USD fails to hold onto ISM driven gains ahead of NFP report

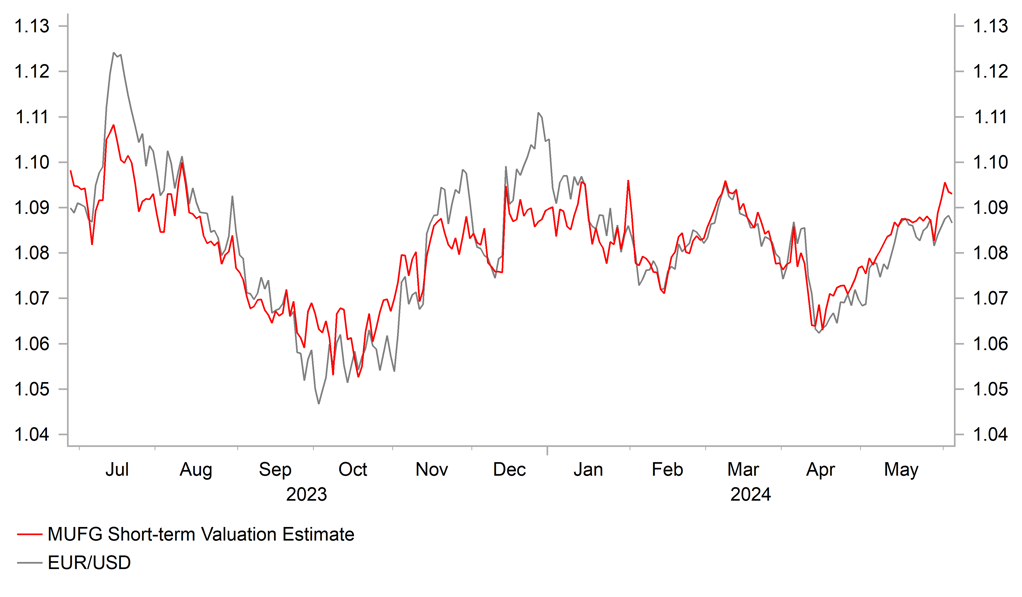

EUR/USD: ECB to start rate cut cycle but signal caution over further rate cuts

The euro has continued to trade close to recent highs against the US dollar ahead of today’s ECB policy meeting at just below the 1.0900-level. The pair briefly fell to an intra-day low yesterday 1.0854 following the release of the stronger than expected US ISM services survey for May but the US dollar has since quickly given back those initial gains. The ISM services survey revealed that business confidence in the service sector picked up more strongly than expected by 4.4 points to 53.8 in May and reached the highest level since August of last year. the recovery in the business activity sub-component was even more marked as it rebounded by 10.3 points to 61.2 in May which was the highest level since November 2022. The improvement in business confidence in the service sector helped at least temporarily to ease some of the building concerns over slowing growth momentum in the US at the start of this year. Two caveats are that the headline index has been a poor guide to consumer spending over the last couple of quarters, and that the improvement in the employment sub-component was more modest (+1.2 points). Over the last two months the employment sub-component has averaged only 46.5 which is the lowest reading over a two month period since August 2020. It supports our cautious outlook for the US labour market and will leave market participants wary of the risk of a softer NFP report on Friday. It helps to partly explain why the US dollar failed to sustain initial gains.

The main focus today for the performance of EUR/USD will be the ECB’s latest policy update. Ahead of today’s meeting the euro-zone rate market is almost fully pricing in a 25bps rate cut from the ECB today (-24bps), and then is expecting the ECB to deliver a second 25bps rate cut either by September (-43bps) or October (-53bps). It is consistent with recent messaging from ECB officials who have shown a united front over the possibility of a rate cut today but are more divided over the timing of a follow up rate cut. The recent run of economic data from the euro-zone including: i) stronger GDP growth in Q1, ii) stronger service sector inflation in May, iii) stronger negotiated wage data for Q1, and iv) a new record low for the unemployment rate in April. While those developments will not prevent the ECB from cutting rates today, they support our view that the ECB will deliver cautious forward guidance today when outlining plans for further rate cuts. The main downside risk to our long EUR/USD trade idea (click here) would be if the ECB signalled that the July meeting is live for a back to back rate cut. The euro-zone rate market is currently pricing in only 29bps of cumulative cuts at the June and July meetings.

SHORT-TERM FUNDAMENTALS MOVING IN FAVOUR OF EURO

Source: Bloomberg, Macrobond & MUFG GMR

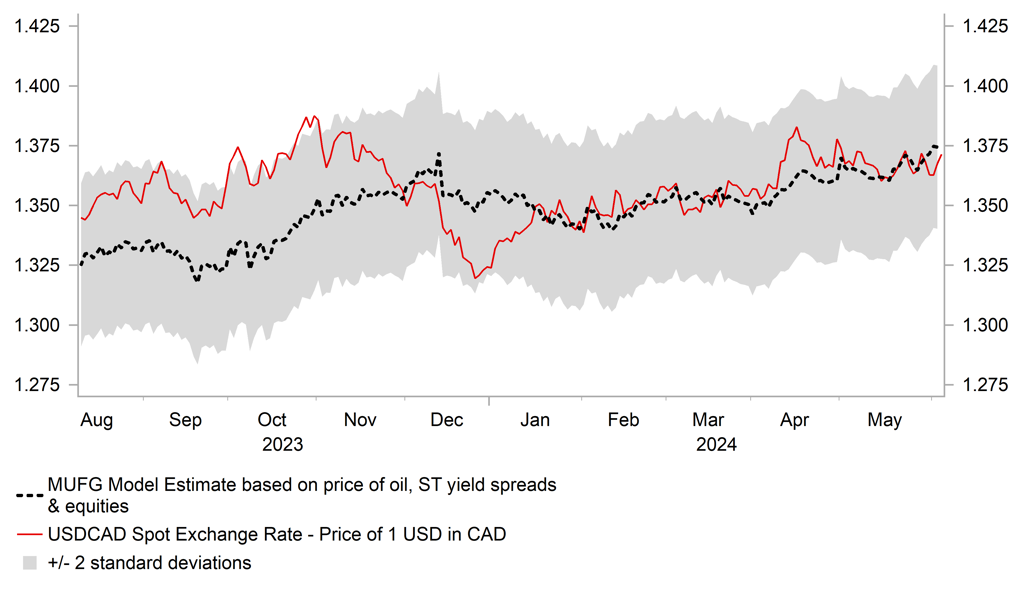

CAD: BoC indicates more rate cuts are on the way

The Canadian dollar has continued to underperform at the start of this month resulting in USD/CAD rising back up towards recent highs at around 1.3740 yesterday, before falling back below the 1.3700 as the US dollar weakened more broadly. The Canadian dollar initially weakened after the BoC announced yesterday that they had started their rate cut cycle by delivering a 25bps cut which lowered the policy rate to 4.75%. The decision to cut rates in June rather than wait a little until July was in line with our own forecast (click here). The decision to cut rates this month reflected the BoC’s increased confidence that underlying inflation pressures “increasingly point to a sustained easing”. The BoC has been encouraged by: i) headline inflation slowing from 3.4% in December to 2.7% in April, ii) their preferred measure of core inflation slowing from about 3.5% in December to about 2.75% in April, iii) the 3-month annualized rates of core inflation have slowed from about 3.5% in December to under 2% in March and April, and iv) the proportion of CPI components increasing faster than 3% has now moved back to being more in line with the historical average which indicates that price increases are no longer broad-based. As a result of these positive inflation developments, the BoC believes that “monetary policy “no longer needs to be as restrictive”.

The BoC’s updated forward guidance has encouraged a weaker Canadian dollar as well. Governor Macklem signalled clearly that “if inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, “it is reasonable to expect further cuts to our policy rate”. No specific guidance was provided over the exact timing of the next rate cut. The BoC only indicated that policy decision would be made one meeting at a time. It has encouraged the Canadian rate market to price in a higher probability of the BoC delivering back to back rate cuts in June and July. Another rate cut as soon as in July is now judged as closer to a 50:50 call. Governor Macklem did note though that he was aware of the risk of lowering their policy rate too quickly could jeopardize inflation progress. It suggests that the next cut is more likely in September although another cut as soon as July can’t be ruled out if underlying inflation pressure eases further in the month ahead. The BoC’s decision to start their rate cut cycle ahead of the Fed who appear unlikely to cut rates until September unless there is a sharp slowdown in employment growth in the coming months, has opened up a window of widening policy divergence in the near-term. Governor Macklem stated that he was concerned over policy divergence with the Fed at the current juncture, but did warn that there are limits to divergence although they are not there yet. It suggests that the BoC would be open to cutting rates at least a couple of more times ahead of the Fed. Overall, the developments support our forecast for USD/CAD to continue to trade in the 1.3000’s. Recent evidence of slowing US growth and the correction lower for the price of oil should contribute as well to the Canadian underperforming against other G10 currencies as well.

SHORT-TERM FUNDAMENTAL DRIVERS CONTINUE TO MOVE AGAINST CAD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Construction PMI |

May |

52.5 |

53.0 |

!!! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q1 |

-- |

0.3% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Apr |

-0.2% |

0.8% |

! |

|

US |

12:30 |

Challenger Job Cuts (YoY) |

-- |

-- |

-3.3% |

! |

|

EC |

13:15 |

Deposit Facility Rate |

Jun |

3.75% |

4.00% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

220K |

219K |

!!! |

|

US |

13:30 |

Trade Balance |

Apr |

-76.20B |

-69.40B |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q1 |

4.7% |

0.4% |

!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg