Risk aversion intensifies and US dollar gains vs high-beta G10

USD: JPY, CHF & EUR perform best

The performances of G10 currencies yesterday was similar to the more normal type response to risk aversion that we were used to before the global inflation shock when the yen in particular lost its safe-haven status. The yen was top performing G10 currency yesterday, gaining 1.0% versus the dollar at one stage while the Swiss franc was next best followed by the euro. The higher beta G10 currencies suffered most with AUD, NOK and NZD the three worst performing G10 currencies.

Global growth fears are certainly intensifying which we suspect will potentially see a further extension of G10 FX performance like we saw yesterday – at least through to the FOMC meeting on 18th September. A weak ISM Manufacturing report yesterday prompted US equity market weakness with tech leading the way. Risk reduction is always most evident in where positioning is heaviest and Nvidia fell by 9.5% as global growth fears intensify. The ISM data was not all bad – the headline index increased but the production index fell to a new cyclical low of 44.8 – it was the fifth consecutive decline in the index and for the second consecutive month it was the lowest since Covid collapse in 2020. The employment index did improve (by 2.6ppts) but that was after a 5.9ppt drop last month and still left the average level over the last two months at the worst point since covid. Inventories also added to the overall increase in the index which could well be unintentional and a signal of weakening demand and if so could prompt a quick reversal. That could explain also the drop in the New Orders Index to the lowest level since May last year. So the overall picture hasn’t changed – the manufacturing sector remains weak and the outlook is not particularly favourable.

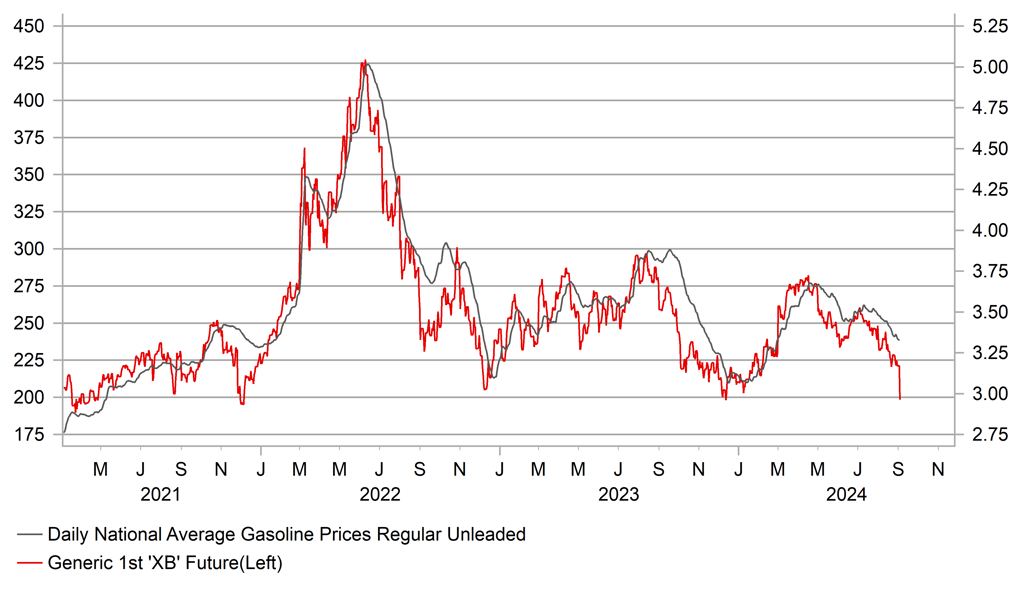

Every piece of economic data will be traded on in terms of shaping expectations on whether the FOMC will cut by 25bps to 50bps on 18th September. The jobs data will be key and today we get the JOLTS report which could influence expectations for Friday. But broader global conditions could also shape the reaction function of the FOMC. Certainly the moves in commodity prices at the margin could mean FOMC members are a little less concerned over inflation risks. NYMEX crude oil is now down close to 20% from the year-to-date high in April and is at the lowest level since the very start of January. Most important from a US consumer perspective is gasoline prices and we have seen sharp declines in gasoline prices as well – the front contract hit a new year-to-date low yesterday and is close to falling to levels we haven’t seen since early 2021. As can be seen in the chart below, the wholesale NYMEX price correlates tightly with the retail gasoline price and the drop points to the potential for retail gasoline prices to fall further, possibly to levels below USD 3 per gallon.

The OIS market implies 33bps of cuts priced for the FOMC meeting on 18th September. If we continue to see risk-off moves in global markets and global commodity market in particular, that points to increased risks of a larger 50bp cut from the Fed as inflation risks ease further which will pressure USD/JPY further to the downside.

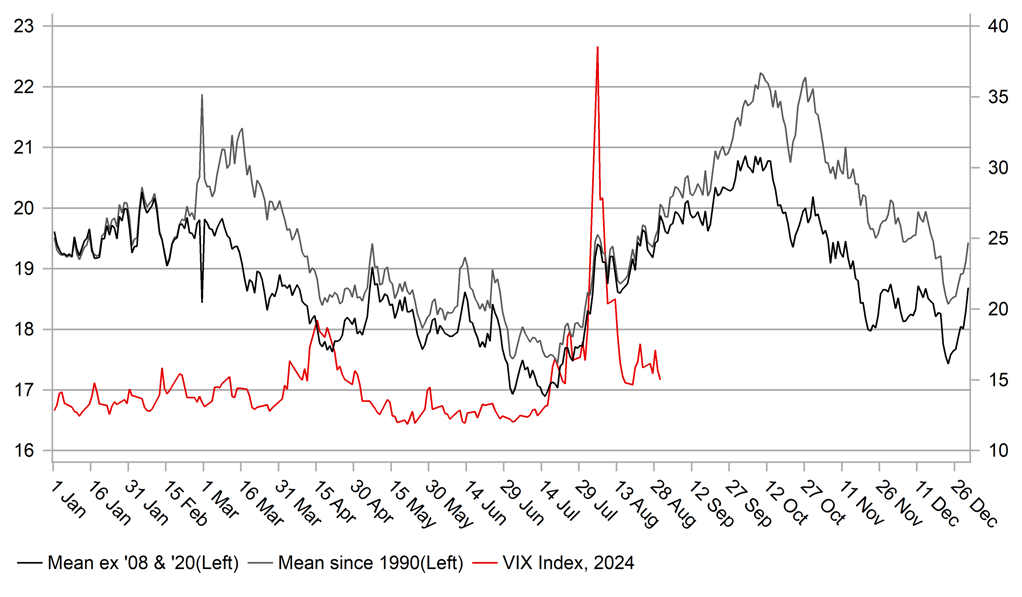

HEADING INTO THE HIGHEST PERIOD OF VOLAILITY IN THE CALENDAR YEAR

Source: Macrobond & Bloomberg

CAD: BoC set to cut again

The Bank of Canada is set today to cut the key policy rate by another 25bps, which will be the third consecutive 25bp cut following the cuts at the June and July meetings. The OIS market is currently priced for 30bps implying some risk of a larger than expected cut today. We doubt the BoC will take that bolder step but Governor Macklem is certainly in a position today to emphasise the scope for further easing ahead. With the FOMC about to commence its own easing cycle, the BoC has a little more license to confidently signal the scope for further easing ahead. Since the BoC began cutting on 5th June, the Canadian dollar has advanced by about 1.0% versus the US dollar.

Since the last cut in July we have had another favourable inflation print with the underlying trimmed mean and median annual rates coming in 0.1ppt lower than expected. The median annual rate at 2.4% is now just below the mid-point of the 1.0%-3.0% range. Given the broader moves in commodity prices and energy in particular, as outlined above, the BoC may well see increased risks of inflation extending further lower from here. While real GDP growth on a Q/Q SAAR basis did come in stronger than the BoC expected at 2.1% other data was weaker with the jobs data confirming two consecutive declines in employment. While only very small declines it was the first back-to-back decline in employment since Aug-Sep 2022.

Assuming the BoC do not cut by 50bps and assuming there is no strong guidance on a plan to do so we see the scope for yields to extend lower as quite limited. The OIS implies the policy rate getting to close to 3.00% by the middle of next year, which suggests a steady rate cutting cycle in 25bps clips with some risk of a 50bp cut along the way. The 3.00% policy rate is about 40bps lower than where the market sees the fed funds rate – implying some narrowing going forward which will help support CAD and limit upside pressure for USD/CAD. Given the BoC began cutting in June, there is less need at this juncture to become more aggressive in easing and that should help ensure continued CAD support.

DISINFLATIONARY COMMODITY PRICE DECLINES WILL HELP EASE INFLATION CONCERNS FURTHER AHEAD OF FOMC

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

IT |

08:45 |

Italian Services PMI |

Aug |

52.4 |

51.7 |

! |

|

FR |

08:50 |

French Services PMI |

Aug |

55.0 |

50.1 |

!! |

|

GE |

08:55 |

German Composite PMI |

Aug |

48.5 |

49.1 |

!! |

|

GE |

08:55 |

German Services PMI |

Aug |

51.4 |

52.5 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Aug |

51.2 |

50.2 |

!! |

|

EC |

09:00 |

Services PMI |

Aug |

53.3 |

51.9 |

!! |

|

UK |

09:30 |

Composite PMI |

Aug |

53.4 |

52.8 |

!!! |

|

UK |

09:30 |

Services PMI |

Aug |

53.3 |

52.5 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Jul |

-2.5% |

-3.2% |

! |

|

EC |

10:00 |

PPI (MoM) |

Jul |

0.3% |

0.5% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

0.5% |

! |

|

US |

13:30 |

Trade Balance |

Jul |

-78.80B |

-73.10B |

!! |

|

CA |

13:30 |

Trade Balance |

Jul |

0.70B |

0.64B |

!! |

|

CA |

14:45 |

BoC Rate Statement |

-- |

-- |

-- |

!!! |

|

CA |

14:45 |

BoC Interest Rate Decision |

-- |

4.25% |

4.50% |

!!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Jul |

-- |

10.4% |

! |

|

US |

15:00 |

Durables Excl Transport (MoM) |

Jul |

-- |

-0.2% |

! |

|

US |

15:00 |

Factory Orders (MoM) |

Jul |

4.6% |

-3.3% |

!! |

|

US |

15:00 |

Factory orders ex transport (MoM) |

Jul |

-0.2% |

0.1% |

! |

|

US |

15:00 |

JOLTs Job Openings |

Jul |

8.090M |

8.184M |

!!! |

|

US |

15:00 |

Total Vehicle Sales |

Aug |

15.40M |

15.80M |

! |

|

CA |

15:30 |

BOC Press Conference |

-- |

-- |

-- |

!!!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

Source: Bloomberg