FX market in “wait & see” mode ahead of Trump tariff deadline

USD: Tariff deadline important for US performance going forward

The US dollar has given back some of its strong gains recorded at the end of last week resulting in EUR/USD rising back above the 1.0400-level overnight. The rebound for the US dollar at the end of last week reflected more concern amongst market participants that President Trump will follow through with some of his threats to implement more disruptive tariffs in the coming months. An important stress test will be tomorrow’s self-imposed deadline to implement 25% tariff hikes on Canada and Mexico and an additional 10% tariff hike on China. It would come on top of the 10% tariff hike that has already been put in place from 4th February on all goods imported from China. Market participants are hopeful that the tariff hikes on Canada and Mexico will be delayed again. While the Canadian dollar and Mexican peso have weakened over the past week, the scale of sell-offs has been relatively modest compared to the size of the tariffs President Trump is threatening to implement. Treasury Secretary Bessent has previously stated that the US dollar should strengthen to offset around 40% of the tariff hike all things being held equal. It fits with our view that the Canadian dollar and Mexican would weaken by around 5-10% if the President Trump puts in place tariffs hikes of 25% on Canada and Mexico.

Market expectations for another tariff delay and/or watering down of the tariff threats have been encouraged by comments from Commerce Secretary Lutnick over the weekend who told Fox News that “they have done a lot, so he’s sort of thinking about right now how exactly he wants to play with Mexico and Canada and that is a fluid situation”. However, he did go on to warn that “there are going to be tariffs on Tuesday on Mexico and Canada, exactly what they are, we’re going to leave that for the president and his team to negotiate”. Canadian Prime Minister Trudeau emphasized over the weekend that “ we will continue to work to ensure to do everything we can to make sure that there are no tariffs on Tuesday, but if ever there were tariffs on Tuesday, as we have all seen – we are ready to do last time – we will have a strong unequivocal and proportional response as Canadians expect”. Mexico is reportedly even considering applying tariffs to imports from China as part of deal to avoid US tariffs. In contrast, we are less optimistic that China can avoid another 10% tariff hike posing downside risks for the renminbi and other Asian currencies. We would expect Chinese policymakers to be more willing to allow the renminbi to weaken further against the US dollar to provide an offset to the negative impact on external demand from another US tariff hike lifting USD/CNY up towards our forecast of 7.5000.

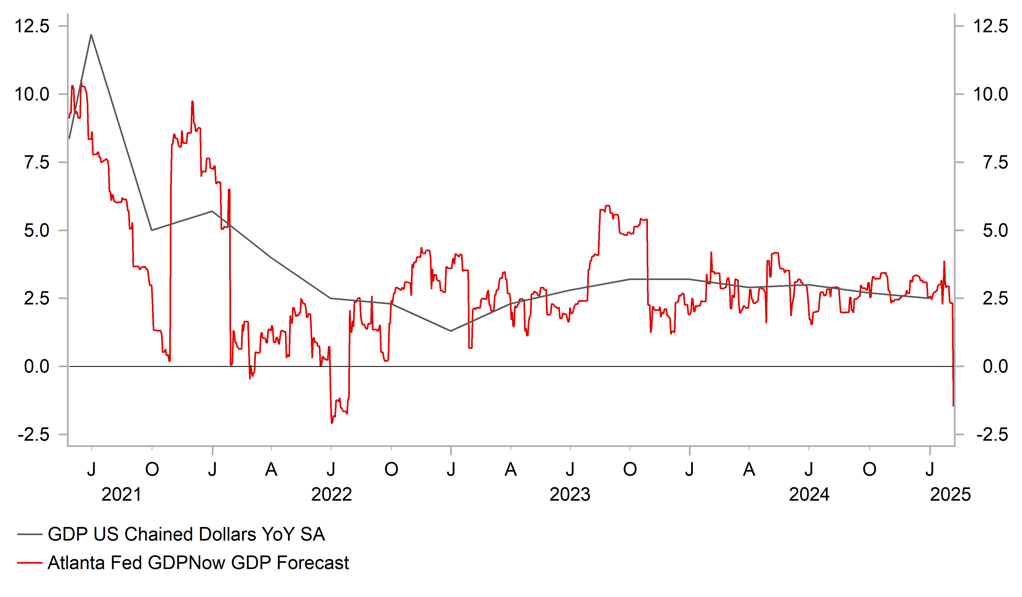

The negative impact of trade policy uncertainty also appears to be weighing on the US economy at the start of this year helping to put a dampener on US dollar strength. The release at the end of last week of the Atlanta Fed’s current tracker of Q1 GDP growth attracted more market attention than usual as it showed significant weakness. Their GDPNow forecast dropped sharply to -1.5% on 28th February down from +2.3% on 19th February. It was mainly driven by the nowcast for the contribution of next exports for Q1 GDP growth which increased from a drag of -0.41 percentage points up to -3.70 percentage points while the positive contribution from real personal consumption fell from +2.3 percent to +1.3 percent. US importers have been bringing forward demand at the start of this year in order to avoid tariff hikes.

US GROWTH TO BE HIT BY TRADE POLICY UNCERTAINTY IN Q1

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Government spending optimism & ECB meeting could provide support

The euro continues to derive support as well from building optimism over a significant pick-up in government spending following the German election. The German newspaper Bild and other sources including Reuters have suggested over the weekend that the centrist parties are discussing creating two large fiscal funds outside of the constitutional debt brake with at least EUR200 billion for the special defence fund which could potentially be accompanied by a similarly large fund for public investment. The centrist parties will have a two thirds majority in the current lame duck session of the outgoing parliament that could be used to pass required legislation. Putting in place a public investment fund would reportedly help to win support from the SPD and Greens for the defence fund as well. Reaching an agreement on the two large two funds is still expected to be complicated and remains far from a done deal but it has the potential to provide more support for growth in Germany and will put upward pressure on government borrowing costs. The yield differential between 10-year US and German government bonds continues to narrow reaching 1.8 percentage points down from almost 2.3 percentage points in December. The need for a step up in European defence spending will have been heightened by the Trump administrations recent actions including the fall-out with Ukrainian President Zelensky on Friday. The other focus for the euro in the week ahead will be the ECB’s latest policy meeting on Thursday. It poses another potential upside risk for the euro if the ECB delivers a hawkish rate cut by signalling that they may skip another rate cut at the following meeting in April. However, those positive factors for the euro could be more than offset by President Trump putting in place more aggressive tariff hikes this week.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Manufacturing PMI |

Feb |

-- |

51.2 |

!! |

|

EC |

09:00 |

Manufacturing PMI |

Feb |

47.3 |

46.6 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Feb |

46.4 |

48.3 |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Feb |

2.3% |

2.5% |

!!! |

|

CA |

14:30 |

Manufacturing PMI |

-- |

51.9 |

51.6 |

!! |

|

US |

14:45 |

Manufacturing PMI |

Feb |

51.6 |

51.2 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Jan |

-0.1% |

0.5% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Feb |

50.6 |

50.9 |

!!! |

Source: Bloomberg