Softer US inflation supports risk taking & weighs on USD

USD: Softer US inflation keeps USD on weaker footing ahead of NFP report

The US dollar has continued to trade at weaker levels at the start of this month after the sell-off on Friday. It has resulted in the dollar index falling back towards support from the 200-day moving average at around 104.40 which has held since the middle of last month. The decline for the dollar index in April was the first monthly decline so far this year after four consecutive months of gains at the start of this year. The recent loss of upward momentum for the US dollar was reinforced on Friday by the release of the latest US PCE deflator report for April. The report provided confirmation that the core PCE deflator slowed to an increase of 0.2%M/M in April which marks a step down from the faster pace of underlying inflation pressures recorded in Q1. In the previous two months the core deflator had increased by 0.3%M/M in both February and March. It has brought some short-term relief for market participants and the Fed although is unlikely on its own to make the Fed more willing to begin lowering their policy rate at upcoming policy meetings in June or July. The break down provides further encouragement as well with the deflator for core services excluding housing showing a marked improvement when it increased by 0.27%M/M in April compared to the average of 0.45%M/M in Q1. At the same time, core goods inflation remains muted increasing by only 0.1%M/M. The main driver for the increase in core services inflation was a large 0.8%M/M increase in the financial services component reflecting the ongoing rally in the Us equity market. The market-based measure of the core PCE deflator after stripping out computed measures of inflation increased more modestly by +0.17%M/M. For the Fed to more actively consider cutting rates, it will need to see further evidence of slowing inflation in the coming months and/or a more marked softening in the US labour market. The latest nonfarm payrolls report for May will be the main economic data release in the week ahead and will be important in determining whether the recent US dollar sell-off extends further this month or proves to be only a temporary correction lower.

The pullback in US yields has helped to put a dampener on further upside for USD/JPY at the start of this week. After failing to break above 5.00% at the end of last month, the 2-year US Treasury yield has dropped back below 4.90%. Similarly, the 10-year US Treasury yield has run into resistance at 4.60%. Unlike US yields which have corrected modestly lower, USD/JPY has only lost upward momentum as it continues to trade close to recent highs just above the 157.00-level. The release of the official intervention data from the MoF on Friday provided confirmation that current market conditions are making it very challenging for Japan to push back against the yen weakening trend. The MoF revealed that Japan purchased a record JPY9.8 trillion of yen between 26th April and 29th May with suspected intervention taking place on 29th April and 1st May. It was bigger than the nearly JPY9.2 trillion of yen purchases undertaken between September and October 2022. It could help to explain why there appears to be growing pressure from the government on the BoJ to help support the yen as well through speeding up policy tightening by bringing forward rate hike plans and/or slowing down the pace of JGB purchases. We continue to expect the BoJ to raise rates by a further 0.15 point in July and announce plans to slowdown JGB purchases at the next policy meeting in June. Yields in Japan have continued to adjust higher over the past month but have provided limited support for the yen so far.

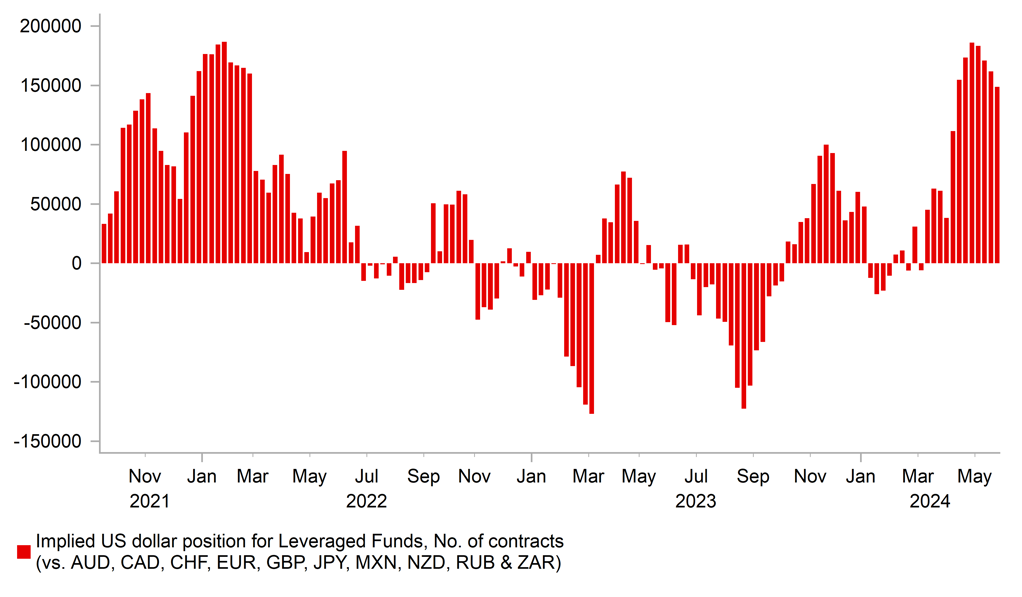

LEVERAGED FUNDS REMAIN LONG USD

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC is expected to become next G10 central bank to cut rates

The BoC is expected to be the next G10 central bank to begin cutting rates in the week ahead although it is still judged as close decision over whether they will start this week or wait until July. The Canadian rate market is more convinced that Canadian economists. The Canadian rate market is currently pricing in around 21bps of cuts for this week, while according to Bloomberg 19 out of 30 Canadian economists are expecting a 25bps rate cut this week. The case for a rate cut as soon as this week was supported by the release on Friday of the softer than expected Canadian GDP report for Q1. The report revealed that Canada’s economy expanded by 1.7% in Q1 which was below the consensus forecast of 2.2%, and the BoC’s own forecast for growth of 2.8% from the April Monetary Policy Report. GDP growth in Q4 of last year was also revised lower by 0.9 point to 0.1%. However, the breakdown of growth in Q1 presented a more favourable picture. Headline GDP growth in Q1 was held back by a large -1.5 point drag from inventories. Household consumption remained strong expanding by just over 3% for the second consecutive quarter and business investment increased by just over 3% as well in Q1 bringing an end to two consecutive quarters of contraction.

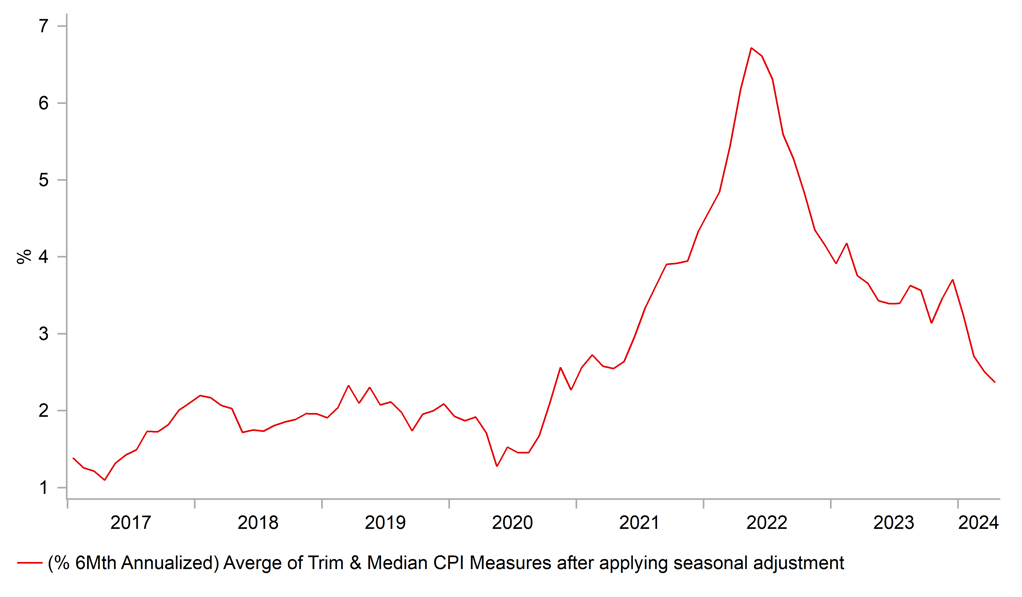

The developments haven’t changed our forecast for the BoC to begin cutting rates this week. With core inflation in Canada surprising to the downside at the start of this year which has resulted in inflation moving back closer to the BoC’s 2.0% target, there has been sufficient evidence for the BoC to begin cutting rates if they choose to do so this week. With the BoC expected to cut rates ahead of the Fed, it should help to keep USD/CAD trading in the high 1.3000’s in the month ahead.

SLOWING INFLATION OPENS DOOR FOR BOC RATE CUTS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

procure.ch PMI |

May |

45.4 |

41.4 |

!! |

|

IT |

08:45 |

Italian Manufacturing PMI |

May |

47.9 |

47.3 |

!! |

|

FR |

08:50 |

French Manufacturing PMI |

May |

46.7 |

45.3 |

!! |

|

GE |

08:55 |

German Manufacturing PMI |

May |

45.4 |

42.5 |

!! |

|

NO |

09:00 |

Manufacturing PMI |

May |

-- |

52.4 |

! |

|

EC |

09:00 |

Manufacturing PMI |

May |

47.4 |

45.7 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

May |

51.3 |

49.1 |

!!! |

|

CA |

14:30 |

Manufacturing PMI |

May |

50.2 |

49.4 |

! |

|

US |

14:45 |

Manufacturing PMI |

May |

50.9 |

50.0 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Apr |

0.2% |

-0.2% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

May |

49.8 |

49.2 |

!!! |

Source: Bloomberg