Volatility in US bond market spilling over into FX market

JPY: Japanese officials declined to confirm if intervened

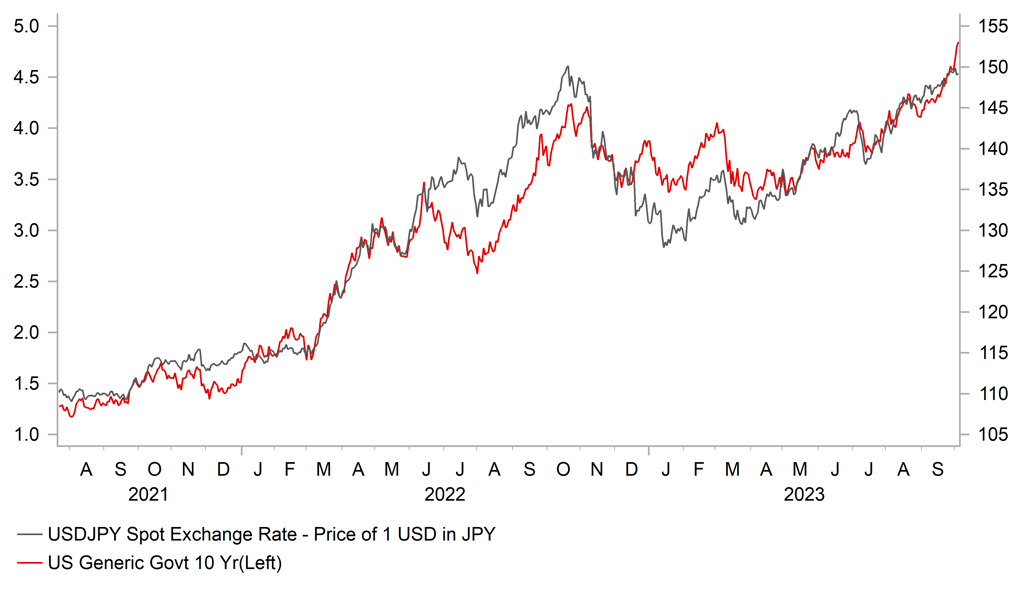

The yen has continued to trade at stronger levels overnight after yesterday’s more volatile trading session. After briefly rising back above to the 150.00-level and hitting an intra-day high of 150.16, the pair then fell abruptly to an intra-day low of 147.43. It has encouraged speculation that Japan intervened to support the yen like in September and October of last year. The scale of yesterday’s move was though more modest than recorded on 22nd September and 21st October when USD/JPY fell 5.54 and 5.72 big figures respectively from their intra-day highs to intra-day lows. At the same time, Finance Minister Suzuki has stated earlier in the day that he won’t judge the possibility of FX intervention on currency levels but through volatility which would seem somewhat inconsistent with intervening to support the yen just as USD/JPY broke above the 150.00-level. Overnight Japanese officials have declined to confirm if they intervened. Chief currency official Kanda instead continued to emphasize that they respond as always to excessive FX moves and are not ruling out any options regarding foreign exchange. He met with Prime Minster Kishida to discuss the economy but stated that he didn’t particularly discuss foreign exchange. He noted as well that it has been normal not to announce intervention. A similar message regarding excessive FX moves was repeated as well by Finance Minister Suzuki who warned that they are watching FX with a high sense of urgency. Overall, the comments continue to highlight that Japanese officials want to keep market participants wary over the imminent threat of intervention in an attempt to at least slow the pace of the move higher in USD/JPY. As we saw late last year, USD/JPY only began move lower on a more sustained basis when US yields topped out alongside intervention. The peak for the 10-year US Treasury yield last year on 21st October at 4.34% coincided with intervention from Japan and the peak for USD/JPY at 151.95.

However, it is not yet evident that the sell-off in the US Treasury market has reached a crescendo on this occasion. The 10-year US Treasury yield has continued to surge higher this week hitting a new cyclical high overnight of 4.86%. It has now increased sharply by around 80bps in just over a month with the pace of the move higher in US yields picking up at the start of October. It has been encouraged in recent days by more evidence that the US economy is proving resilient, although the moves appear somewhat exaggerated relative to the importance of the economic data flow. The latest JOLTS report revealed that job openings rebounded to 9.61 million in August. It was the first increase in job openings after three consecutive months of declines. The underlying trends from the JOLTS report are still that the rate of job openings, hiring and quits are all slowing and point to weakening labour demand and less pressure on wage growth. Nevertheless, the US rate market has been moving to price in a slightly higher probability of one final Fed hike later this year which currently stands at around a 50:50 probability. The release of the non-farm payrolls report on Friday should prove more important in determining whether the US bond market sell-off and US dollar rally extends further in the near-term. Japanese officials will be hoping for a weaker report to ease upward pressure on USD/JPY.

RISING US YIELDS BRIEFLY LIFT USD/JPY BACK ABOVE 150.00-LEVEL

Source: Bloomberg, Macrobond & MUFG Research

NZD: RBNZ adopts higher for longer rates mantra as well

The other main event overnight was the RBNZ’s latest policy meeting. It has resulted in the New Zealand dollar weakening modestly overnight. The NZD/USD rate briefly fell back below the 0.5900-level to an intra-day low of 0.5871, and the AUD/NZD rate rose back above the 1.0700-level. The initial market reaction highlights that the RBNZ’s policy update was not as hawkish as expected heading into the meeting. The New Zealand rate market is now somewhat less confident that the RBNZ will resume rate hikes after leaving rates on hold for the third consecutive meeting at 5.50%. The main change to the policy statement was the introduction of the guidance that “the Committee agreed that interest rates may need to remain at a restrictive level for a more sustained period of time”. It follows similar communication recently from other G10 central banks such as the ECB and Fed who have signalled that rates may need to remain at higher levels for longer.

The New Zealand rate market has interpreted the updated guidance as signalling it now favours keeping rates on hold for longer although it does not rule out further hikes. Stronger GDP growth after it was confirmed that New Zealand’s economy surprisingly avoided recession in the 1H of this year, the still tight labour market and the recent rise in oil prices have increased upside risks to the near-term inflation outlook. And could yet encourage another hike after the upcoming election on 14th October. The incoming data including release of the Q3 CPI report on 17th October will be important in determining whether the RBNZ hikes further or leaves rates on hold for longer. Over the past week the New Zealand dollar alongside other G10 commodity currencies have come under more selling pressure as the sharp ongoing adjustment in global yields is starting to have more of a negative spill-over impact on commodity prices alongside other risk assets.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q3 |

-- |

-0.4% |

! |

|

IT |

09:00 |

Italian Public Deficit |

Q2 |

-- |

12.1% |

! |

|

EC |

09:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

Services PMI |

Sep |

48.4 |

47.9 |

!! |

|

UK |

09:30 |

Services PMI |

Sep |

47.2 |

49.5 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Aug |

-11.6% |

-7.6% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Aug |

-0.3% |

-0.2% |

! |

|

US |

11:00 |

OPEC Meeting |

-- |

-- |

-- |

!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Sep |

153K |

177K |

!!! |

|

US |

14:45 |

Services PMI |

Sep |

50.2 |

50.5 |

!!! |

|

US |

15:00 |

Factory Orders (MoM) |

Aug |

0.2% |

-2.1% |

!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Sep |

56.5 |

57.3 |

! |

Source: Bloomberg