JPY extends outperformance – more to come?

JPY: Wage data the latest catalyst for yen buying

The dollar swings have been notable in recent days reflecting the announcements and then postponements of tariffs against Canada and Mexico and the implementation of tariffs against China and the threats against Europe. From the high traded on Monday, the US dollar is down now by close to 2%, which on a DXY basis nearly captures a full retracement of the move stronger for the US dollar from the low on 30th January. Unpredictable policy announcements will inevitably lead to more financial market swings like we have had in recent days.

The dollar is now weaker on a year-to-date basis and if we proceed over the coming days and certainly weeks without any additional tariff announcements then we are likely to see the dollar retrace further weaker following the significant 8% advance in Q4 last year on expectations of an aggressive start to trade tariffs. We certainly believe there is more to come on tariffs but a lull in announcements is of course possible. That leaves high-beta G10 currencies best placed to outperform. But it is the yen that remains the top performing G10 currency on a year-to-date basis, up 2.7%. The BoJ hike in January continues to have an impact in shifting investor expectations on the outlook for BoJ policy this year which is helping to narrow rate spreads and fuel appetite for USD/JPY selling, even when risk appetite is favourable and USD/JPY volatility is low. 1-month vol remains below 10%, levels not seen since July last year before the BoJ-triggered turmoil sent USD/JPY sharply lower and vol higher. The 2-year US-JP bond yield spread today hit the lowest level since October last year.

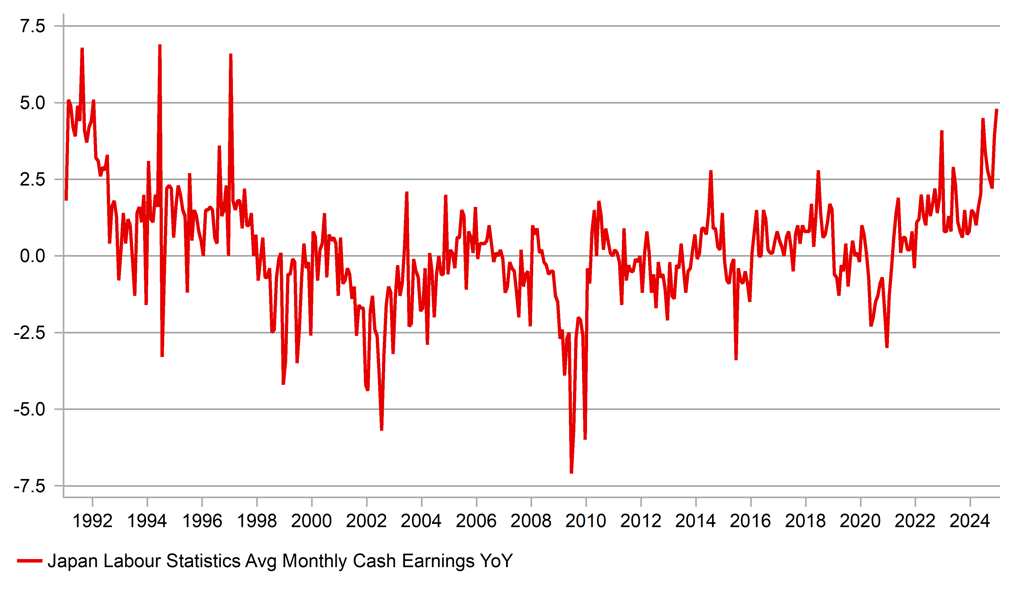

The latest catalyst for yen buying was the much stronger wage data released today. The data was notably stronger than market expectations – total cash earnings jumped 4.8% YoY. The consensus was 3.7%. This was driven by winter bonuses, with ‘special cash earnings’ surging 6.8%. Data that removes distortions related to survey samples changes and stripping out bonuses – base salaries for full-time workers – increased by 2.8%, which is around the levels the BoJ believes are consistent with price stability. The wage data is strong as we approach the ‘shunto’ wage negotiation period that the BoJ believes will confirm another year of solid wage increases.

The data comes just after the BoJ hiked rates in January so it will have limited impact on near-term rate expectations. But the data still argues that the BoJ could certainly hike on two more occasions this year, which is certainly not priced. The dynamics are changing in the JPY market and narrowing spreads can continue, encouraging increased JPY-buying hedging and discouraging speculative yen selling. Selling USD/JPY on rallies increasingly makes sense.

TOTAL LABOUR CASH EARNINGS INCREASED 4.8% YOY IN DECEMBER, THE LARGEST INCREASE SINCE JANUARY 1997

Source: Bloomberg, Macrobond & MUFG GMR

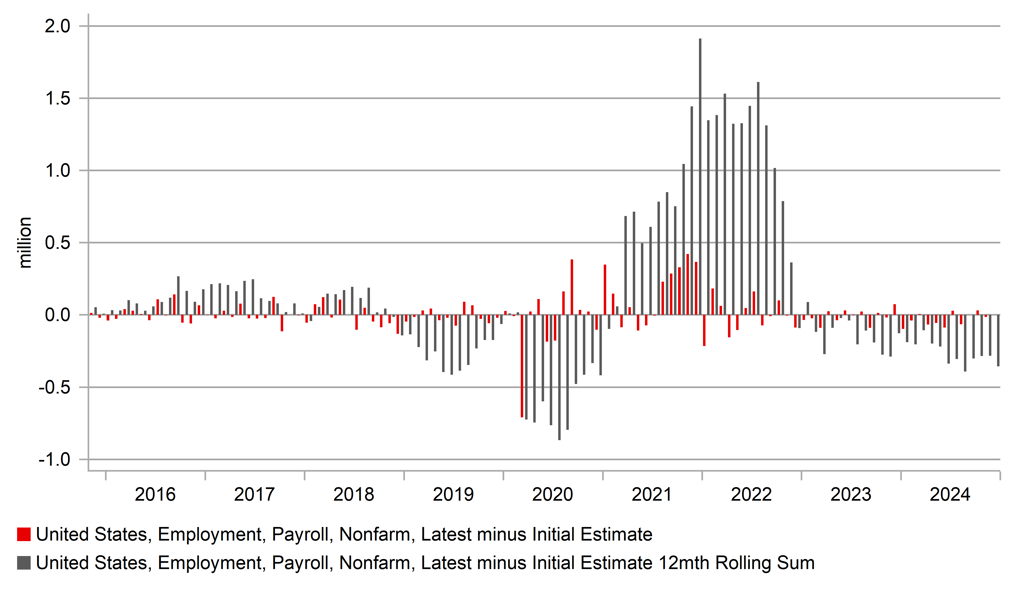

USD: Focus may now shift back to incoming data

The uncertainty related to Trump’s trade tariff policies will likely have some impact on business decision-making. The obvious areas where that could become apparent in the data would be in business investment and the labour market. FOMC transcripts released in January from meetings that took place in 2019 highlighted the concerns that were growing then over the signs of a negative impact on businesses from the ongoing trade uncertainties during Trump’s first term in office. The above chart highlights the latest NFP estimate minus the initial estimate with the 12mth cumulative total showing a large downward revision in 2019 prior to covid. That’s not necessarily relevant now for first estimates of the jobs market but it does underline the worsening labour market back then which at least some FOMC members felt was down to trade policy uncertainties.

The difference now is that we are at a different point in the economic cycle and policy has already been restrictive for some time and the economy is likely heading for a slowdown after a period of strong growth. The JOLTS data released yesterday certainly highlights the course of travel – which is a loosening of labour market conditions due in part to the restrictive monetary policy and now potentially reinforced by trade policy uncertainty. Job openings fell from 8.16mn in November to 7.60mn in December – the drop was larger than nearly all Bloomberg estimates and was led by healthcare and professional and business services.

Crucially from the Fed it is hard to see much in the way of inflation risks stemming from the labour market. The number of vacancies per unemployed worker remained at 1.1, the current low point and well below the 2:1 ratio that we saw at the peak of labour market strength post-covid. The Quits rate, which correlates well with wage pressures remained at 2.0% and consistent with labour market conditions back in early 2016 before Trump’s first term in office (when covid is excluded). The annual growth rate in average hourly earnings around the beginning of 2016 was 2.5%, well below the current growth rate of 3.9%.

The data is consistent with the risk to Friday’s NFP being skewed to the downside. There is no direct month-to-month link of course between JOLTS and NFP but the data does certainly throw doubt on the idea that the US jobs market is strengthening post-election. The 256k increase in December therefore looks like an outlier and hence we may see a correction. We also had very cold weather through the payrolls survey week. We still see a cyclical slowdown unfolding that points to scope for the FOMC cutting by more than currently priced that will allow for some dollar correction weaker once we get beyond the pronounced period of trade policy uncertainty.

US LABOUR MARKET CONDITIONS WERE DETERIORATING PRIOR TO COVID – 12MTH ROLLING SUM OF LATEST PAYROLL ESTIMATE MINUS 1ST ESTIMATE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Composite PMI |

Jan |

50.1 |

48.0 |

!! |

|

GE |

08:55 |

German Services PMI |

Jan |

52.5 |

51.2 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Jan |

50.2 |

49.6 |

!! |

|

EC |

09:00 |

Services PMI |

Jan |

51.4 |

51.6 |

!! |

|

UK |

09:30 |

Composite PMI |

Jan |

50.9 |

50.4 |

!!! |

|

UK |

09:30 |

Services PMI |

Jan |

51.2 |

51.1 |

!!! |

|

EC |

10:00 |

PPI (MoM) |

Dec |

0.5% |

1.6% |

! |

|

EC |

10:00 |

PPI (YoY) |

Dec |

-0.1% |

-1.2% |

! |

|

US |

12:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Jan |

148K |

122K |

!!! |

|

US |

13:30 |

Trade Balance |

Dec |

-96.50B |

-78.20B |

!! |

|

CA |

13:30 |

Trade Balance |

Dec |

1.00B |

-0.32B |

!! |

|

US |

14:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

EC |

14:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Jan |

52.4 |

55.4 |

!! |

|

US |

14:45 |

Services PMI |

Jan |

52.8 |

56.8 |

!! |

|

US |

15:00 |

ISM Non-Manufacturing PMI |

Jan |

54.2 |

54.1 |

!!!! |

|

US |

18:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

20:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg