USD giving back some of recent strong gains ahead of US election

USD: All eyes on the US election as NFP report weakness viewed as temporary

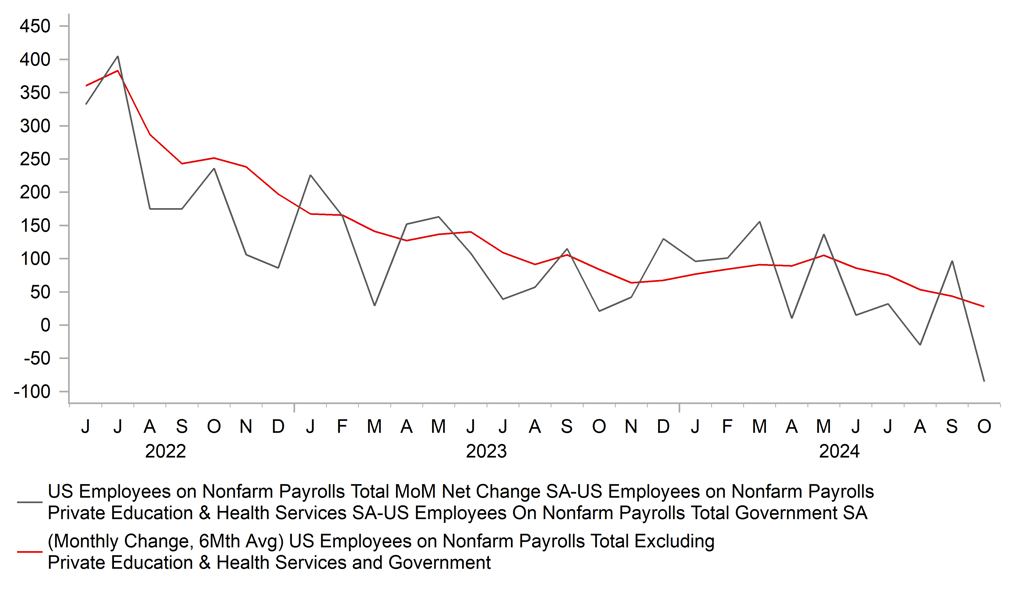

The US dollar has weakened modestly at the start of this week ahead of tomorrow’s US election. It follows the release of the much weaker than expected nonfarm payrolls report at the end of last week although it failed to prevent US yields from continuing to move higher. The 10-year US Treasury bond yield jumped by a further 10bps on Friday moving closer to 4.40% even after the latest nonfarm payrolls report revealed that the US economy added only 12k jobs in October. Market participants appear to be attributing most of the weakness to temporary factors that held back employment growth in October. The drag on employment from the strikes was estimated at around -37k while the negative impact from the Hurricane Milton remains unclear. It makes the report difficult to assess the underlying health of the US labour market. The downward revisions to prior months employment growth totalling -112k does though reinforce our view that the labour market continues to slow and indicates that the pick-up in September was more of a one-off. After the downward revisions, nonfarm employment growth has averaged 148k/month in the six months to September down from 240k/month in the previous six months. Slowing employment growth should continue should encourage the Fed to stick to plans for gradual 25bps rate cuts at this week’s and the final FOMC meeting of this year in December unless employment growth picks up strongly after US political uncertainty eases after tomorrow’s election.

The further adjustment higher in US yields at the end of last week despite the weaker nonfarm payrolls report also likely reflects market participants positioning for the risk of a Trump win and Red Sweep scenario that could trigger a further sell-off in the US bond market. However, as we move closer to the US election there is less confidence that Trump will win the election. The probability of Trump winning according to PolyMarket has fallen to around 56% from a high towards the end of October of around 66%. The probability of Trump winning is even narrower according to PredictIt at 53%. Trump’s lead over Harris appears to have narrowed as indicated by opinion polls released over the weekend. Bloomberg has reported that there have been some encouraging signs for Kamala Harris. A final poll from ABC news and Ipsos gave Harris a 49%-46% lead over Trump nationally, while the New York Times/Siena survey showed Harris ahead in five of the seven swing states. A poll by the Des Moines Register also showed with a 47%-44% lead in Iowa although that it viewed as a likely outlier. With the US election outcome on a knife edge, we are expecting an outsized market reaction. A Trump win and Red Sweep would be the most bullish outcome for the US dollar while a Harris win with a divided Congress could see the US dollar quickly giving back last month’s strong gains. Please see our latest monthly FX Outlook report released on Friday for more details (click here).

DOWNWARD REVISIONS ADD TO EVIDENCE OF SLOWING LABOUR MARKET

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK Budget favours BoE sticking to gradual rate cuts in week ahead

The continued fallout from last week’s UK Budget will also remain in focus in the week ahead with the BoE holding their latest MPC meeting. The pound staged a modest rebound on Friday after the Gilt market showed some encouraging signs of stabilizing at higher levels. The 10-year Gilt yield failed to break above the high from Thursday set at 4.53% although it remains around 20bps higher than prior to the Budget announcement. It has helped EUR/GBP to drop back below the 0.8400-level after hitting a high on Thursday at 0.8448.

The Gilt market sell-off has been driven in part by the hawkish repricing of BoE rate cut expectations ahead of this week’s MPC meeting. The BoE will take into consideration the government’s updated fiscal plans for the first time which includes more front-loaded government spending which is only partially offset by the higher taxes mainly in the form of higher employer national insurance contributions. While we would expect the government’s updated fiscal plans to make the BoE more cautious over further monetary easing, we don’t think it will prevent the BoE from lowering rates for the second time this week. Inflation and wage growth surprised to the downside over the past month which should give the BoE more confidence that inflation continues to slow towards their target. It could be another close vote similar to in August when 5 vs. 4 MPC members voted for the first 25bps cut in the easing cycle. However, we are no longer expecting the BoE to signal that they could speed up the pace of rate cuts in the near-term by opening the door to back-to-back cuts in December as well. The government’s updated fiscal plans are more supportive for the BoE sticking to gradual rate cut guidance at this week’s MPC meeting.

A slower pace of BoE rate cuts should remain supportive for a stronger pound by keeping rates on offer in the UK relatively higher for longer than in other major economies. The main downside risk for the pound is posed by a continued sell-off in the Gilt market especially if it starts to be driven more by the long-end of the curve reflecting a further loss of confidence in the UK government’s fiscal consolidation plans.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

08:45 |

Italian Manufacturing PMI |

Oct |

48.8 |

48.3 |

!! |

|

FR |

08:50 |

French Manufacturing PMI |

Oct |

44.5 |

44.6 |

!! |

|

GE |

08:55 |

German Manufacturing PMI |

Oct |

42.6 |

40.6 |

!! |

|

EC |

09:00 |

Manufacturing PMI |

Oct |

45.9 |

45.0 |

!! |

|

EC |

09:30 |

Sentix Investor Confidence |

Nov |

-12.7 |

-13.8 |

! |

|

GE |

10:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Sep |

-1.1% |

-1.1% |

! |

|

NZ |

20:00 |

RBNZ Financial Stability Report |

-- |

-- |

-- |

!! |

|

NZ |

22:00 |

RBNZ Gov Orr Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg