US dollar hit hard by plans for dramatic loosening of fiscal policy in Europe

USD: Improving economic outlook outside of US reinforces sell-off

The US dollar has continued to trade at weaker levels overnight following yesterday’s sharp sell-off. It has resulted in the dollar index falling back below support from the 200-day moving average at around the 105.00-level for the first time since the start of November. The US dollar has now given back all of the gains recorded since President Trump won the US election. The sharp sell-off for the US dollar yesterday was primarily driven by the improving outlook for growth outside of the US driven by the dramatic shift in Germany’s fiscal policy stance. The 10-year German government bond yield surged higher by 30bps yesterday which was the worst daily performance for Bunds according to the FT since 1997. It has helped to narrow the 10-year yield spread between 10-year German and US government bonds to -1.5 percentage points compared to the widest point in December of almost -2.3 percentage points.

Chancellor-in-waiting Friedrich Merz outlined plans for significant changes to Germany’s debt brake that would create open-ended fiscal room for defence. Under the plans, all defence spending above 1% of GDP will be excluded from the borrowing limit under the debt brake and the regions (“Lander”) will be allowed additional borrowing under the debt brake. Defence spending had already started to pick up last year reaching 2.1% of GDP up from 1.6% in 2023. Defence spending is likely to be significantly stepped up in the coming years. It has been estimated that ramping up defence spending up to 3% to 3.5% of GDP over the next 5-10 years could require additional spending of between EUR700 billion to EUR1.0 trillion. While creating room for additional spending for regional governments could open up additional borrowing of EUR70 billion over ten years.

The plan also includes setting up a EUR500 billion special fund (SPV) for infrastructure spending over the next ten years of which EUR100 billion will be directly channelled to regional governments. No details have been released over how the funds will be allocated for infrastructure investment over the 10 year period but they will cover infrastructure, digitalisation, power grids and education. Furthermore, by creating more room for spending under the debt brake it will free up more room for other policy proposals under the next government such as corporate tax cuts (~6ppt cut by 2029). Overall, the plans for extra spending on defence and public investment might plausibly add something in the region of around 20 percentage points or more to debt/GDP over the coming decade. Our European economist estimates that looser fiscal policy could lift growth in Germany next year closer to 2% up from the current consensus forecast of around 1.0%.

At the same time, the US dollar has been encouraged by the announcement yesterday from President Trump to partially water down tariffs applied to Canada and Mexico earlier this week. USD/CAD and USD/MXN have dropped back towards 1.4300 and 20.400 respectively. White House press secretary Karoline Leavitt confirmed that “we are going to give a one-month exemption on any autos coming through USMCA”. The exemption also applies to auto parts that comply with the trade pact. Automakers have been told to “start investing, start moving, shift production to the US where there will be no tariff to pay”. President Trump’s initial plans to put 25% tariffs on all imports from Canada and Mexico with the one initial exemption of a lower 10% tariff on energy imports from Canada was applied to close to USD920 billion worth of US imports. By exempting cars and car parts for one month, the higher tariffs still apply to around USD750 billion of imports. It highlights that the economic disruption caused by the tariffs still in place will remain significant. US Agriculture Secretary Brooke Rollins also told Bloomberg News that they are considering exempting certain agricultural products from tariffs imposed on China and Mexico too.

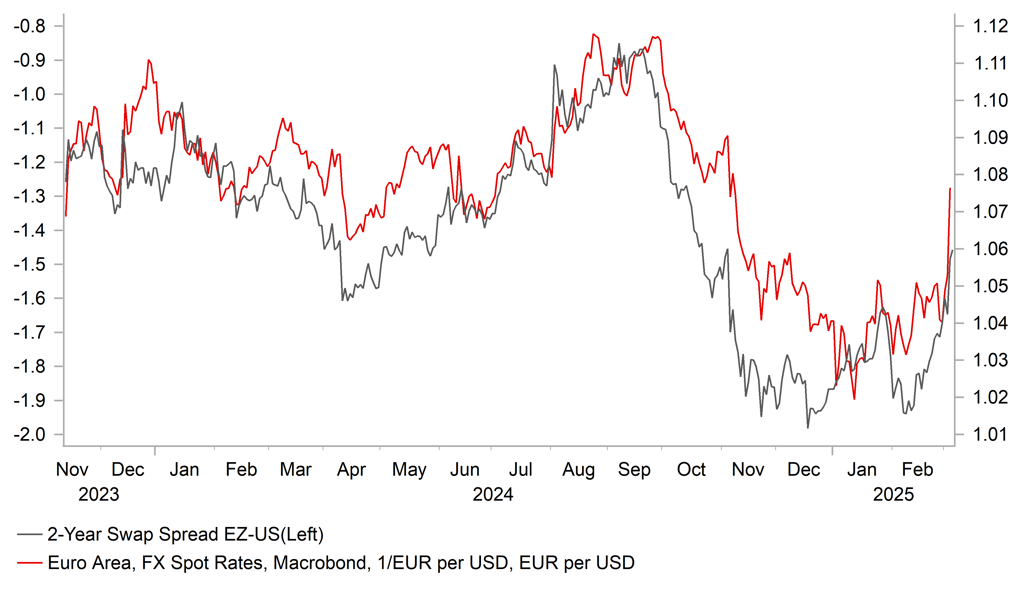

LESS POLICY DIVERGENCE EXPECTED NOW BETWEEN ECB AND FED

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Will ECB deliver a hawkish rate cut adding to euro’s upward momentum?

The euro has surged higher over the last couple of days rising back above 1.0800 against the US dollar ahead of today’s ECB policy meeting. The German fiscal package outlined above alongside the EU‘s plans to step up defence spending amongst members have been a game changer for the performance of the euro. The additional government spending will help to initially dampen downside risks to growth in eurozone this year from trade disruption with President Trump planning to announce significant tariff hikes in the coming months that could hit the European economies hard. Beyond the near-term, looser fiscal policy should support a stronger economic recovery from next year onwards. While it is still early days for the ECB to fully incorporate these plans into their outlook for policy at today’s policy meeting given the legislation has not yet been passed, it should have a significant impact in the coming years.

The euro-zone rate market has already reacted accordingly to price in a more hawkish path for the ECB’s policy rate. The 2-year euro-zone government bond yield has risen by around 30bps as market participants have scaled back expectations for the ECB’s policy rate to move below 2.00%. With fiscal policy expected to play a bigger role going forward in supporting the euro-zone economy, it will reduce pressure on the ECB to lower rates below neutral territory which President Lagarde has stated recently is estimated at around 1.75% to 2.25%. It fits with our own forecast that the ECB will lower rates to 2.00% this year but not below.

We will also be watching closely today to see if the ECB delivers a more hawkish rate cut by signalling that they may skip cutting rates at the next policy meeting in April. The euro-zone rate market is less convinced now that the ECB will deliver back-to-back rate cuts today and in April .There is currently around 35bps of cuts priced in by April. A stronger signal over a potential skip in April could reinforce the euro’s upward momentum today alongside any tentative indication from the ECB that room for rate cuts will be curtailed by updated fiscal plans.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Construction PMI |

Feb |

49.5 |

48.1 |

!!! |

|

EC |

10:00 |

EU Leaders Summit |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Retail Sales (MoM) |

Jan |

0.1% |

-0.2% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Feb |

-- |

0.28% |

! |

|

EC |

13:15 |

Deposit Facility Rate |

Mar |

2.50% |

2.75% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

234K |

242K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q4 |

1.2% |

2.2% |

!! |

|

US |

13:30 |

Trade Balance |

Jan |

-128.30B |

-98.40B |

!! |

|

CA |

13:30 |

Trade Balance |

Jan |

1.40B |

0.71B |

!! |

|

US |

13:45 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

UK |

20:15 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

US |

20:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg