JPY gives back some of recent gains as Japanese equities rebound strongly

USD/JPY: Stronger wage growth & ISM services survey provide some relief

The high level of volatility in financial markets has continued overnight. After plunging by around 13% yesterday, the main Japanese equity indices have staged a strong rebound today advancing by 9-10%. It has brought some relief for market participants who had been braced for the risk of further weakness. The tentative improvement in global investor risk sentiment has spilled over into the performance of the FX market. The low yielding funding currencies of the yen and Swiss franc have given back some of their recent strong gains. It has resulted in USD/JPY briefly rising back above the 146.00-level overnight after hitting a low yesterday at 141.70. Officials from Japan’s MoF, the BoJ and the Financial Services Agency have just held a meeting to discuss recent market developments. After the meeting, Japan's Vice Finance Minister for International Affairs Mimura stated that they exchanged views on moves in stock markets but will refrain from commenting on the background behind stock moves. They have not changed their view on Japan’s economic recovery. They are in communication with overseas authorities and will keep watching FX developments closely. It follows comments earlier in the day from Prime Minister Kishida who stated he was watching market moves with a sense of urgency and that it is important to judge the market situation calmly. He reiterated the government wants to manage the economy in close co-ordination with the BoJ. He also welcomed the positive wage trends in Japan.

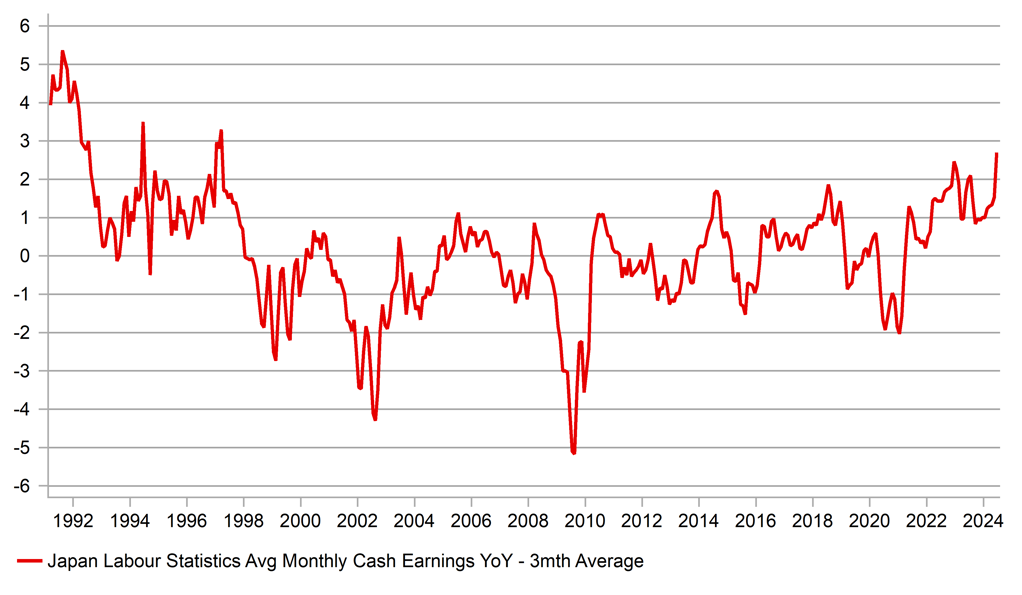

The release overnight of the latest cash earnings report from Japan for June revealed that wage growth picked up more than expected. The BoJ’s preferred measure of cash earnings that smooths out distortions from sample changes picked up to 5.4% in June from 2.6% in May. The main driver of pay gains in June was a category called “special cash earnings” which probably reflected back-pay of base salary increases following the shunto wage negotiations. The report supports the BoJ’s decision to raise rates at last week’s policy meeting despite criticism from some market participants that it has triggered the sharp equity market sell-off. The report would also encourage expectations for further BoJ hikes later this year although the market impact from the stronger cash earnings report is currently being offset by equity market weakness and the sharp strengthening of the yen which are cautioning against delivering further hikes.

