JPY continues to surge higher amidst global equity market rout

JPY: Stock market rout & hard landing fears reinforce yen rebound

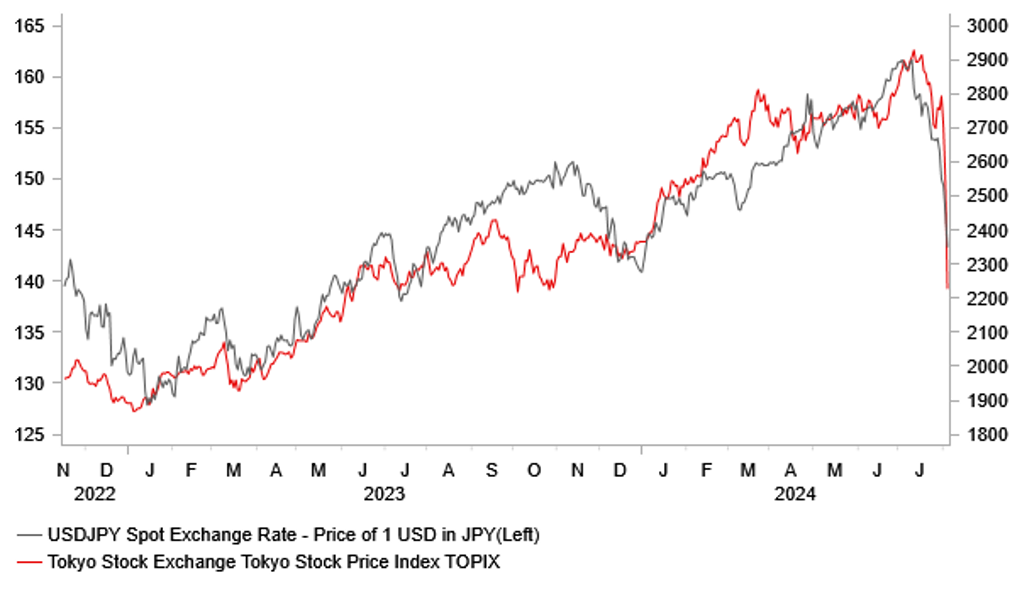

The yen has continued to surge higher at the start of this week resulting in USD/JPY dropping to a low of 142.22. The pair has now fallen by around 20 big figures over the past month. The sharp pace of yen appreciation is coinciding with an intensifying sell-off for global equity markets. The TOPIX equity index in Japan has fallen overnight by almost 13% extending its decline since last month’s peak to 25% as it has fully reversed all of the gains recorded over the last year and officially moved into bear market territory. According to Bloomberg, the three-day percentage decline is the biggest on record dating back to 1959. The sharp strengthening of the yen and the BoJ’s hawkish policy update are contributing to the underperformance of the Japanese equity market after years of outperformance. Other equity markets in Asia have also plunged in value with the sharp sell-off set to extend into the European and US trading sessions today. The intensifying risk-off trading conditions have contributed to the other traditional safe haven currency off the Swiss franc outperforming in the FX market. In contrast, the US dollar has corrected lower for now following the release at the end of last week of the much weaker US nonfarm payrolls report for July which has heightened fears that the Fed has fallen behind the curve in easing policy. Alongside the plunge in global equity markets, the weaker nonfarm payrolls report will also heightened fears over a harder landing for the US and global economies. In light of these negative developments, the US rate market has moved to price in much more aggressive Fed rate cuts. There is now almost 50bps of Fed rate cuts fully priced in by the next FOMC meeting in September, and a cumulative total of around 225bps of cuts in the year ahead. If the plunge in global equity markets continues in the coming days and weeks, it will no doubt encourage speculation that the Fed could even consider an inter-meeting rate cut. So far the sharp drop in US yields has been weighing on the US dollar, but there are already tentative signs this morning that the US dollar could begin to benefit from a pick-up in safe haven demand alongside the yen and Swiss franc.

The release of the nonfarm payrolls report Friday revealed that employment growth in the US slowed to just 114k in July following a downwardly revised increase of 179k in June. The recent run of downward revisions to the nonfarm payrolls suggests that it likely to be revised to an even weaker number for July in the coming months. It provides further evidence that labour demand continues to slow in the US while the labour supply is still improving. The household survey revealed that the labour force increased by 420k in July which more than offset the 67k increase in employment. The increasing slack in the US labour market was evident by a further 0.2point increase in the unemployment rate to 4.3% in July. The unemployment rate has now increased by 0.9 points from the cyclical low of 3.4% from last April. The triggering of the Sahm rule has contributed to building concerns over a harder landing for the US economy. With slack in the US labour market continuing to loosen more than the Fed expected and more compelling evidence of slowing US inflation emerging, it is clear that the Fed should start to cut rates, and should have cut last week. The Fed had been expecting the unemployment rate to remain at just above 4% in the coming years. Developments in financial markets will now determine whether they wait until the next meeting in September to start cutting rates.

JAPANESE EQUITIES PLUNGE AS THE JPY CONTINUES TO SURGE HIGHER

Source: Macrobond & MUFG GMR

GBP: More troubled waters for the GBP over the summer period

The GBP has been one of the worst performing G10 currencies over the past week resulting in EUR/GBP rising back up to 0.8550. The GBP has been undermined by the marked deterioration in global investor risk sentiment. Global equity markets have been correcting sharply lower since the middle of last month which is encouraging an unwind of carry trade positions. Long GBP positions held by leveraged funds prior to the recent correction lower for global equity markets had reached their highest levels since April 2018. It leaves the GBP vulnerable to further weakness in the near-term from the scaling back of excessive long positioning.

At the same time, the GBP has been undermined by the BoE’s decision to begin to lower rates at last week’s MPC meeting. The 0.25 rate cut was not fully priced in before the MPC meeting, and the UK rate market has since moved to price in more easing encouraged as well by heightened global growth concerns and the sharp global equity market sell-off. The UK rate market has moved to more fully price in 50bps of cuts by November. Another cut as soon as at the next meeting in September was judged as unlikely given that the decision to cut rates last week was such a close call (5-4 vote in favour of a cut and some members who voted for a cut noted their decision was finely balanced), but negative external developments could pressure the BoE to cut rates again sooner. At the September MPC meeting the BoE will also update plans for QT. The BoE will vote on the QT target for the next twelve months. Market participants expect the pace of QT to remain the same as in the previous twelve months at GBP100 billion even as the BoE begins to cut rates.

For the year ahead there are currently around 125bps of cuts priced. It roughly matches our own forecasts for the BoE policy rate (click here) with risks to the policy rate more skewed to the downside. While the BoE remains concerned over the risk of more persistent inflation for now, we expect those risks to ease further heading into next year. Further evidence of a lagged slowdown in services inflation and wage growth will open up more room for the BoE to lower rates to less restrictive levels next year. The BoE’s own updated inflation forecasts show the median projections for headline CPI slowing to 1.7% in two years’ time and 1.5% in three years’ time although the skew is to the upside. The GBP’s near-term performance though will be driven more by global equity market developments which are increasing the likelihood of a sharper correction lower for cable as well. EUR/GBP has already risen up to resistance from the 200-day moving average at around 0.8560, and for cable support from the 200-day moving average comes in at around 1.2650.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Services PMI |

Jul |

51.9 |

52.8 |

!! |

|

UK |

09:30 |

Services PMI |

Jul |

52.4 |

52.1 |

!!! |

|

EC |

09:30 |

Sentix Investor Confidence |

Aug |

-5.5 |

-7.3 |

! |

|

EC |

10:00 |

PPI (YoY) |

Jun |

-3.3% |

-4.2% |

! |

|

CA |

12:00 |

Leading Index (MoM) |

Jul |

-- |

0.15% |

! |

|

US |

14:45 |

Services PMI |

Jul |

56.0 |

55.3 |

!!! |

|

US |

15:00 |

CB Employment Trends Index |

Jul |

-- |

110.27 |

! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Jul |

-- |

49.6 |

! |

|

US |

19:00 |

Loan Officer Survey |

-- |

-- |

-- |

! |

|

US |

22:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg