USD/JPY surges but sustainability is questionable

JPY: Political change fuelled JPY demand reverses

USD/JPY gained nearly 2% yesterday with a host of factors combining to fuel heavy yen selling. The US dollar was broadly stronger yesterday but moves were generally modest across G10 so the stronger ADP employment report is only a partial explanation with the 2-year UST note yield up just 3bps. The 143k increase reported in the ADP data was a little stronger than expected but was still indicative of a continued slowing in the jobs market. The 3mth and 6mth averages (119k & 143k) fell to new cyclical lows. Still, it has reduced marginally the risks of a downside surprise in Friday’s payrolls report which has helped support yields. The factor that is most significant for USD/JPY were the comments made by PM Ishiba and BoJ Governor Ueda following their first meeting to discuss the economy and monetary policy. The comment from PM Ishiba that “now was not the environment to raise rates again” has shifted perceptions of Ishiba’s approach to monetary policy and reinforced expectations that the BoJ could remain on hold for longer than expected. The OIS market pricing currently implies a 25% probability of a 25bp rate hike at the December meeting. We saw nothing in Ueda’s comments that were different to the comments made following the policy meeting on 20th September. Governor Ueda stated that the policy rate would be adjusted if the BoJ’s outlook was realised and added that the BoJ has time to consider the policy stance. We would argue that PM Ishiba’s comments are consistent with the comments from Governor Ueda but nonetheless we accept the change of government has created some added uncertainty over the near-term course for monetary policy. Crucial we believe will be the fiscal stimulus package that PM Ishiba is planning. If this is larger than expected and if at the same time we see optimism over global growth rising due to China stimulus, a December rate hike remains very feasible but our conviction on a December hike has come down.

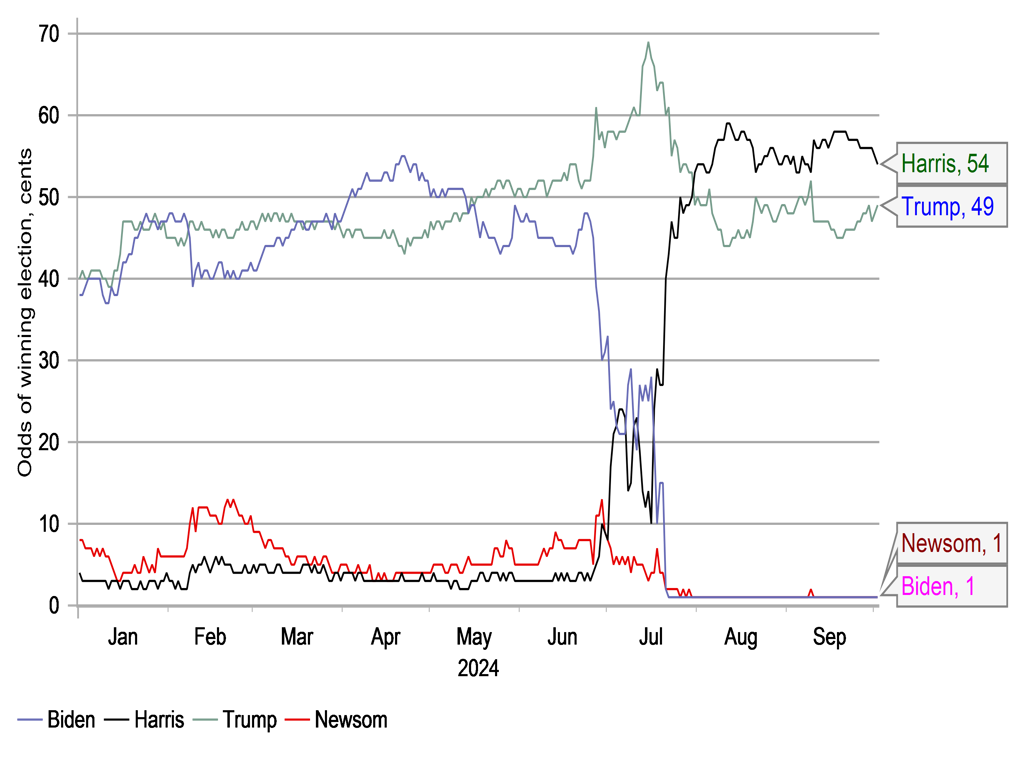

There are other factors that are likely also encouraging some renewed yen selling. The upturn in geopolitical risks in the Middle East has seen a 7% jump in crude oil prices and with Japan a large energy importer this development is yen bearish. Fears of a renewed global inflation shock on an escalation of the conflict is also yen bearish. We would also argue that worsening developments in the Middle East could well play into the hands of Donald Trump with polling suggesting voters trust him more on foreign policy. The Institute for Global Affairs published the results of a poll on 24th September conducted in the six key swing states which found that voters favoured Trump over Harris 56% vs 44% on protecting US interests abroad and in managing conflicts abroad. On who is more likely to end conflicts abroad the same poll found voters favoured Trump 58% vs 42%. If this Middle East conflict continues to escalate it raises the odds of a Trump victory and we would argue initially at least that USD/JPY would jump notably higher on Trump returning to the White with a clean sweep in Congress. The VP TV debate could also be a factor in lifting expectations of a Trump win with Tim Walz deemed to have performed poorly against JD Vance on Tuesday.

So there are numerous factors that look to have encouraged strong USD/JPY buying. However, we are sceptical of the scope for this to extend much further. We still expect there to be plenty of hedge-related demand for the yen at weaker levels given the scale of the drop in USD/JPY and the need to hedge yen liability exposures. But equally Middle East developments could undermine our view if the conflict escalates notably.

TRUMP LOOKS TO BE CLOSING THE GAP WITH HARRIS – POSSIBLY TIED TO INCREASED GEOPOLITICAL RISKS

Source: Macrobond & Bloomberg

GBP: Bailey signals potential for faster rate cuts

In the October Foreign Exchange Outlook released this week (here) we altered our BoE rate cutting view believing the BoE would potentially up the pace of rate cuts by cutting at both of the remaining meetings this year – in November and December. That is looking more likely now after an interview by BoE Governor Bailey in the Guardian newspaper was published this morning. The key comment on the monetary policy outlook was when Bailey stated that “if the news on inflation continued to be good” then the BoE could become “a bit more activist” in its approach to cutting interest rates. Bailey also added that he was “encouraged” by the fact that inflation had not been “as persistent” as the BoE originally thought. That was really all what was said on policy in what was a wide-ranging interview covering the Middle East conflict and the potential for another inflation shock. Bailey also pushed back on the Liz Truss claims that the BoE was of the “deep state” in playing a role in her unseating as PM!

We altered our view on the BoE to assume back-to-back rate cuts before year-end given our view that the economy was now showing clearer evidence of decelerating economic growth. Sentiment indicators are now turning lower – the GfK consumer confidence index, the PMIs, the CBI Orders index, the Lloyds Business Barometer have turned lower pointing to weaker growth and the potential for a further softening in underlying inflation.

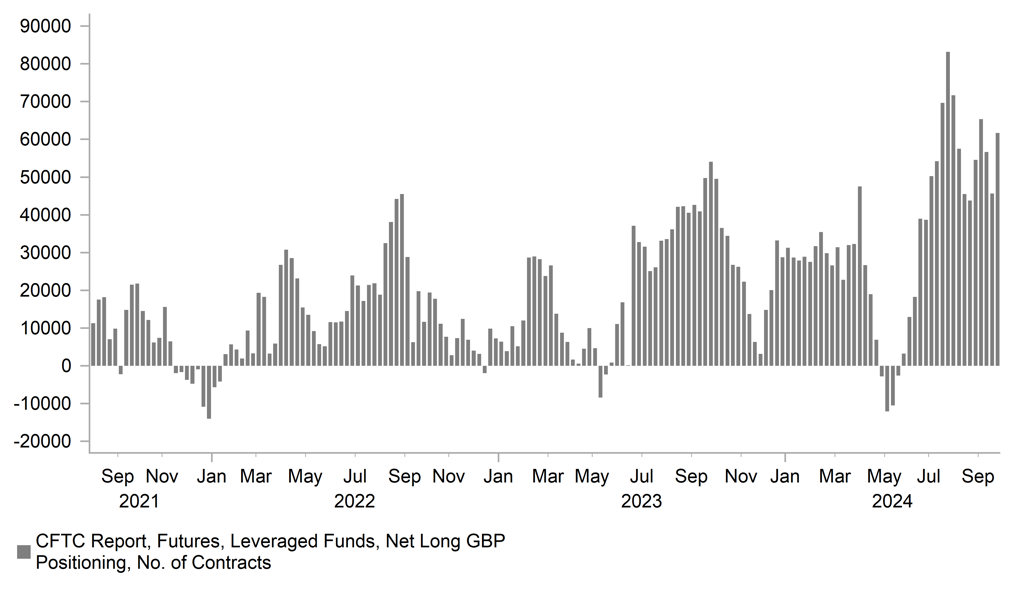

With the Fed and ECB also likely cutting at back-to-back meetings before year-end the damage for the pound should not be considerable. Still, long GBP has been a popular and fruitful trade this year and there is a risk of a downside correction especially if financial market volatility was to pick-up on increased risk aversion.

LONG GBP POSITIONING AMONGST LEVERAGED FUNDS REMAIN ELEVATED

Source: Bloomberg & MUFG Research

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:50 |

French S&P Global Composite PMI |

Sep |

47.4 |

53.1 |

! |

|

GE |

08:55 |

German Composite PMI |

Sep |

47.2 |

48.4 |

! |

|

GE |

08:55 |

German Services PMI |

Sep |

50.6 |

51.2 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Sep |

48.9 |

51.0 |

!! |

|

EC |

09:00 |

Services PMI |

Sep |

50.5 |

52.9 |

!! |

|

UK |

09:30 |

Composite PMI |

Sep |

52.9 |

53.8 |

!!! |

|

UK |

09:30 |

Services PMI |

Sep |

52.8 |

53.7 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Aug |

-2.4% |

-2.1% |

! |

|

EC |

10:00 |

PPI (MoM) |

Aug |

0.4% |

0.8% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Sep |

-- |

75.891K |

! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

221K |

218K |

!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Sep |

54.4 |

54.6 |

!! |

|

US |

14:45 |

Services PMI |

Sep |

55.4 |

55.7 |

!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Aug |

-- |

-0.2% |

! |

|

US |

15:00 |

Durables Excluding Transport (MoM) |

Aug |

-- |

0.5% |

! |

|

US |

15:00 |

Factory Orders (MoM) |

Aug |

0.1% |

5.0% |

!! |

|

US |

15:00 |

Factory orders ex transportation (MoM) |

Aug |

-- |

0.4% |

! |

|

US |

15:00 |

ISM Non-Manufacturing PMI |

Sep |

51.6 |

51.5 |

!!! |

|

US |

15:40 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg