the estimated storage level for natural gas in Europe at around 72% is the lowest at this point of the year since 2021. The 1-month TTF natural gas price has jumped nearly 27% since the middle of December to reach the highest level since Q4 2023. The UK’s lack of storage capacity leaves it more vulnerable to market price moves and has increased fears over further utility price increases this year. The OFGEM price cap increased 1.2% on 1st January.

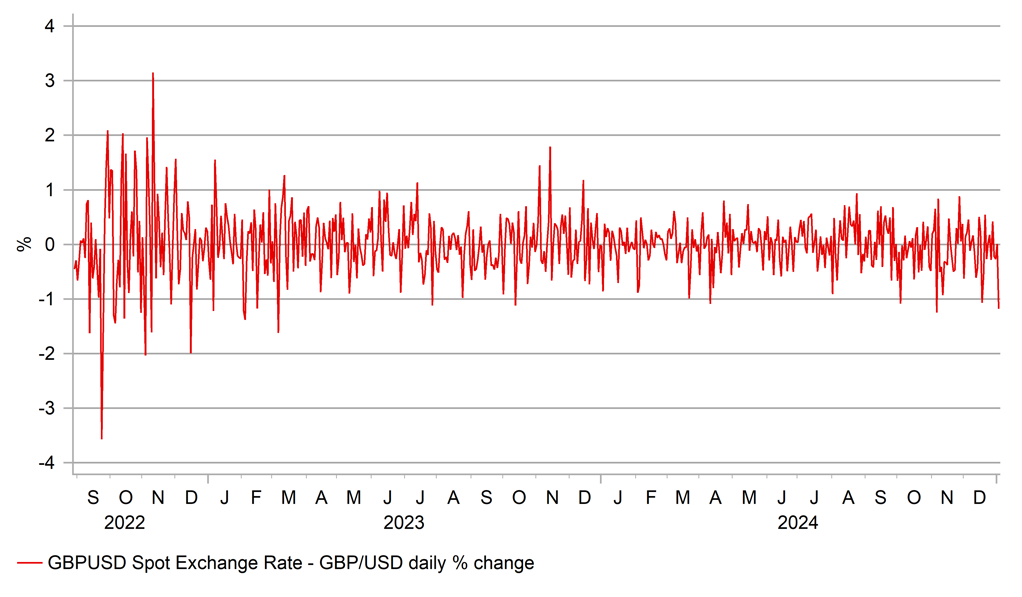

The drop in GBP/USD of 1.25% was the largest since the day Trump was confirmed as winning the election which was the largest drop since March 2023. Taking the retracement level from the low in 2023 to the high last year, GBP/USD yesterday broke through the 61.8% retracement level pointing to technical factors behind the move as well.

The disappointing PMI data and the increased fears over the economic impact of a renewed rise in natural gas prices saw the probability of a BoE rate cut in February increase modestly, by 3bps to 18bps implying nearly a 75% probability of a cut. We see a rate cut as likely at that meeting which should act to help business sentiment. We see the pricing for BoE rate cuts this year as too cautious and expect the BoE to cut by more which will likely see the pound underperform non-dollar currencies later in the year with the US dollar by then weakening more broadly.

BIGGEST DAILY % DROP IN GBP/USD SINCE TRUMP’S ELECTION WIN IN NOVEMBER

Source: Bloomberg, Macrobond & MUFG GMR; as of 1700 GMT 2nd Jan 2025

EUR: Drop indicates Trump could push EUR even lower

EUR/USD has dropped considerably since the end of September – nearly 10 big figures or around 9% - suggesting a lot of the bad news related to the policies of incoming President-elect Trump are well priced. There has been no rally, or squeeze of short euro positions into year-end that often is what you see which suggests positioning is not yet stretched and the renewed selling yesterday with EUR/USD down over 1.0% highlighting the fact that appetite remains strong and that tariffs and divergence expectations between the US and the euro-zone could fuel further EUR/USD selling over the coming weeks and potentially months.

A lot will depend on what comes over the next few weeks and in particular around inauguration on 20th January. While there has been limited signs of overstretched positioning through the turn of the year, any sense that Trump will not first focus on trade would likely see quite a notable reversal of US dollar strength – in a circumstance of trade tariffs not being announced on day one or in the day or two after would potentially see EUR/USD recover to around the 1.0500-level. We still see this scenario as unlikely and expect Trump to follow through on his word and act quickly.

Tax cuts via the extension of the Tax Cuts and Jobs Act of 2017 is another key plank of expectations of divergence in economic performance between the US and the euro-zone. For this to happen, Trump needs near-on 100% support from Republicans in the House given the slim Republican majority of 219 to 215. Today Congress will convene for the first time and its first task will be to select the House Speaker. Trump has thrown his support behind Mike Johnson and he is favourite to win. But one Republican has vowed to vote against meaning just one further Republican vote against would leave the vote tied and create problems. Still, the vote today will underline how tight the House majority is and potential issues for Trump going forward.

But for the US dollar this month it will be all about trade tariffs which Trump can implement independent of Congress. We expect day one announcements on China, Mexico, Canada and possibly Vietnam. Other countries will be hit quickly with investors sensing an aggressive approach that will likely boost the dollar further. Given the lack of year-end US dollar selling, a breach of parity in EUR/USD now looks likely with dollar strength persisting over the coming months as Trump at least meets market expectations with a risk of surpassing expectations initially.

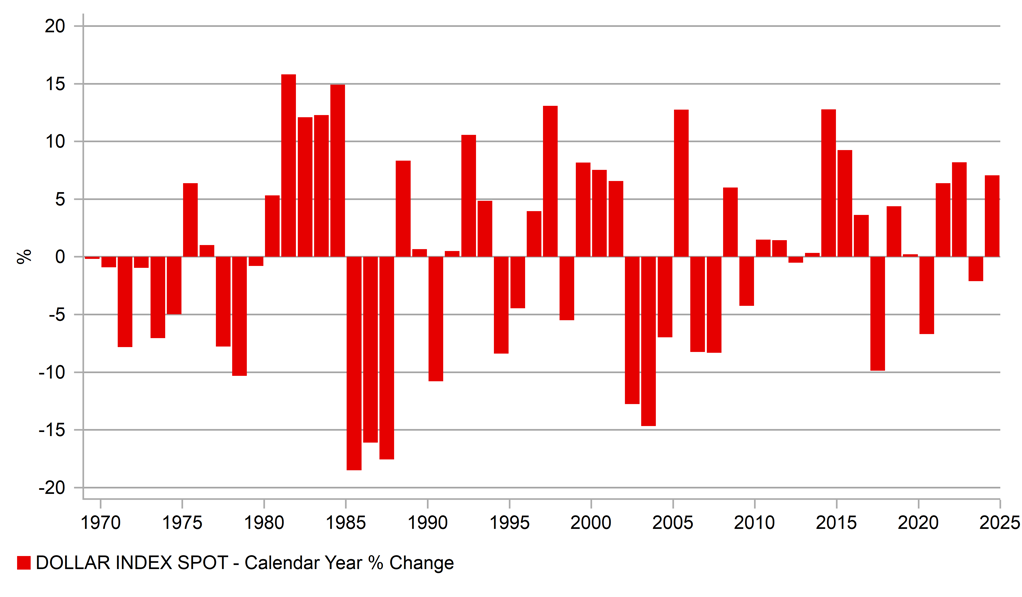

CALENDAR YEAR PERFORMANCE OF USD SHOWS THREE OUT OF FOUR YEARS APPRECIATION OF OVER 5% FOR FIRST TIME SINCE 2001

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Dec |

15K |

7K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Dec |

6.2% |

6.1% |

!! |

|

UK |

09:30 |

BoE Consumer Credit |

Nov |

1.200B |

1.098B |

! |

|

UK |

09:30 |

M4 Money Supply (MoM) |

Nov |

0.1% |

-0.1% |

! |

|

UK |

09:30 |

Mortgage Approvals |

Nov |

69.00K |

68.30K |

! |

|

UK |

09:30 |

Net Lending to Individuals |

Nov |

4.400B |

4.532B |

! |

|

US |

15:00 |

ISM Manufacturing Index |

Dec |

48.3 |

48.4 |

!!!! |

|

US |

15:00 |

ISM Manufacturing Prices |

Dec |

52.0 |

50.3 |

!!! |

|

US |

15:00 |

Total Vehicle Sales |

Dec |

16.50M |

16.50M |

! |

|

US |

15:30 |

Natural Gas Storage |

-- |

-- |

-93B |

! |

|

US |

16:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

EC |

16:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

Atlanta Fed GDPNow |

Q4 |

2.6% |

2.6% |

!! |

Source: Bloomberg