China attempts to dampen pace of CNY sell-off

CNY: Chinese policymakers move to dampen depreciation expectations

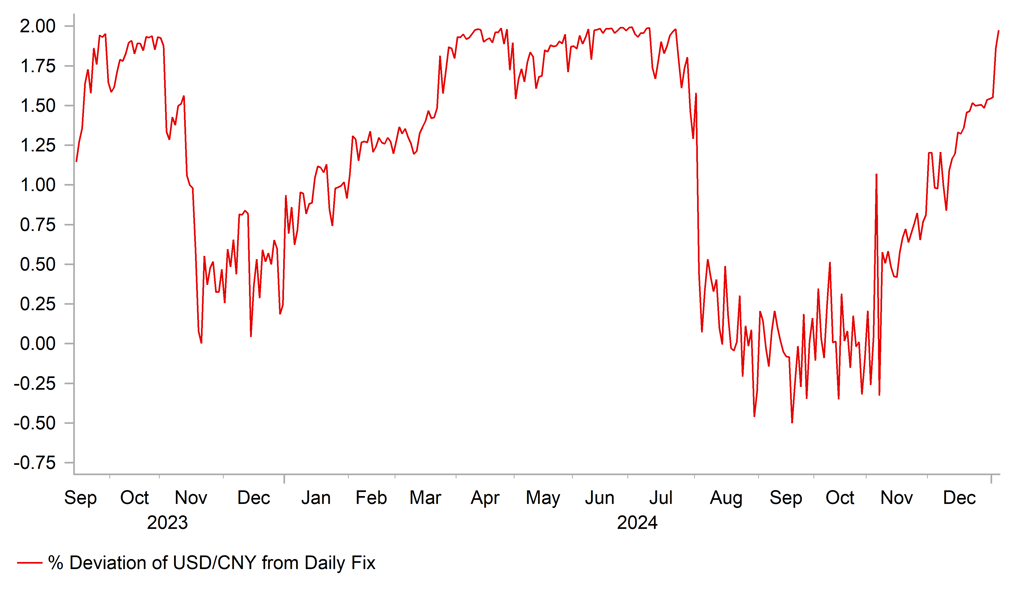

The Chinese renminbi has continued to weaken at the start of this week resulting in USD/CNY hitting a fresh high overnight of 7.3295 as it moves back to within touching distance of the September 2023 high set at 7.3503. The offshore renminbi already rose above the autumn 2023 highs at the end of last year when it hit a high of 7.3695 on 31st December. Chinese policymakers have attempted to dampen expectations for further renminbi depreciation at the start of this week. The PBoC set a stronger daily fixing rate at 7.1876. It has been held just below the 7.2000-level in recent months. It has meant that USD/CNY has moved close to the top of the daily trading band (+/-2%) where the top of the band is currently located at 7.3320. The last time that USD/CNY was trading at the top of the daily trading band was between April and July of last year. If the PBoC continues to keep the daily fixing rate stable at just below the 7.2000-level it will provide stronger pushback against further CNY weakness in the near-term now that USD/CNY is trading at the top of the daily trading band. At the same time, Bloomberg has reported that the PBoC-backed Financial News has released commentary highlighting that the PBoC’s quarterly monetary policy meeting showed a strong resolution to stabilize the renminbi. The commentary highlighted the PBoC’s call for increasing the resilience of the foreign exchange market, and their warning to resolutely crackdown on behaviours that disrupt the foreign exchange market to prevent one-sided market expectations and of the foreign exchange rate overshooting. The commentary went on to emphasize that the PBoC has sufficient tools and experience in handling depreciation of the exchange rate, and is capable of keeping the renminbi basically stable at a reasonable equilibrium level.

The stronger daily fix and PBoC commentary overnight support our view that China continues to favour a gradual depreciation of renminbi. Weakness in the renminbi has accelerated recently in anticipation that President-elect Trump will move quickly to further raise tariffs on imports from China at the start of this second term, and in response to the sharp widening of yield spreads between the US and China which are encouraging a weaker renminbi. Yields in China have fallen sharply to record lows at the start of this year while yields in the US are closer to the highest levels in recent years. Market participants are expecting more active monetary easing from the PBoC this year to provide more support for domestic demand while the Fed has become more cautious over delivering further rate cuts. The path of least resistance is for USD/CNY to keep moving higher but China clearly wants to discourage expectations for faster/sharper depreciation of the renminbi.

The yen has weakened alongside the renminbi at the start of this week resulting in USD/JPY rising back up towards the 158.00-level. A break above the 158.00-level would open up further upside for USD/JPY at the start of this year and a move back above the 160.00-level. BoJ Governor Ueda spoke briefly overnight at a new year conference held by the Japanese Bankers Association in Tokyo in his first public speech of 2025. He sent a fresh reminder that the BoJ plans to keep raising rates by stating “our stance is that we will raise the policy rate to adjust the degree of monetary easing if economic and price conditions keep improving”. However, there was no fresh signal over the likely timing of the BoJ’s next rate hike. The Japanese rate market is continuing to price in a higher probability that the BoJ will wait until the March policy (+19bps) meeting rather than at the next meeting later this month (+11bps). Governor Ueda had indicated he would like to see more information on wage growth and Trump’s policy agenda at the start of his second term before hiking again at the last meeting in December. Market expectations for only a gradual pace of BoJ rate hikes have encouraged speculators to rebuild short yen positions.

USD/CNY MOVES TO TOP OF DAILY TRADING BAND

Source: Bloomberg, Macrobond & MUFG GMR

CAD: Domestic political uncertainty remains a headwind

One of the main developments at the start of this week have been reports that Canadian Prime Minister Justin Trudeau is expected to announce his resignation as leader of the Liberal Party this week. He has been under pressure from elected lawmakers in his party to quit for months. The pressure on him to resign intensified further after former Finance Minister Chrystia Freeland stepped down on 16th December when she criticized his fiscal policy plans (click here). The reports suggest that Trudeau’s decision about what to do next is being held very closely. If Trudeau does announce he intends to step down after nine years in power, the ruling Liberal party will have to choose a new leader. Liberal lawmakers are scheduled to hold a caucus meeting this Wednesday. Bloomberg has reported that the timeline to choose a new leader would have to be very tight given that the major opposition parties have stated that they intend to vote against the government in the next sitting of the House with the government potentially only having until March before it would face a vote of no-confidence. It will reinforce speculation as well over early elections being held before October.

The additional political uncertainty in Canada adds to headwinds for the Canadian dollar. USD/CAD has been consolidating at higher levels over the Christmas holiday period at just below the 1.4500-level. Market participants are nervously waiting to see if President-elect Trump will follow through on his threat to impose higher tariffs on Canada at the start of his second term. The government has already announced significant investments (CAD1.3 billion) to strengthen border security and their immigration system (click here). It follows President-elect Trump’s threat to impose a 25% tariff on all imports from Canada if they don’t restrict the flow of illegal immigrants and drugs into the US. The fresh investment helps to support our view that we don’t expect tariff hikes to be implemented against Canada. If we are wrong then the Canadian will be significantly weaker than outlined in our latest forecasts released later today in our Annual FX Outlook report.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Services PMI |

Dec |

51.4 |

49.5 |

!! |

|

UK |

09:30 |

Services PMI |

Dec |

51.4 |

50.8 |

!!! |

|

EC |

09:30 |

Sentix Investor Confidence |

Jan |

-17.7 |

-17.5 |

! |

|

GE |

13:00 |

German CPI (YoY) |

Dec |

2.4% |

2.2% |

!! |

|

US |

14:30 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

! |

|

US |

14:45 |

Services PMI |

Dec |

58.5 |

56.1 |

!!! |

|

US |

15:00 |

Factory Orders (MoM) |

Nov |

-0.3% |

0.2% |

!! |

Source: Bloomberg