US dollar unlikely to be at a turning point just yet

USD: EUR gains likely to reverse

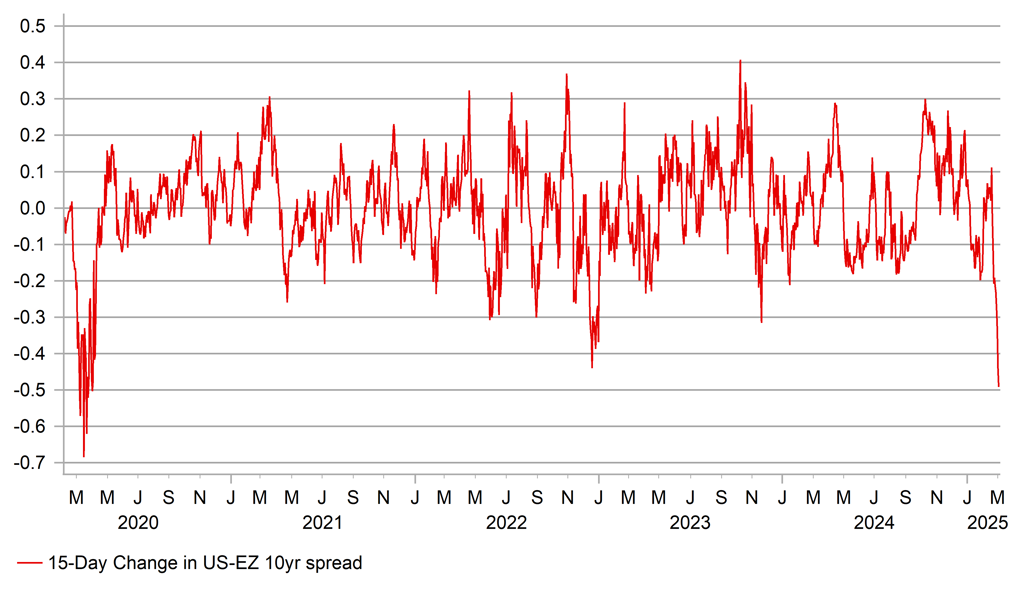

The dollar depreciation momentum could have further to run and while we abandoned our call for EUR/USD to drop below parity, we maintain our view that renewed US dollar strength is still likely. The sheer scale of the move in spreads is a very significant short-term headwind for the dollar and is of primary importance in influencing FX at the moment. Yesterday, we highlighted the 10-year yield US-EZ spread move versus EUR/USD highlighting the scope for further EUR/USD gains. To put that in context, the below chart highlights that change from the most recent peak on 12th February (the day of stronger US CPI data that was then followed by weaker PPI data the following day) – which covers a 14-day period. The drop was just short of 50bps – the largest drop since 1st April 2020 when financial markets were still responding to the initial shock of Covid. EUR/USD soon after began a sharp rally higher. EUR was the top performing G10 currency yesterday helped toward the end of the trading day by the confirmation that Friedrich Merz and the CDU-CSU had agreed a deal with the SPD to create separate funds to boost spending on defence and infrastructure. For defence, the agreement would mean that any defence spending over 1.0% of GDP (or about EUR 45bn) would be excluded from the calculations for Germany’s debt brake (the constitutional rule limiting the structural deficit to just 0.35% of GDP). Secondly, a special fund, also excluded from debt brake calculations, of EUR 500bn would be created in order to boost investments in infrastructure over a 10-year period. The agreement also includes the ability of Federal states to run deficits up to 0.35% of GDP – currently the Federal states cannot run any budget deficits.

The Greens were not part of the deal and under the numbers of the current parliament will be key in getting this passed. The current parliament can be convened up until 25th March. The Greens are staunch supporters of Ukraine and have argued the need for increased infrastructure spending, so on the face of it these plans could pass parliament. The AfD will strongly oppose this and remind voters that Merz campaigned against changes to the debt brake but extraordinary developments in recent days likely provides cover for Merz to justify the action.

But more tariff action is very likely still coming for Europe, which in our view will limit EUR/USD upside from these levels. Trump last night in his address to Congress was clear that the EU would be hit with tariffs. The EU was specifically mentioned along with China, Brazil, India, Mexico and Canada. However, as always with Trump, action remains unclear. Howard Lutnick stated prior to Trump’s address that he was considering a deal to ease tariffs on Canada and Mexico as soon as Wednesday.

With US yields rebounding last night and Trump sounding very aggressive on future tariff action on the EU and others, we are unconvinced that this move higher in EUR will extend much further. Leveraged Funds have been short EUR but positioning has already been reduced and is not extreme by historical comparison.

DROP IN US-EZ 10YR SPREAD SINCE 12TH FEB TO YESTERDAY (14 DAYS) THE LARGEST IN THAT PERIOD SINCE COVID IN 2020

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Washington unease a further positive for yen

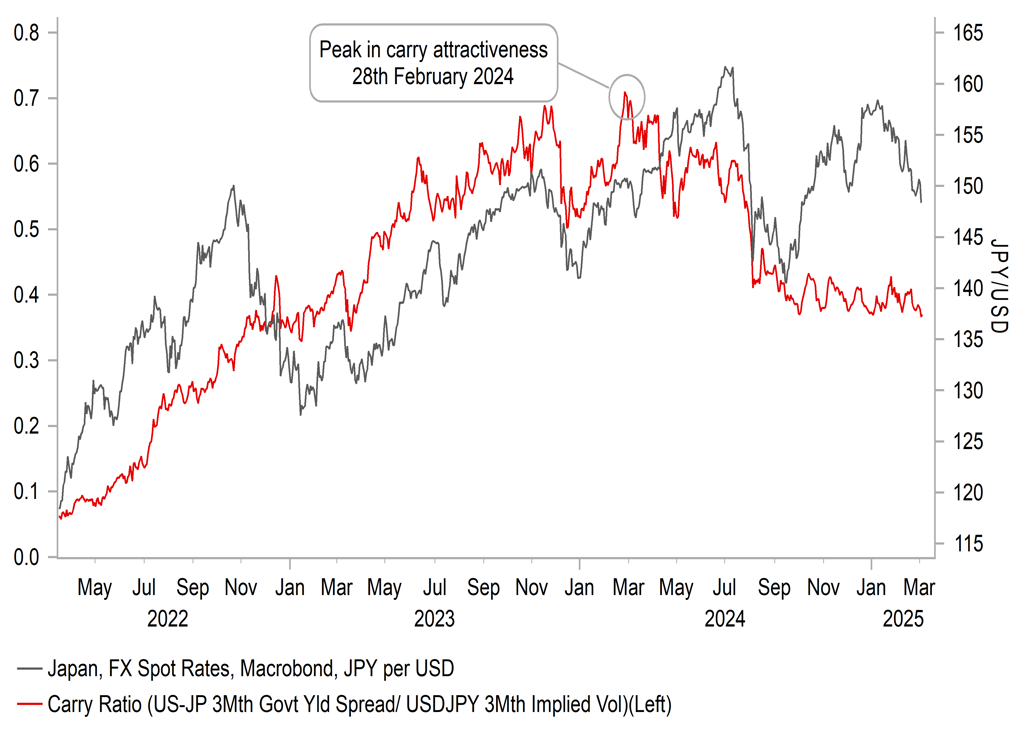

The yen ended up the worst performing G10 currency yesterday driven lower by the bounce in front-end US yields toward the end of the trading day. The yen had been the best performing currency helped by lower yields and falling equity markets. That risk correlation was greatly diluted during the global inflation shock given US rates were in general surging higher and was often the very reason for episodes of risk-off curtailing the scope for JPY and CHF to strengthen. But we are now back to signs of more traditional FX responses given front-end yields in the US are declining. The 2-year UST bond yield is still down 46bps since 12th February but was down 55bps at one stage yesterday. In this world of tariffs and trade wars, the yen could benefit further from Washington’s complaints in regard to currency misalignment. Trump on Monday stated that “Japan, China and other countries are devaluing their currencies”. He went to add that “the solution is tariffs. We’ll make up for it with tariffs”. If Trump does become more vocal about currency manipulation and complains about excessive US dollar strength it will very likely for starters discourage yen speculative selling and if forceful and repetitive enough could encourage yen speculation buying, especially if US yields decline further from here.

Vice Finance Minister for International Affairs, Atsushi Mimura, earlier on Monday spoke about the weak yen stating that “this will definitely have some negative impact in terms of achieving real wage increases”. This should serve as a reminder to the Trump administration that in general, the government in Japan views yen depreciation as being negative and have of course proven that with yen buying intervention both in 2022 and 2024. Yen buying totalled a record JPY 24,55bn (USD 160bn). Sustained inflation over the medium to long term is far more likely via solid wage growth than via any currency depreciation that could be further delivered from these levels.

Therefore with both the Japanese and the US authorities seemingly not opposed to an orderly strengthening of the yen, this could be seen as the line of least resistance. Of course, front-end rate moves in the US will remain key but both Tokyo and Washington being content to see a strengthening it would fuel outperformance, especially if Trump makes clear that’s the best avenue for Japan to avoid reciprocal tariff action that is scheduled for April. Downward momentum in USD/JPY has now certainly eased following the sharp rebound in 2-year US yields but we continue to favour a lower USD/JPY and this bounce higher, which could extend further, is unlikely to prove sustained. Deputy Governor Uchida spoke today and while he emphasised caution on hiking rates, the rates market did not react and his speech had limited impact on FX.

USD/JPY VOL VS CARRY PICK-UP MAKING SHORT JPY LESS ATTRACTIVE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Composite PMI |

Feb |

51.0 |

50.5 |

!! |

|

GE |

08:55 |

German Services PMI |

Feb |

52.2 |

52.5 |

!!! |

|

IT |

09:00 |

Italian GDP (YoY) |

Q4 |

0.5% |

0.5% |

! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q4 |

0.0% |

0.0% |

! |

|

EC |

09:00 |

S&P Global Composite PMI |

Feb |

50.2 |

50.2 |

!! |

|

EC |

09:00 |

Services PMI |

Feb |

50.7 |

51.3 |

!! |

|

UK |

09:30 |

Composite PMI |

Feb |

50.5 |

50.6 |

!!! |

|

UK |

09:30 |

Services PMI |

Feb |

51.1 |

50.8 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Jan |

-- |

0.0% |

! |

|

EC |

10:00 |

PPI (MoM) |

Jan |

0.3% |

0.4% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-1.2% |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Feb |

144K |

183K |

!!! |

|

CA |

13:30 |

Labor Productivity (QoQ) |

Q4 |

0.3% |

-0.4% |

!! |

|

UK |

14:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

UK |

14:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Feb |

50.4 |

52.7 |

!! |

|

US |

14:45 |

Services PMI |

Feb |

49.7 |

52.9 |

!! |

|

US |

15:00 |

Factory Orders (MoM) |

Jan |

1.5% |

-0.9% |

! |

|

US |

15:00 |

ISM Non-Manufacturing PMI |

Feb |

53.0 |

52.8 |

!!!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

|

NZ |

20:30 |

RBNZ Gov Orr Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg