A stronger USD ahead of the NFP report

USD: Middle East risks & faster rate cuts in Europe provide support for USD

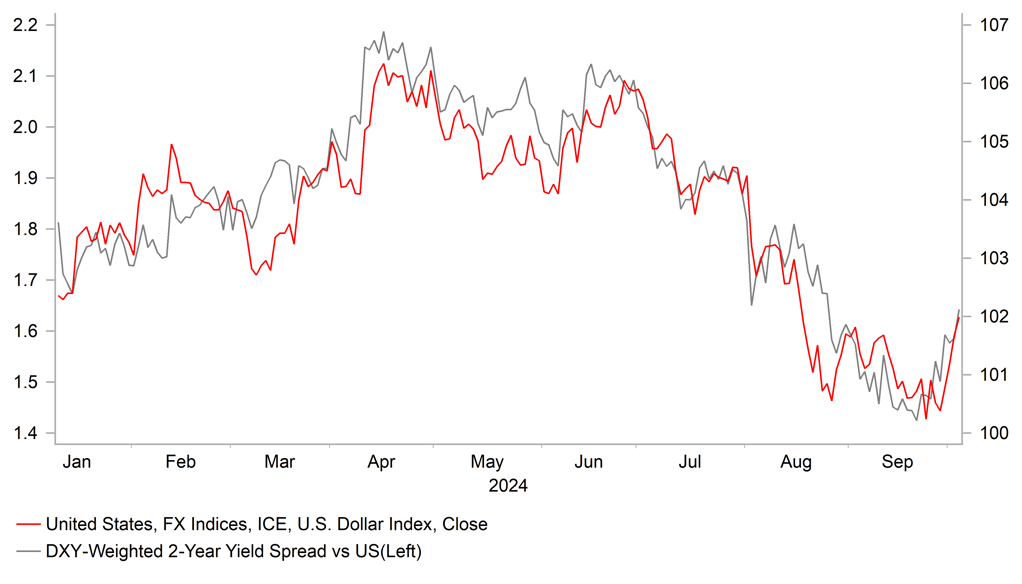

The escalating geopolitical tensions in the Middle East are starting to have more impact on financial markets including the foreign exchange market. The price of oil continued to move higher yesterday in response to heightened fears that supply could be negatively impacted by the conflict. It follows comments yesterday from US President Biden who when asked if he would support Israel striking Iran’s oil facilities stated that “we’re discussing that”. The price of Brent has since extended its advance this week to an intra-day high yesterday of USD77.99/barrel up from a low earlier this week of USD69.91/barrel on 1st October. The pick-up in geopolitical risks has helped the US dollar to rebound alongside the Norwegian krone ahead of the release today of the latest nonfarm payrolls report for September. Upside inflation risks from the Middle East have also contributed to a modest pick-up in US yields from year to date lows. The 2-year and 10-year US Treasury bond yields have risen by around 20bps and 25bps respectively since last month’s lows. The move higher in US yields has been driven by a combination of rising market-based measures of inflation expectations, and the scaling back of Fed rate cut expectations. Market participants have become more confident that the Fed will deliver a smaller 25bps rate cut at the next FOMC meeting in November. US rate market pricing has been moving more into line with the Fed’s own plans for two further 25bps cuts this year. The hawkish repricing has been supported by the recent run of stronger US economic data releases. The US economic data surprise index has turned positive this month for the first time since April/early May. Those expectations will be tested today by the latest nonfarm payrolls report for September. With the Fed becoming less concerned by upside risks to inflation and switching their focus more to downside risks to the labour market when setting policy, any further evidence of a weakening labour market today could encourage the Fed to deliver further larger 50bps rate cuts posing downside risks for the US dollar.

At the same time, the US dollar has derived support this week from building expectations for faster rate cuts from European central banks which is helping to provide an offset to the negative impact on the US dollar from Fed policy action. The pound took a big hit yesterday after BoE Governor Bailey signalled that the BoE could speed up the pace of their rate cut plans if they continue to see positive progress on inflation in the UK. The UK rate market has moved to more fully price in the possibility of the BoE delivering back-to-back 25bps rate cuts in November and December in line with our own updated forecasts. Similarly, the euro-zone rate market has moved to fully price in two further 25bps rate cuts from the ECB by the end of this year in October and December. Comments from ECB President Lagarde and even the normally hawkish Executive Board member Schnabel in recent days have given the green light for speeding up the pace of rate cuts. Inflation has surprised significantly to the downside in the euro-zone and Switzerland this week. With inflation in Switzerland moving further below the SNB’s target, it will keep pressure on the SNB to cut rates further and/or intervene to weaken the Swiss franc. The SNB will be concerned that the Swiss franc could strengthen sharply if tension in the Middle East becomes more disruptive for the global economy and financial markets.

USD REBOUND SUPPORTED BY YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Delayed BoJ rate hike expectations continue to weigh on the yen

The yen has been the worst performing G10 currency this week. It has seen USD/JPY rise from an intra-day low of 141.65 on Monday to a high yesterday of 147.24. Heightened uncertainty over the outlook for BoJ has encouraged a weaker yen this week alongside the pick-up in US yields and Middle East tensions.

In his first speech to parliament overnight, new Prime Minister Ishiba emphasized that his top economic policy is to defeat deflation. He stated that “I will decisively end deflation ad build a future for our economy”. He will seek to raise wages, boost productivity, support the revival of rural areas and turn Japan into an ”investment powerhouse” by continuing to encourage a shift of private savings into investment. He has already instructed his cabinet to draw up a package of fiscal support measures that aim to reduce the impact of high prices and support growth. The package is expected to include cash handouts for low-income households and regional economies. The government will submit an additional budget to parliament after the snap election on 27th October to help fund the fiscal support measures. Beyond price relief efforts, the government is also expected to try to help households become more energy efficient and support regional economies.

This week’s developments have further encouraged market expectations that the BoJ will not be in a rush to hike rates further. The BoJ had already indicated at their last policy meeting that the stronger yen and financial market instability over the summer had helped to dampen upside inflation risks and given them more time to consider whether to hike rates further. If the BoJ waits until next year to hike rates further, it poses upside risks to our forecast (click here) for USD/JPY to end this year at 141.00.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

08:55 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

IT |

11:00 |

Italian Retail Sales (MoM) |

Aug |

0.2% |

0.5% |

! |

|

EC |

11:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

CA |

12:00 |

Leading Index (MoM) |

Sep |

-- |

0.15% |

! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Sep |

0.3% |

0.4% |

!!! |

|

US |

13:30 |

Nonfarm Payrolls |

Sep |

147K |

142K |

!!! |

|

US |

13:30 |

Unemployment Rate |

Sep |

4.2% |

4.2% |

!!! |

|

US |

14:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg