Loss of growth momentum for US economy weighs on USD

USD: ISM services survey adds to concerns over loss of US growth momentum

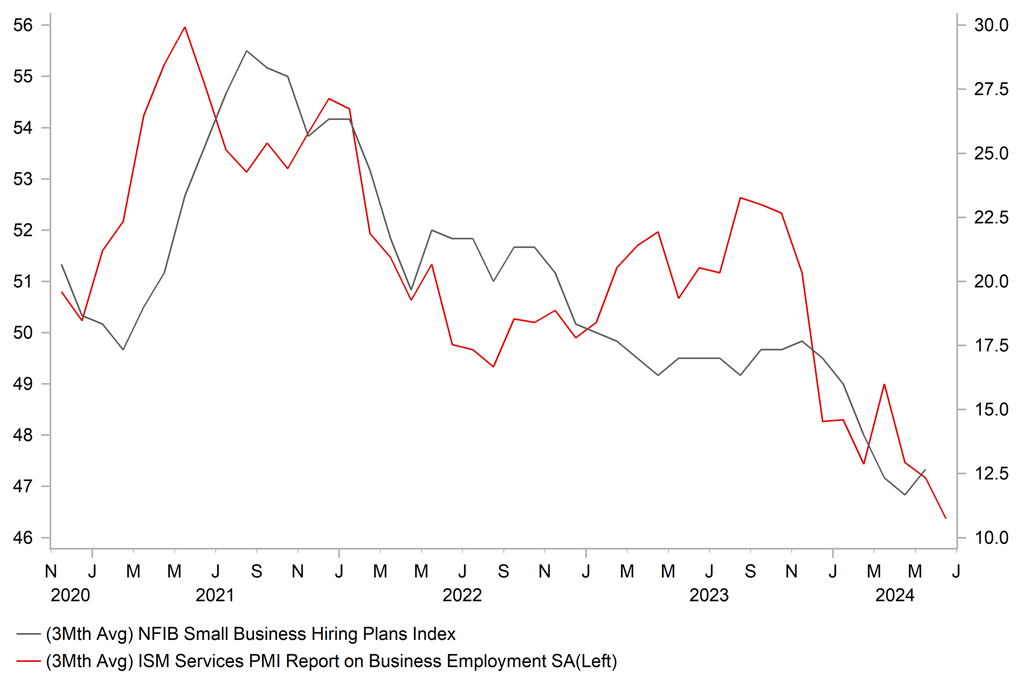

The US dollar has remained at weaker levels overnight following yesterday’s sell-off triggered by the release of the much weaker than expected ISM services survey for June. It resulted in the dollar index briefly dropping to an intra-day low yesterday of 105.40 as it extends the correction lower from the highs at the end of last month. The main trigger for yesterday’s US dollar sell-off was the release of the latest ISM services survey for June that revealed a sharp drop in business confidence which hit the lowest level since the initial negative COVID shock back in May 2020. It was the second month out of the last three in which the ISM services index has fallen below the 50.0-level resulting in the three-month average falling to 50.7 in Q2 down from 52.5 in Q1. The survey will understandably heighten concerns over slowing growth momentum for the US economy in the 1H of this year. After expanding robustly by just over 4% in the 2H of last year, economic growth appears currently on track to expand by around 1.5% in 1H of this year. Some payback weakness was always likely at the start of this year as growth at the end of last year at just over 4% was clearly unsustainable, it would become more concerning for the Fed and market participants if the US economy continued to slow further during the 2H of this year as well. The breakdown of the ISM survey revealed that weakness in June was mainly driven by the business activity component that dropped sharply by 11.6 points to 49.6 which more than fully reversed the 10.3 points increase in May. It was also notable the new orders, employment and prices paid components all weakened in June. The employment component has been weakening since February and over the last three months has averaged just 46.4 which is the weakest period since August 2020. It provides another signal that the US labour market is softening ahead of the release of the NFP report for June on Friday. Earlier in the day the ADP survey estimated that private sector job growth slowed to 150k in June. The Fed will also have been reassured by the drop back in the prices paid component which after a brief pick-up earlier this year is no longer signalling that inflation pressures are reaccelerating in the US economy. Overall, the developments give us more confidence that inflation and growth in the US will continue to slow providing encouragement for the US rate market to price back in more rate cuts from the Fed in the year ahead. A key assumption behind our outlook for a weaker US dollar heading into next year (click here).

The minutes from the last FOMC meeting 12th June were released yesterday but have had limited impact on the US dollar’s performance. The minutes revealed that FOMC participations only cautiously welcomed the better inflation prints for April and May by saying that further progress towards their objective had been “modest”. They were still waiting for “additional information…to give them greater confidence” that inflation is returning sustainably to their 2% objective. Several participants even observed that if inflation were to persist at an elevated level or increase further, the Fed might need to raise rates further. At the June FOMC meeting, the Fed signalled that they only plan to cut rates once this year rather than three times. However, the Fed remains highly sensitive to incoming data and if inflation and growth slows as we expect then they will end up being more active in cutting rates than currently planned.

SOFTENING US LABOUR DEMAND

Source: Bloomberg, Macrobond & MUFG GMR

GBP/USD: Improving UK growth momentum not enough to save the Tories

The pound has rebounded against the US dollar so far this week ahead of today’s UK election. It has resulted in cable rising to a high yesterday of 1.2777 after it failed to break below support at the 1.2600-level at the start of this week. Cable benefitted yesterday from the release of further disappointing US economic data releases. According to Bloomberg, US economic data surprises have been surprising to the downside relative to expectations since May and it is the worst run of negative economic surprises since the summer of 2022. In contrast, economic data releases have been surprising to the upside in recent months. UK GDP growth in Q1 was revised even higher by 0.1 point to 0.7%Q/Q and the BoE’s staff are expecting stronger growth to continue in Q2 (+0.5%Q/Q).

While improving cyclical momentum for the UK economy is helping to support the pound this year, it is not expected to help the current UK government remain in power after today’s election. The final opinion polls ahead of today’s UK election make grim reading for Prime Minister Sunak. YouGov’s MRP poll projects that the Labour party are on course to win 431 seats compared to only 102 for the Tories. It would represent a record majority for the Labour party. Polls by More in Common and Focaldata also predicted a landslide victory for the Labour party with majorities of 210 seats and 238 seats respectively. As we have highlighted before market participants appear comfortable with the prospect of the Labour party winning a large majority (click here) which should limit the market impact for the pound from today’s election. The Labour party’s pledge to prioritise economic stability and respect fiscal rules is curtailing nervousness over the risk of looser fiscal policy and a loss of confidence in the pound. On the other hand, investors will welcome greater political stability in the UK and the possibility of an improvement to the Brexit trade deal that could support the pound.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

Construction PMI |

Jun |

54.0 |

54.7 |

!!! |

|

FR |

10:00 |

French 10-Year OAT Auction |

-- |

-- |

3.05% |

! |

|

EC |

10:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

U.K. General Election |

-- |

-- |

-- |

!!! |

|

CA |

12:00 |

Leading Index (MoM) |

Jun |

-- |

0.15% |

! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Total Vehicle Sales |

-- |

15.80M |

15.90M |

! |

Source: Bloomberg