USD & US yields lose some upward momentum but for how long?

USD: Some relief for US bond market but will it prove short-lived?

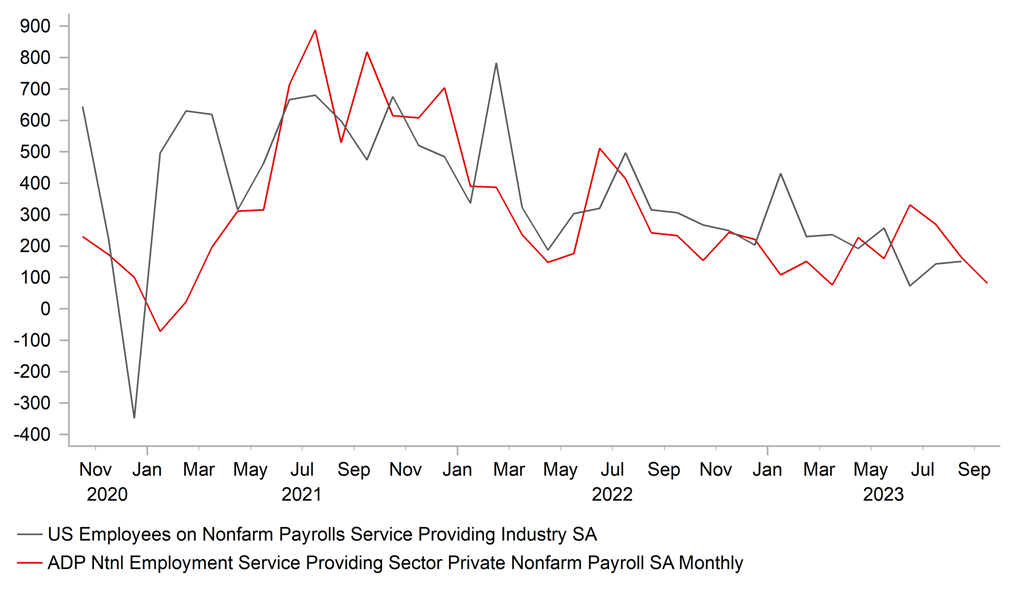

It was another volatile trading session yesterday in the foreign exchange market which continues to be driven by spill-overs from the US bond market. After hitting an intra-day high of 4.88% yesterday, the 10-year US Treasury bond yield has since fallen back to an intra-day low overnight of 4.70%. The pullback in US yields has resulted in a reversal of recent US dollar strength. The dollar index has fallen by around -0.8% from the high at the end of last week resulting in EUR/USD moving back above the 1.0500-level and USD/JPY falling back closer to the 148.00-level. The correction lower for US yields has been encouraged by the release of softer US economic data but more importantly could be an indication that the trends are starting to lose upward momentum. Technical momentum indicators are signalling that 10-year US Treasury yield is the most overbought since September of last year just prior to the peak in October. The two main economic data releases that have brought some temporary relief for the US bond market have been the ADP and ISM services surveys for September. The ADP survey has estimated that private sector jobs growth likely slowed further to 89k in September. The breakdown revealed that service sector job growth slowed to 81k. While the ADP survey is not always the most reliable leading indicator of employment growth in the non-farm payrolls report, it did prove to be an accurate indicator for the last NFP report for August (ADP for August at 177k vs. NFP private at 179k) which may encourage market participants to place more weight on the importance of the ADP reading ahead of the release of the next NFP report on Friday. The ADP survey does fit with other indicators pointing towards a continuing slowdown in labour demand as employment growth is moving back to more normal levels prior to COVID.

The correction lower for US yields was alo supported by softening in the more forward leading components of the ISM services survey. The new orders sub-component dropped sharply by 5.7 point to 51.8 in September. It was the lowest reading since December 2022 although that did prove to be just a one-off sharp fall. While the sharp drop in September could prove again to be a one-off that is quickly reversed, it will also heighten concerns that the negative impact of higher rates is starting to be felt more by the service sector. With US rates moving sharply higher over the past month, the US bond market is helping to tighten financial conditions and should make the Fed feel more comfortable that they don’t need to hikes rates again. Market attention will now switch to the release of the NFP report on Friday which will be important in determining whether the US bond market sell-off and US dollar rally extends further in the week ahead.

One additional factor that has also helped to dampen upward pressure on US yields and market-based measures of inflation expectations has been the sharp decline in the price of oil. After hitting an intra-day high of USD97.69/barrel at the endo f last month, the price of Brent has fallen back abruptly to closer to USD86/barrel at the start of October. It brings the price level back below where it was trading a year ago which if sustained is a more supportive development for a further slowdown in headline inflation readings going forward. Bloomberg’s commodity price index has dropped back closer to year to date lows as well contributing to the underperformance of G10 commodity currencies so far this month.

US EMPLOYMENT GROWTH HAS BEEN SLOWING

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Weak growth and falling inflation to keep BoE on hold

The pound has benefitted from the temporary easing of upward pressure on the US dollar from rising US yields. It has resulted in cable rising to an intra-day high yesterday of 1.2177 up from an intra-day low of 1.2037 as the pair was moving closer to falling back below the 1.2000-level for the first time since March. The pound also derived some support from an upward revision to the UK services PMI for September which was raised by 2.1 point to 49.3. It now shows that business sentiment in the service sector stabilized at lower levels in September rather than deteriorating further. For Q3 as a whole, the service PMI has averaged 50.1 compared to 54.9 in Q2 which still signals that growth has likely slowed markedly and has been weak in Q3.

The combination of weak growth and building evidence of easing inflation pressure in the UK is making market participants more confident that the BoE will not have to hike rates further. There is currently around 19bps of hikes priced in by the March MPC meeting. The release of the BRC shop price index earlier this week provided further encouraging news by revealing the annual rate of inflation for all items slowed further to 6.2% in September. The breakdown revealed a further slowdown in food price inflation. Over the last six months to September the BRC’s food price index has increased by an annualized rate of 5.1% down from November of 19.4%. It fits with comments yesterday from BoE Governor Bailey who stated that he expects headline inflation to dip to 5% or a bit below by he end of this year. But emphasized that they still have a way to go to bring it back down to the 2% target.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

IHS S&P Global Construction PMI (MoM) |

Sep |

-- |

43.4 |

! |

|

UK |

09:30 |

Construction PMI |

Sep |

49.9 |

50.8 |

!!! |

|

UK |

10:45 |

BoE MPC Member Broadbent Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:45 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Challenger Job Cuts |

Sep |

-- |

75.151K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

210K |

204K |

!!! |

|

US |

13:30 |

Trade Balance |

Aug |

-62.30B |

-65.00B |

!! |

|

CA |

13:30 |

Trade Balance |

Aug |

-1.50B |

-0.99B |

!! |

|

US |

14:00 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

|

US |

16:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

17:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg