JPY rebound supported by BoJ hike expectations & China growth concerns

JPY: China growth concerns & BoJ rate hike expectations in focus

The yen has strengthened during the Asian trading session amidst more risk-off trading conditions. Yen strength has been most evident against the G10 commodity currencies of the Australian and New Zealand dollars with AUD/JPY and NZD/JPY both falling by around 1% overnight. In our latest monthly FX Outlook report (click here) released yesterday we raised our outlook for the yen to show further gains in the year ahead. In our updated forecasts USD/JPY is expected to fall towards 137.00 by the middle of next year. The case for further yen strength is supported by our expectation that the BoJ will continue to tighten monetary. Recent comments form BoJ Governor Ueda have supported our view that the BoJ will hike rates again at the December policy meeting if Japan’s economy progresses in line with their outlook and financial market conditions continue to stabilize after the bout of volatility in early August. We expect political uncertainty ahead of the upcoming LDP leadership election and possibility of an early general election will prevent an even earlier rate hike in the autumn. At the same time, the Fed has signalled strongly that it plans to begin cutting rates later this month. The release on Friday of the latest nonfarm payrolls report for August will be important in determining whether the Fed begins with a normal 25bps rate cut or delivers a larger 50bps cut to reflect more concern that it has fallen behind the curve in easing policy. The August nonfarm payrolls report would have to reveal evidence of a sharper slowdown in employment growth to trigger a larger rate cut even after the significant downward revisions to employment growth over the past year. The US rate market is currently pricing in around 33bps of cuts ahead of the September FOMC meeting highlighting that a 25bps is judged as the most likely outcome. It leaves the US dollar vulnerable to a further sell-off if the nonfarm payrolls report proves significantly weaker than expected on Friday.

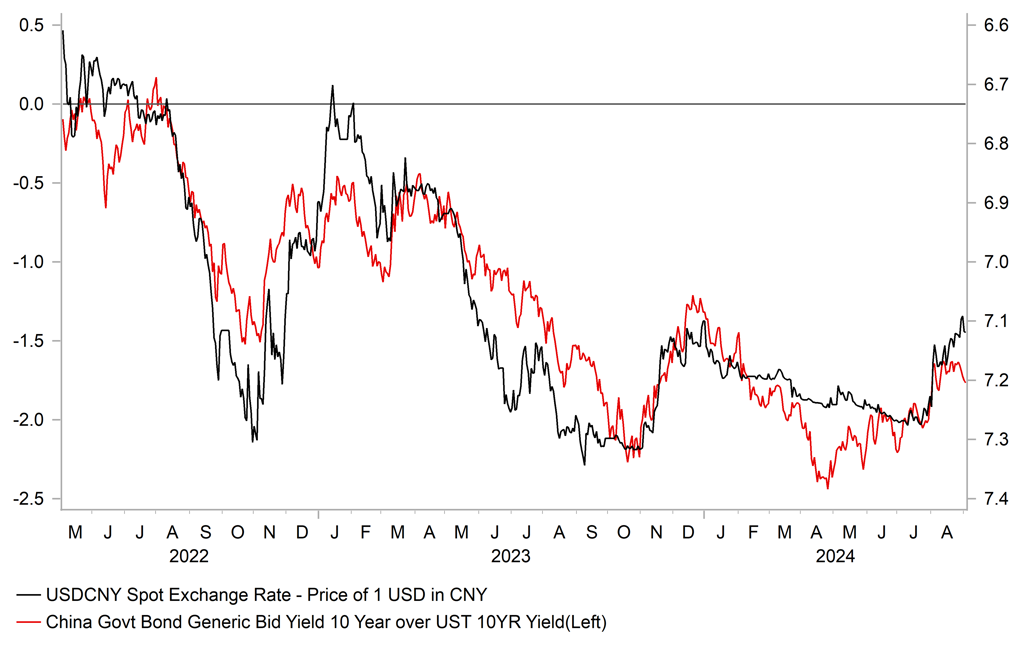

The yen has also been supported overnight by more risk-off trading conditions which has weighed on the G10 commodity currencies of the Australian and New Zealand dollars. Economic data releases at the start of this week have highlighted China’s economy is still struggling and will require further policy stimulus to meet the government’s GDP target for this year of around 5%. The composite PMI survey for August weakened for the fifth consecutive month and fell to its lowest level since the end of 2022. It will keep pressure on the PBoC to lower rates further. In these circumstances, we are not convinced that the recent strengthening for the renminbi against the US dollar will be sustained. Our analysts in Hong Kong are forecasting a more modest drop for USD/CNY to 7.0500 by year end after the pair has already fallen from around 7.2500 to 7.1000 since July.

USD/CNY VS. LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Will the ECB stick to a gradual pace of rate cuts?

The euro is continuing to consolidate at the higher levels after breaking out above the 1.0500 to 1.1000 trading range that has been in place for most of the time since late in 2022. Over that period there have been a handful of occasions when the pair has moved above the 1.1000-level but on each occasion the move higher proved to be short-lived. On this occasion, we are more confident that pair has moved into a new higher trading range between 1.1000 and 1.1500 supported by our expectations that the Fed soon start their rate cutting cycle. We expect the Fed to deliver at least 75-100bps of cuts by year end.

In contrast, we expect the ECB to stick to a more gradual pace of easing heading into year end. After delivering the first 25bps rate cut back in June, we expect the ECB to cut rates by a further 25bps this month. The ECB refrained from delivering back to back rate cuts at the July policy meeting. A 25bps rate cut in September is almost fully priced in so should have only limited negative impact on the euro. Market participants will be watching more closely the updated guidance from the ECB to assess if they plan to stick to the quarterly pace of cuts or speed up the pace of cuts by lowering rates again at the next meeting in October. The euro-zone rate market is currently pricing in around 37bps of cuts by the October meeting highlighting that market participants are currently sat on fence over the outcome. We expect the ECB to stick to a quarterly pace of rate cuts and expect a third rate cut in December rather than in October which supports our outlook for further modest euro strength against the US dollar.

Reuters released a sources report yesterday indicating that ECB policymakers are increasingly at odds over the outlook for growth which could complicate decision making beyond this month. The hawks at the ECB have argued that actual growth figures this year have persistently outperformed weak survey results. It supports their preference for gradual rate cuts until the ECB is certain inflation is heading back to their 2% target, and are concerned that if they cut rates quicker it could delay achieving their inflation target into 2026. It seems unlikely that President Lagarde will strongly signal that the ECB will cut rates again in October at the September policy meeting and is more likely to reiterate that decisions are made meeting by meeting.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

13:00 |

German Buba Vice President Buch Speaks |

-- |

-- |

-- |

!! |

|

CA |

14:30 |

Manufacturing PMI |

Aug |

-- |

47.8 |

! |

|

US |

14:45 |

Manufacturing PMI |

Aug |

48.0 |

49.6 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Jul |

0.1% |

-0.3% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Aug |

47.5 |

46.8 |

!!! |

|

US |

15:00 |

Total Vehicle Sales |

Aug |

15.40M |

15.80M |

! |

|

EC |

15:00 |

ECB's Supervisory Board Member Jochnick Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Atlanta Fed GDPNow |

-- |

2.5% |

2.5% |

!! |

|

GE |

17:45 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg