FX market still hoping Canada & Mexico tariffs will not remain in place for long

USD: Trump follows through with tariff hikes marking step-up in trade war

The Canadian dollar and Mexican peso have continued to trade at weaker levels overnight after President Trump decided to implement 25% tariff hikes on imports from Canada and Mexico with the only exception being the lower 10% tariff rate on imports of energy from Canada. In addition, President Trump decided to put in place another 10% tariff hike on imports from China. It represents a significant escalation in the global trade war during President Trump’s second term. Bloomberg has reported that the tariffs will apply to around USD1.5 trillion of annual imports into the US. Up until this point President Trump had only put in place a 10% tariff hike on imports from China that became effective form 4th February. It has resulted in USD/CAD rising back above the 1.4500-level overnight and USD/MXN rising up closer to the 21.000-level. The size of initial moves lower for the Canadian dollar and Mexican peso have been relatively modest considering the scale of the tariffs that have been put in place. The price action suggests that market participants remain hopeful that the tariff hikes won’t remain in place for long helping to limit trade and economic disruption. The longer the tariffs are in place the more likely that both Canada’s and Mexico’s economies will slow sharply and fall into recession. It will increase pressure on the BoC and Banxico to cut rates more deeply to provide support for economic growth reinforcing the sell-off for the Canadian dollar and Mexican peso. We continue to believe that both currencies could fall by around 5-10% in response to more persistent tariff hikes. It poses downside risks to our forecasts released in yesterday’s monthly FX Outlook report (click here).

Part of the negative impact on the Canadian dollar, Chinese renminbi and Mexican peso from the US tariff hikes will be offset by retaliatory action and evidence of slowing economic growth in the US at the start of this year. Canadian Prime Minister Trudeau stated that “Canada will not let this unjustified decision go unanswered” alongside plans to put in place retaliatory tariffs on imports form the US. The plan was initially announced back in February and involves two stages. In the first stage, Canada has applied 25% tariffs on about CAD30 billion of imports. In the second stage, Canada will apply a 25% tariff on CAD125 billion of imports in three weeks time including on big-ticket items like cars, trucks, steel and aluminium. The two-stage approach for retaliatory tariffs highlights that the Canadian government is holding out hope that a deal can still be reached with President Trump to reverse tariff hikes in the coming weeks. President Trudeau confirmed that Canada’s tariffs will remain in place until US trade action is withdrawn, while threatening to pursue several non-tariff measures as well to hit back if the US tariffs do not cease. Non-tariff measures under discussion include limiting or shutting out US companies from government contracts.

China also announced another targeted package of retaliatory trade measures against the US overnight. The measures include placing tariffs as high as 15% on US agricultural goods including on chicken and cotton. Soybeans, beef and fruits are among US imports facing a 10% tariffs. The Chinese tariffs will take effect from 10th March. In addition, China has stated that it will put 10 American companies on an unreliable entity list, mainly involved in defence work. It also added 15 firms, including defence contractors General Dynamics Land Systems and Skydio Inc., to an export control list. The measure to prevent exports to those companies is anew step by China and comes after they banned the sale of dual-use goods to the US military in December, and the export of some dual-use metals such as gallum and germanium to all US entities. Market participants will be watching even more closely this week’s annual National People’s Congress (NPC) to assess China’s plans for further stimulus to support domestic demand going forward and provide an offset to the hit to external demand. We continue to expect China to allow the renminbi to weaken more against the US dollar to help provide an offset as well.

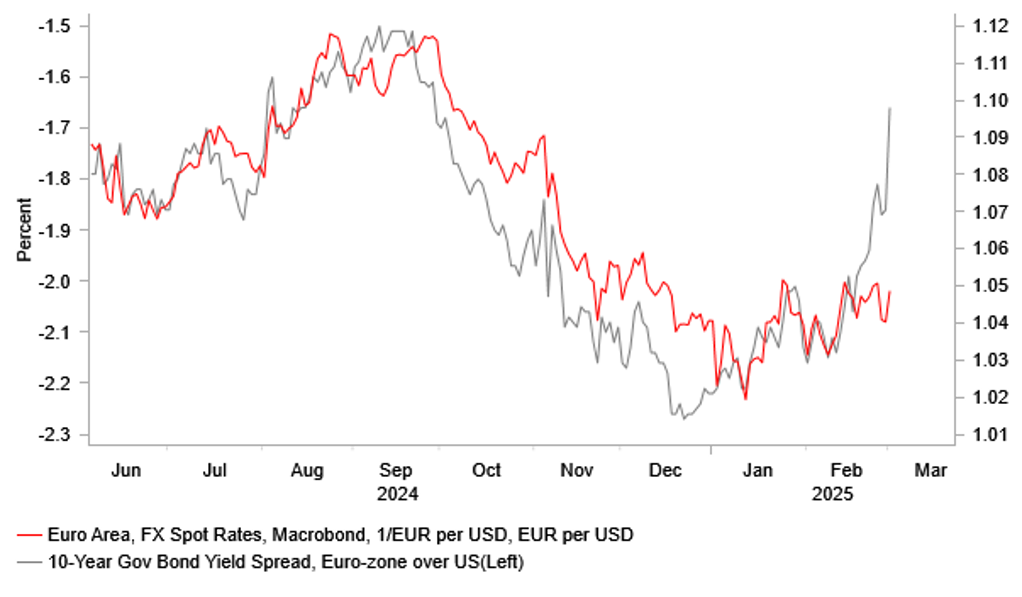

Now that President Trump has followed through with his threat to put more disruptive tariffs in place it increases the risk that he will take further action in the coming months. He is already planning to put in place: i) 25% tariffs on steel and aluminium imports from 12th March, ii) 25% tariff on imports from the EU from 2nd April, iii) 25% tariffs on imports of autos, pharmaceuticals and semiconductors from 2nd April, iv) unspecified “reciprocal tariffs” against all imports from 2nd April and v) unspecified tariffs on imports of copper from 22nd November. He added to that list overnight plans to impose tariffs on “external” agricultural products from 2nd April. The US Department of Agriculture forecast only last week that the US trade deficit for agricultural products is set to widen to a record USD49 billion this year. The plans highlight that President Trump is planning a structural shift in the global trading system. It is one reason why we remain reluctant to drop our call for a stronger US dollar even after weakness at the start of this year. However, our updated forecasts were pared back to reflect less upside potential for the US dollar to better reflect recent weakness in the US economy at the start of this year. Rising optimism over a ceasefire deal in Ukraine and a significant step up in government spending in Europe has also helped to provide more support for European currencies at the start of this year helping to dampen upside potential for the US dollar as we saw again yesterday when EUR/USD rose back above the 1.0500-level. As a result, we have pulled our forecast for EUR/USD to drop back below parity.

LONG-TERM YIELD SPREAD HAS MOVED SHARPLY IN FAVOUR OF EUR

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Unemployment Rate |

Jan |

6.3% |

6.3% |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

6.2% |

! |

|

JP |

14:15 |

BOJ Gov Ueda Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

IBD/TIPP Economic Optimism |

Mar |

53.1 |

52.0 |

! |

|

US |

19:20 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

AU |

22:00 |

Services PMI |

Feb |

51.4 |

51.2 |

! |

Source: Bloomberg