Yen continues to outperform as global yields diverge

USD/JPY: Hawkish BoJ comments & lower US yields continue to weigh

The yen has continued to strengthen overnight resulting in USD/JPY falling to a low of 151.82. The stronger yen has been encouraged by further hawkish comments from BoJ officials. The BoJ’s most hawkish board member Naoki Tamura stated that “the short-term interest rate should be at the 1 percent level by the second half of the upcoming fiscal year. He went on to add that “I think the bank needs to raise this rate in a timely and gradual manner, in response to the increase in the likelihood of achieving the price stability target”. He also reiterated his view that the neutral rate for the BoJ is at least 1% with a rate of 0.75% described as still clearly negative in real terms and a long way from neutral emphasizing the need for more than just one more 25bps rate hike. His hawkish outlook for the policy rate is backed up by his view that the BoJ’s stable inflation target will be reached by the second half of the upcoming fiscal year. The market impact of the comments will have been dampened by the fact that he is a well-known hawk. He was the only person on the nine-member board to propose raising rates in December when the BoJ decided to leave rates on hold before hiking again last month.

When asked about the timing of future BoJ hikes he stated that “it’s not like we’ve already decided on hiking once every half year” which is if the current market view. He emphasized that the pace of rate hikes could be faster or slower depending on the economic data. The release yesterday of the stronger wage data from Japan for December will encourage speculation over the possibility of an earlier rate hike although the BoJ will be watching closely the preliminary results from the upcoming Rengo wage negotiations in Japan which will start to be released from next month to further assess whether stronger wage growth will be sustained in the upcoming fiscal year. Our current forecast is for the BoJ to hike again in July and then January of next year lifting the policy rate up to 1.00% with risks skewed towards earlier hikes.

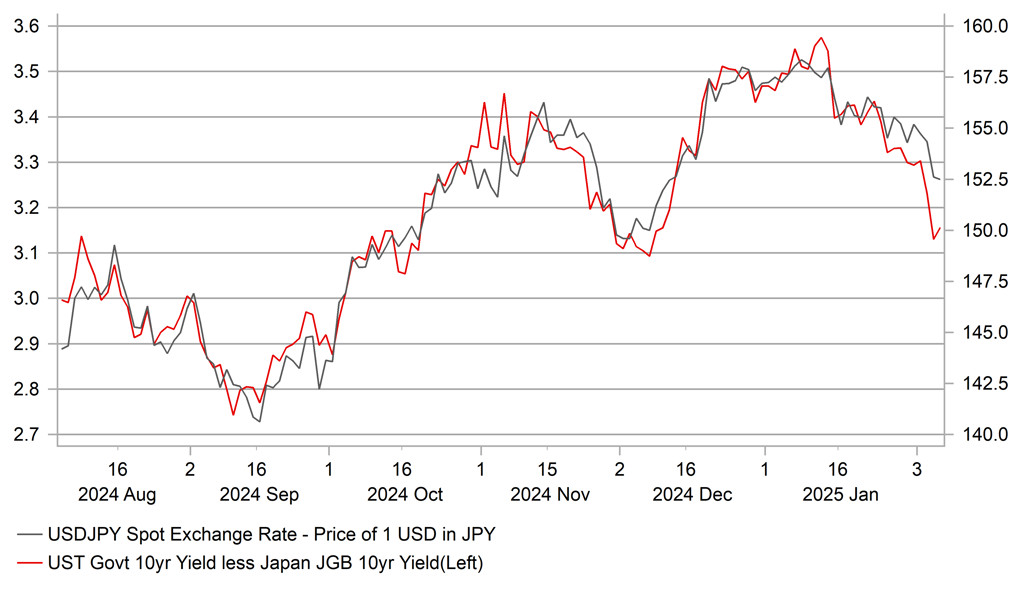

The ongoing hawkish repricing of BoJ rate hike expectations lifted the 10-year JGB to a fresh high yesterday 1.30%. It has risen by around 20bps so far this year which stands in comparison to lower yields outside of Japan. The 10-year US Treasury yield has fallen by around 15bps since the end of last year moving back closer to 4.40%. The correction lower for US yields has been reinforced this week by President Trump’s decision to delay implementing 25% tariff hikes on imports from Canada and Mexico. It has made us cautiously more optimistic that a wider global tariff war can be avoided which dampens the risk of Trump’s policies proving more inflationary for the US economy. The drop in the 10-year US Treasury yield should please President Trump. In an interview with Fox News new Treasury Secretary Scott Bessent stated that “he and I are focused on the 10-year Treasury” when asked about whether President Trump wants to lower interest rates. He denied that President Trump was calling for/putting pressure on the Fed to lower rates. He added that “the bond market is recognising that” under Trump “ energy prices will be lower and we can have non-inflationary growth”. Furthermore if “we cut spending, we cut the size of the government we get more efficiency in government. And we’re going to go into a good interest-rate cycle”. The main risks to his favourable outlook for lower yields are Trump’s other plans for tax cuts, tighter immigration and tariff hikes. At the same time, the US Treasury announced yesterday that it has maintained its guidance on keeping sales of longer-term debt unchanged well into 2025 despite previous criticism of the guidance from Scott Bessent. The Treasury will sell USD125 billion of debt in its quarterly refunding auctions next week which is the same amount as in previous quarters.

USD/JPY VS. LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE to cut rates further but stick to gradual guidance for now

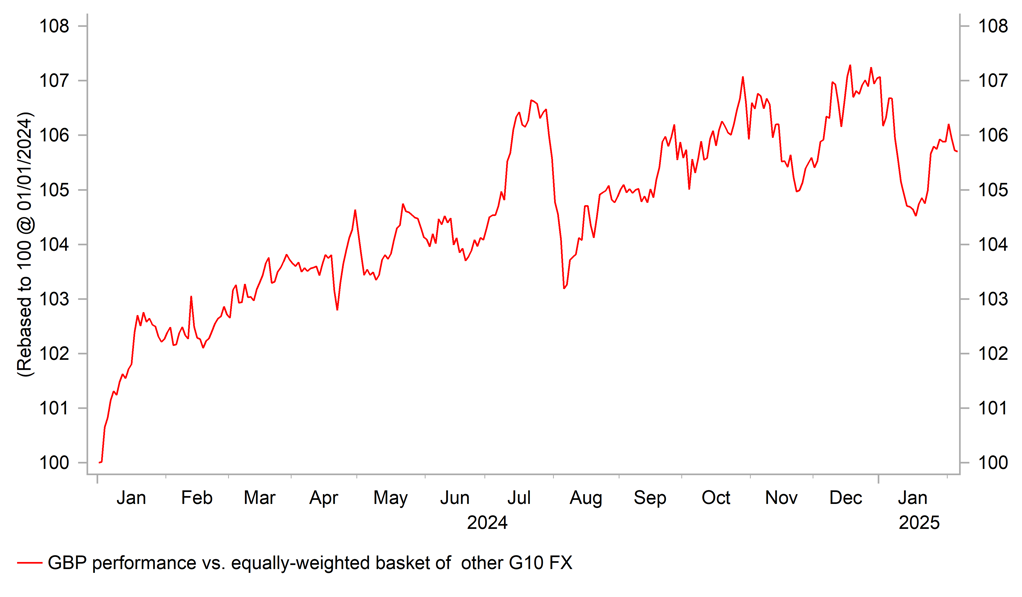

The pound has been rebounding ahead of today’s BoE policy meeting after the heavy sell-off in January. After hitting a high of 0.8474 on 20th January, EUR/GBP has fallen back towards levels that were in place at the start of this year at closer to the 0.8300-level. Similarly, cable has climbed back up to the 1.2500-level after hitting a low of 1.2100 on 13th January. Pound-specific selling intensified last month when gilt yields hit fresh highs fuelling fears over the health of the public finances in the UK. Those fears have since subsided as gilt yields have fallen alongside US yields since the middle of last month. The 10-year and 30-year gilt yields have since both fallen sharply by around 50bps. It still leaves yields in the UK higher than in other major economies which helps to keep the pound attractive as a carry currency especially with volatility easing back again after last month’s sharp sell-off. It was one of the main reasons why the pound was one of the strongest performing G10 currencies last year.

The BoE’s cautious approach to cutting rates has been an important reason why yields have remained at higher levels in the UK. We expect the BoE to deliver another 25bps rate cut today lowering the policy rate to 4.50%. However, the policy rate spread over the ECB will still be substantial at 1.75%. The case for further BoE rate cuts has been supported by the sharp slowdown in the UK economy in the second half of last year when growth ground to a halt. We expect the BoE to revise lower their forecast for GDP growth this year from 1.5% set back in November. There has also been more evidence of softening labour market conditions which should give the BoE more confidence that wage growth will slow going forward and create more room to make the policy rate less restrictive. Core and services inflation fell sharply in December but it was likely exaggerated by the airfares component related to the timing of data collection. So we do not expect the BoE to overemphasize the positive December CPI report. In these circumstances, we expect the BoE to stick to their “gradual approach to removing monetary policy restraint” which has been consistent with a rate cut every quarter since the easing cycle started in August. We expect the BoE to deliver 100bps of easing this year. While it will diminish the pound’s carry attractiveness, we do not expect the BoE’s update today to be sufficient to trigger a bigger pound sell-off unless there was a significant dovish surprise signalling a faster pace of easing.

PERFORMANCE OF GBP VS. OTHER G10 CURRENCIES

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Construction PMI |

Jan |

53.5 |

53.3 |

!!! |

|

EC |

10:00 |

Retail Sales (MoM) |

Dec |

-0.1% |

0.1% |

! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Feb |

4.50% |

4.75% |

!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!!! |

|

US |

12:30 |

Challenger Job Cuts |

Jan |

-- |

38.792K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

214K |

207K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q4 |

1.5% |

2.2% |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q4 |

3.4% |

0.8% |

!! |

|

UK |

14:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

GE |

16:15 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

19:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

CA |

22:00 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg