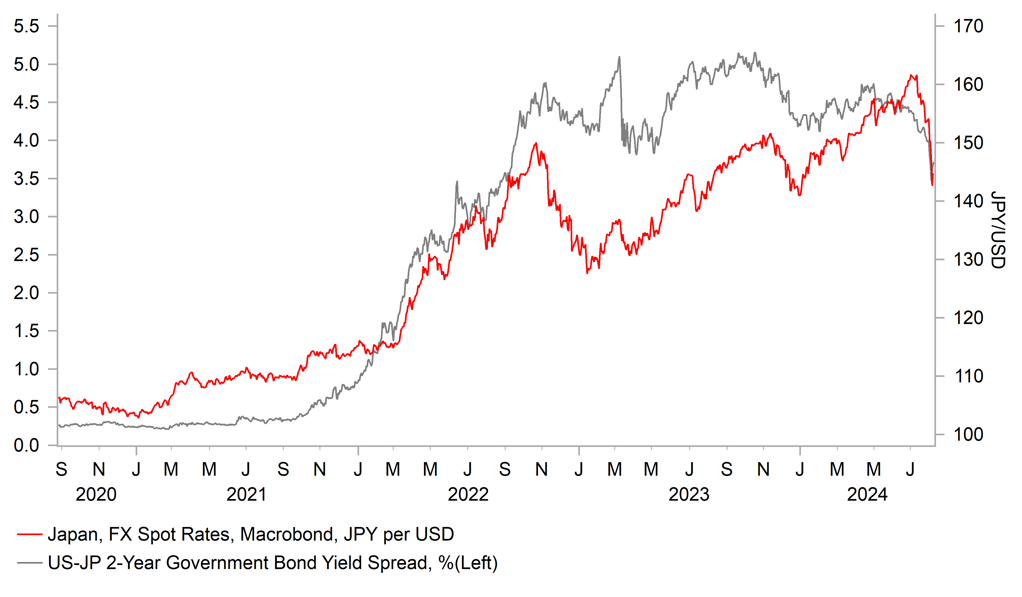

BoJ dials back hawkish rhetoric triggering a reversal of JPY strength

JPY: BoJ dials back hawkish rhetoric to support financial markets

The yen has weakened sharply during the Asian trading session resulting in USD/JPY rising back above the 147.00-level as it moves further above the low from earlier this week at 141.70. The sharp sell-off for the yen has encouraged the Japanese equity market to rebound further overnight. The Nikkei 225 index has now fully reversed the 13% decline recorded at the start of this week. The main trigger for the sharp yen sell-off overnight were reassuring comments from BoJ Deputy Governor Uchida who stated that “I believe that the bank needs to maintain monetary easing with the current policy interest rate for the time being, with developments in financial and capital markets at home and abroad being extremely volatile”. He went on to add that “in contrast to the process of policy interest rate hikes in Europe and the United States, Japan’s economy is not in a situation where the bank may fall behind the curve if it does not raise the policy rate at a certain pace. Therefore the bank will not raise its policy interest rate when financial and capital markets are unstable”. The BoJ will need to monitor any potential impact on prices and the overall economy coming from market moves, and the trajectory for Japan’s interest rates could shift depending on the impact.

As the BoJ emphasized in last week’s hawkish policy update, it is prepared to keep raising rates if the economy and prices evolve in line with their outlook. If Japan’s economy or inflation proves weaker than expected due to adverse market developments such as a sharp tightening in financial conditions then the BoJ will not raise rates. The comments have been welcomed by market participants who had been surprised by the hawkish guidance provided by the BoJ at last week’s policy meeting. The Japanese rate market has moved to pare back expectations for further BoJ rate hikes this year. According to Bloomberg, there are now only 6bps of hikes priced in by the December policy meeting. After the BoJ’s policy meeting last week we had moved our forecast forward for the next BoJ hike to Q4. While the comments overnight suggest that it is less likely now, it will depend on financial market developments. If financial markets stabilize in the coming months another rate hike can’t be ruled out if Japan’s economy and prices evolve in line with the BoJ’s outlook although a delay until next year appears more likely now. In the near-term, the comments from Deputy Governor Uchida should help to reduce the risk of an even deeper unwind of yen carry trades.

NARRWING OF BOJ & FED POLICY DIVERGENCE HAS HELPED LIFT JPY

Source: Bloomberg, Macrobond & MUFG GMR

AUD: Negative external backdrop & dovish RBA repricing have weighed heavily

The G10 commodity currencies of the Australian and New Zealand dollars have been hit the hardest over the past month by the deterioration in global investor risk sentiment. MSCI’s ACWI global equity index has fallen by just over 7% since it peaked on 16th July while Bloomberg’s commodity price index has similarly fallen by just over 8% from in early July and by just over 12% since the peak in May. The price action suggests that there are genuine investor concerns over slowing global growth amidst the recent position unwind. The release of the latest weak nonfarm payrolls report for July has added to the evidence of slower China Q2 GDP and softening business confidence in the euro-zone in recent months. It has created a negative external backdrop for commodity currencies.

At the same time, the Australian dollar has been undermined by the dovish repricing of RBA policy expectations. Up until late last month, the Australian rate market was still wary of the risk of the RBA hiking rates further at yesterday’s policy meeting until the release of the Australian Q2 CPI provided reassurance that inflation was in line with the RBA’s outlook. The Australian rate market has since moved to price in an earlier start for the RBA to begin cutting rates and deeper cutting cycle in the year ahead. There are currently 21bps of cuts priced in by year end and around 66bps of cuts for the year ahead. At yesterday’s policy meeting, RBA left rates on hold at 4.35% but Governor Bullock pushed back against market expectations for rate cuts as soon as in December. The RBA even still discussed the option of raising rates further at yesterday’s policy meeting. However, market participants are willing to look through the RBA’s relatively hawkish rhetoric in anticipation that inflation and growth in Australia will slow further and open the door to lower rates. Overall, the developments have prompted us to downgrade our forecasts for the Australian dollar (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

13:00 |

Leading Index (MoM) |

Jul |

-- |

0.15% |

! |

|

CA |

15:00 |

Ivey PMI |

Jul |

60.0 |

62.5 |

!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

! |

Source: Bloomberg