USD gains resume

USD: Month-end over and USD resumes its ascent

We highlighted at the end of last week the fact that technical and month-end flows may have served to propel the dollar weaker and that we should therefore be sceptical of that move turning into something more sustained. And that is certainly what has unfolded so far with a notable rebound of the dollar helped by the deal to avoid a government shutdown with a deal to keep government operations financed through to 17th November. Can anything turn this US dollar momentum around over the shortterm?

Certainly the data at the start of this week helped with the key ISM manufacturing index coming in stronger than expected at 49.0 compared to a market consensus of 47.9. The breakdown was favourable as well with new orders and employment both increasing while the measures related to inflation and the supply of manufactured goods were favourable in pointing to reduced inflationary pressures. The manufacturing sector accounts for about 12% of US GDP and about 10% of employment so this recovery doesn’t tell us a huge amount about the direction of the overall economy through the remainder of the year and into next year. The headwinds coming will be in the services sector as consumption starts to slow in Q4 as some of the support that has been there since the pandemic end. The depleting of consumers’ excess savings, the restart of student debt servicing, and declining equity markets are likely to weigh on consumer spending.

Yesterday, we released our Foreign Exchange Outlook (here) for October and we have maintained our view of US dollar strength being sustained (we have revised higher our Q4 USD forecasts generally) but have maintained our weaker USD profile for 2024. A recession in Q1-Q2 next year would merely meet the standard timeframe for when a recession unfolds after the start of Fed tightening and hence some of the optimism currently in the markets on the US economy being able to manage the ‘higher for longer’ Fed strategy is misplaced.

For EUR/USD, spot has now broken below 1.0484, the previous year-to-date low and this now opens up the prospect of the move propelling EUR/USD down closer to parity. We do not expect a breach of parity and believe something notable would have to unfold – market turmoil in China; a sudden severe US dollar liquidity crunch; the Fed considering more than one further hike; a severe cold winter emerging in Europe are examples of risks that could propel the dollar back though parity versus the euro.

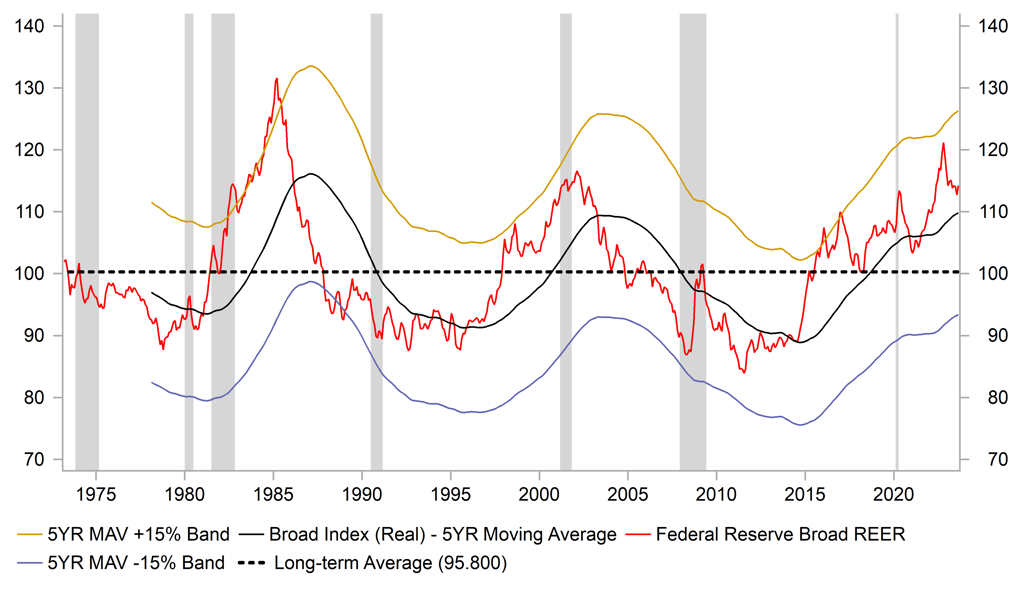

The scope for a sustained run stronger for the dollar from here we believe is relatively limited. Last year, the dollar high at the end of September in REER terms surpassed the high from 2002 and had reached levels not seen since Q4 1985. The speed of the correction lower last year in Q4 illustrated the extreme over-valuation the dollar reached. We are therefore sceptical of a return to those highs although we are mindful of the risks cited above providing a catalyst for further positive dollar momentum.

USD HIGH IN REER TERMS LAST YEAR REACHED HIGHEST SINCE 1985

Source: Bloomberg, Macrobond & MUFG Research

JPY: JGB auction met by strong demand

The 10-year UST bond yield is now up a huge 65bps since early September as strong economic data and a hawkish Fed continues to drive yields higher in a bear-steepening move for the curve. The 2s10s inversion has now shrunk to just over -40bps from a closing low of -109bps three months ago.

With the long-end of the curve under such selling pressure, there was understandable concerns going into today’s 10-year JGB auction. While the bid-to-cover fell modestly from the last auction (3.93 from 4.02), the cut-off price was higher and the tail shrunk highlighting the breadth of the demand. There will be a 30-year auction on Thursday.

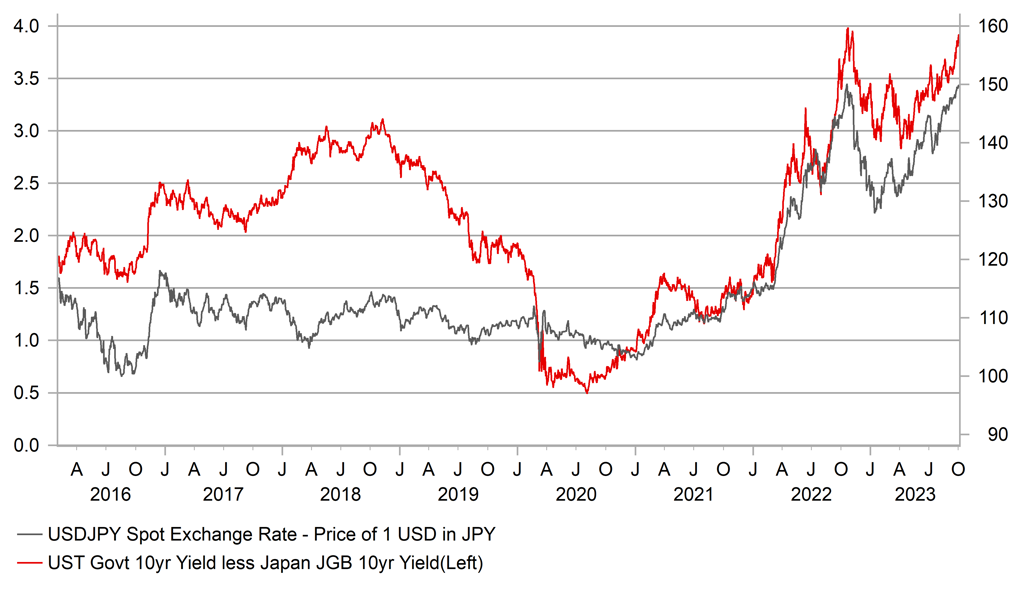

But what this 10-year auction does indicate is that yields in Japan have reached a level that is helping draw increased demand. This auction comes as investors ponder the end of negative interest rates and possible further changes to the current YCC framework. The strong demand has helped push the 10-year JGB yield lower by between 1-2bps in sharp contrast to the moves we are seeing elsewhere. That has resulted in the 10-year US-JP bond spread widening back out and is approaching the cyclical high of just under 400bps (392bps today).

The last time the 10-year spread was approaching the 400bp level was in October of last year when the MoF/BoJ were intervening to halt a move through the 150-level. We are here again and FM Suzuki was again on the wires stating the MoF was watching FX with a “high sense of urgency”. He did importantly add that the focus was on volatility and not particular levels which again highlights the reluctance of the authorities to intervene at this juncture given volatility has been very low and would not justify intervention under the G20 agreement. A break higher still seems most likely given the broad-based US dollar strength, which assuming volatility would pick up would open up the scope for MoF intervention.

US-JP 10-YEAR BOND YIELD SPREAD APPROACHING 2022 HIGH

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:35 |

ECB's Lane speaks |

!!!! |

|||

|

IT |

11:00 |

Italian Trade Balance Non-EU |

Jul |

-- |

9.45B |

! |

|

US |

13:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:45 |

ECB's Villeroy speaks |

!! |

|||

|

US |

15:00 |

JOLTs Job Openings |

Aug |

8.830M |

8.827M |

!!! |

|

US |

16:30 |

52-Week Bill Auction |

-- |

-- |

5.120% |

! |

|

AU |

23:00 |

AIG Construction Index |

Sep |

-- |

-9.9 |

! |

|

AU |

23:00 |

AIG Manufacturing Index |

Sep |

-- |

-19.8 |

! |

|

AU |

23:00 |

Services PMI |

-- |

50.5 |

47.8 |

! |

Source: Bloomberg