Yields in Japan and the US have risen amidst the tentative improvement in global investor risk sentiment. The 10-year JGB yield has risen back above 0.90% and the 10-year US Treasury yield back above 3.80%. The rebound for US yields was initially triggered yesterday by the release of the ISM services survey for July. The survey provided some reassurance that the US economy is not slipping into recession following the weaker nonfarm payrolls report for June. The ISM services survey revealed business confidence improved modestly by 0.6 point to 51.4 in July which brings it back closer into line with the average so far this year of 51.5. The new orders and employment sub-components improved more strongly by 5.1 points and 5.0 points to 52.4 and 51.1 respectively. It has prompted US rate market participants to scale back expectations for more aggressive Fed rate cuts. There are now around 43bps of cuts price in by September and around 200bps of cuts for the year ahead. San Francisco Fed President Daly stated yesterday that “policy adjustments will be necessary in the coming quarters”. “ We have now confirmed that the labour market is slowing, and it is extremely important that we do not let it slow so much that it tips into a downturn”. How much the Fed will cut and when will “depend a lot on the incoming information”. She added though that “underneath the hood of the labour market report, there’s a little more room for confidence”.

STRONGER WAGE GROWTH SUPPORTS BOJ’S DECISION TO HIKE RATES

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Position unwind having diverging impact on EM FX performance so far

It has been a volatile week for emerging market currencies. The Asian currencies of the MYR (+3.6% vs. USD), THB (+1.7%), and CNY (+1.6%) have been the top performing currencies since last Monday. In contrast, the Latam currencies of the MXN (-3.2% vs. USD), COP (-2.2%) and BRL (-1.9%) have been the worst performing currencies. The price action has been mainly driven by ongoing position adjustment triggered by the sharp unwinding of JPY-funded carry trades. The high yielding carry currency of the MXN has been hit the hardest resulting in USD/MXN briefly jumping back above the 20.000-level for the first time since the autumn of 2022. The pair has now risen by almost 4 big figures since the low of 16.262 recorded in April.

On the other hand, Asian currencies have strengthened alongside the JPY as popular short positions have been liquidated. It has resulted in USD/CNY dropping back towards the 7.1000-level. The JPY’s upward momentum was reinforced over the past week by the BoJ’s hawkish policy update. The BoJ hiked rates for the second time and indicated that they could continue to raise rates further this year as long as Japan’s economy progressed in line with their outlook. The BoJ also unveiled plans to cut the pace of monthly JGB purchases in half over the next two years. At the same time, the rising popularity of Kamala Harris in the latest opinion polls is a supportive development for Asian currencies thereby reducing the risk of another trade war if former President Trump wins the US election later this year. While it is still early days, PredictIt.com is now showing Kamala Harris having a higher probability (52%) of becoming the next President than Donald Trump (50%).

Emerging market currencies have on the whole benefitted as well over the past week from intensifying speculation that the Fed will be a lot of more aggressive in cutting rates in the year ahead. The sharp drop in US rates as market participants have moved to more fully price in a larger 50bps cut from the Fed at their next meeting in September and around 200bps of cuts in total in the year ahead has for now provided some support for emerging market currencies. The dovish repricing of Fed rate cut expectations has been encouraged by the release of the much weaker nonfarm payrolls report for July which has heightened concerns that the Fed is behind the curve and should have already started to cut rates last week. However, any USD weakness on the back of lower US yields could prove to be short-lived if fears over a harder landing for the US/global economy begin to encourage a bigger pick-up in safe haven flows into the US. Within EMEA FX, the ZAR, HUF and TRY are the most vulnerable to a further unwind of carry trade positions in the near-term. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

IHS S&P Global Construction PMI (MoM) |

Jul |

-- |

41.8 |

! |

|

UK |

09:30 |

Construction PMI |

Jul |

52.5 |

52.2 |

!!! |

|

EC |

10:00 |

Retail Sales (MoM) |

Jun |

0.0% |

0.1% |

! |

|

CA |

12:00 |

Leading Index (MoM) |

Jul |

-- |

0.15% |

! |

|

US |

13:30 |

Trade Balance |

Jun |

-72.50B |

-75.10B |

!! |

|

CA |

13:30 |

Trade Balance |

Jun |

-2.00B |

-1.93B |

!! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q3 |

2.5% |

2.5% |

!! |

|

NZ |

23:45 |

Employment Change (QoQ) |

Q2 |

-0.2% |

-0.2% |

! |

Source: Bloomberg