AUD outperforms as RBA delivers hawkish policy update

AUD: RBA signals more concern over upside inflation risks

The Australian dollar has been the best performing G10 currency overnight following the hawkish RBA’s policy update. It has resulted in the Australian dollar strengthening by around +0.7% against the US dollar and +0.5% against the New Zealand dollar. The main trigger was the RBA’s unexpected decision to raise their policy rate by a further 0.25 percentage point to 4.10%. In the accompanying policy statement, the RBA stated that inflation is “still too high”, and that “this further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonably time frame”. The RBA believes that recent data indicate that “upside risks to the inflation outlook have increased”. Like other major central banks the RBA flagged concern about “very high” services price inflation that is “proving to be very persistent overseas”. It will continue to pay close attention to both the evolution of labour costs and price-setting behaviour of firms. In these circumstances, the RBA also continued to signal that “some further tightening” of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend on how the economy and inflation evolve. Overall, the developments push back against market expectations that the RBA had reached the end of their hiking cycle. It supports our long AUD/NZD trade recommendation (click here) which will benefit from the widening policy divergence that is opening up between the RBA and RBNZ in the near-term. Unlike the RBA, the RBNZ recently sent a strong signal that their rate hike cycle had ended after lifting their key policy rate to a peak of 5.50%.

WEAKER GROWTH & INFLATION IN US SERVICE SECTOR

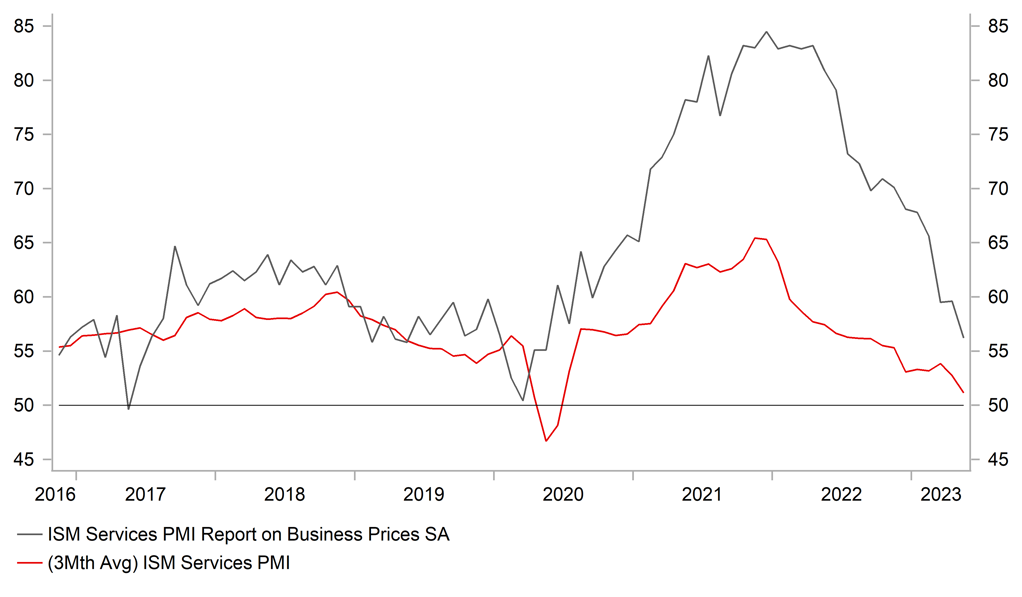

Source: Bloomberg, Macrobond & MUFG GMR

USD: ISM services survey signals weaker US growth & inflation

The US dollar has continued to weaken modestly overnight as it gives back gains recorded after the release at the end of last week of the stronger than expected non-farm payrolls report. The price action provides further evidence that the US dollar is struggling to regain upward momentum in the near-term ahead of next week’s FOMC meeting on 14th June. The US dollar is being held back by the reluctance of US rate market participants to price in another rate hike as soon at next week’s FOMC meeting. There is still only around 6bps of hikes price in for next week despite the recent releases of the stronger non-farm payrolls and CPI reports. The pricing remains more consistent with policy guidance from the Fed leadership including Chair Powell and Governor Jefferson signalling that they favour slowing the pace of hikes and skipping the June meeting to give them more time to assess incoming economic data.

The release yesterday of the latest ISM services survey brought an end to the recent run of stronger than expected US economic data releases. The survey signalled that service sector growth is slowing more notably. The headline confidence index dropped by 1.6 point to 50.3 in May. Unlike the one-off sharp drop to 49.2 in December, the May reading was the third consecutive monthly reading at much weaker levels providing a stronger signal that a sustained slowdown is underway. The survey also provided further encouragement that wage growth will slow further. The prices sub-component declined by a further 3.4 point tot 56.2 and is now back below the pre-COVID average from during 2019 at 57.5. It casts doubt on fears held by market participants and the Fed that service sector inflation will continue to prove sticky. Our forecast for the US dollar to weaken later this year are built on the assumption that inflation will slow more quickly than expected creating room for the Fed to begin reversing their current tight policy stance.

JPY: Wage data disappoints further dampening expectations for BoJ shift

The main economic data release overnight in Japan was the release of the latest wage data for April although it has had limited initial impact on the yen. USD/JPY has continued to trade at just below the 140.00-level. The latest wage data from Japan will have been disappointing for the BoJ who are looking for stronger wage growth to support a sustained pick-up in inflation towards their 2.0% target. The report revealed that labour cash earnings increased by an annual rate of just 1.0% in April down from 1.3% in March, and much lower than the consensus forecast for an increase of 1.8%. After adjusting for inflation, real cash earnings fell by -3.0%Y/Y in April. The upward impact on wages from the recent stronger than expected shunto wage agreements was expected to be more evident in the April wage data. Japan’s major labour unions and employers had reached agreements to raise overall wages by a record 3.66% on average as of 1st June according to the latest data from Rengo. The BoJ has been expecting around 40% of the wage negotiation results to have been reflected in April with the number rising to more than 80% by July. The report is a setback for the BoJ and will reinforce market expectations for the BoJ to maintain current loose policy settings at this month’s policy meeting on 16th June and for the rest of this year unless evidence of much stronger wage growth emerges in the coming months. Without a shift in BoJ policy, the yen is more likely to continue trading at weak levels.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB's Vujcic Speaks |

May |

!! |

||

|

EC |

09:00 |

ECB Consumer Expectations Survey |

May |

!! |

||

|

UK |

09:30 |

S&P Global/CIPS UK Construction PMI |

Apr |

50.8 |

51.1 |

!! |

|

EC |

10:00 |

Retail Sales MoM |

Apr |

0.2% |

-1.2% |

!! |

|

CA |

13:30 |

Building Permits MoM |

Apr |

-5.0% |

11.3% |

!! |

Source: Bloomberg