Can payrolls renew Fed easing expectations?

USD: Jobs data in focus

The focus for the financial markets in recent weeks has been very much on Trump and his economic policies, in particular on trade, but today there is the potential for the jobs data to influence Fed rate expectations. A pretty large divergence from the consensus is still likely required to shift expectations notably but extreme weather at this time of the year has in the past resulted in sharply weaker NFP readings and weather could impact today’s report. We also have the benchmark revision but we have already had the preliminary estimate (-818k) in August and Quarterly Consensus of Employment and Wages data pointed to that initial estimated drop being revised up by 151k. Updates to the birth-death model will also determine the final benchmark revision estimate but we don’t see this benchmark revision estimate having much impact.

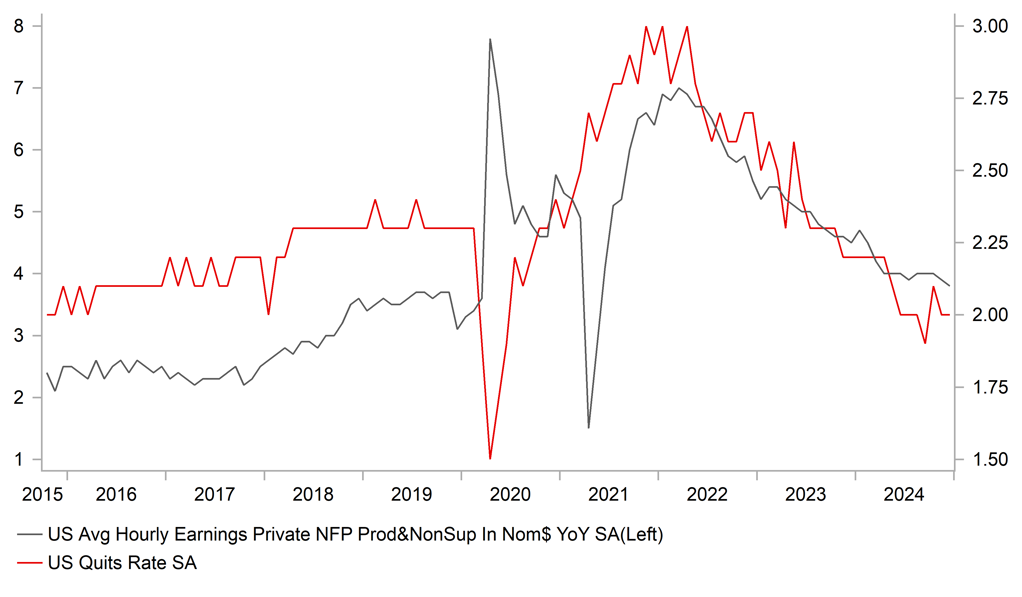

Other regular jobs data – there’s plenty given payrolls is falling on 7th – points to a labour market that is slowing but is still in reasonable condition. The JOLTS data showed job openings are coming down and the Quits rate that confidence in the labour market is declining and will help supress wage growth. The ISM Service Employment index picked up and the ADP employment reading (+183k) was solid. But there are factors that point to downside risks. The fires in Los Angeles, the extremely cold spell on the East Coast are two one-off events that took place in the jobs survey weak and could have a negative impact. We also still have a restrictive monetary stance and January also saw a pick-up in trade policy uncertainty that could have undermined business decision-making ahead of inauguration. The 256k increase last month could well have been an overshoot that corrects lower this month. The December gain was larger than the 3,6, and 12mth averages and looking at the post-covid period whenever that has happened we have seen a notable correction lower the following month.

But it will likely take quite a correction lower to shift the rates markets notably in our view. The messaging from FOMC members has been very strong in favouring a pause. Dallas Fed President Logan is the latest speaker to indicate little appetite for further easing arguing that the policy rate may already be close to neutral. So if there is a knee-jerk drop in yields and the dollar on a weaker print, the one-off risks that may have impacted the data and the FOMC’s strong stance for a pause suggests to us that the move could quickly reverse.

JOLTS QUIT RATE POINTING TO CONTINUED SLOWDOWN IN AVERAGE HOURLY EARNINGS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB neutral rate analysis could be important

At the ECB policy meeting last week President Lagarde was able to bat away the predictable question in relation to the estimated neutral rate by announcing that the ECB staff were working on an updated assessment of an estimate for the neutral monetary policy rate. With a ‘2’ handle on the policy rate following the 25bp cut to 2.75%, that neutral rate is getting more attention. The ECB’s updated assessment is scheduled for release today and could well have an impact on market rates.

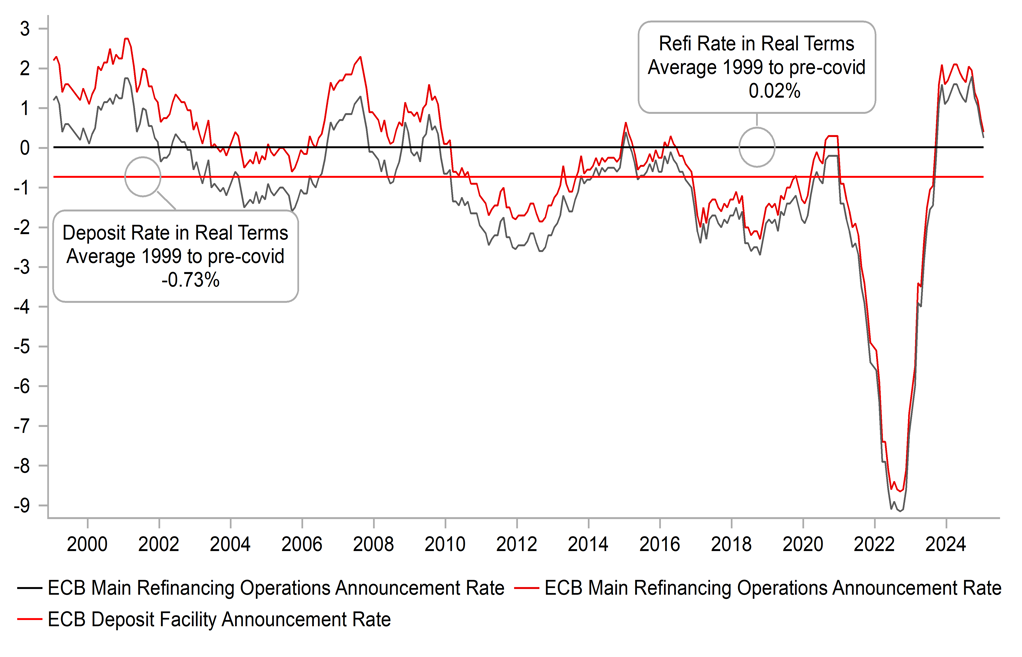

An impact would be most likely if we see an estimate that diverges much from what appears to be the general consensus in the financial markets – that the neutral rate is roughly around 2.00% in nominal terms. This implies the R* (neutral rate in real terms) is around zero percent. Looking at the long-term (1999 to 2019) average for the ECB’s refinancing rate and the deposit rate in real terms (above chart) you can see that for the refinancing rate the real rate was indeed zero percent. For the deposit rate in real terms the average was -0.73%. The statement from the ECB last week described the current monetary stance as still “restrictive” but the timing of this updated assessment may well be a signal that the ECB could soon be in a position to alter the description of the degree of restrictiveness to the current stance. Another cut could take us to the top of a feasible range of neutral and hence could signal some toning down of the degree of restrictiveness.

Certainly if the report today was to imply a lower than expected neutral rate or range of neutral, it could result in a downside move in yields that prompts a move lower in EUR/USD. That said, it is also highly likely that today’s assessment will come with a very clear, strong warning – that estimates of neutral are theoretical and measuring the monetary stance is done in many different ways.

In that context it was interesting to read ECB Chief Economist Philip Lane’s speech on Wednesday. In the speech Lane concluded with some comments on the subject of the neutral rate and highlights the fact that the ECB assesses the restrictiveness of the monetary stance by suggesting that a “restrictiveness index” would have to incorporate at least nine different factors. Without listing them all here, the index would have to include the likes of super cheap debt rolling off and being refinanced at much more expensive rates; the evolution of credit standards in bank lending; and the dynamics of bond and equity risk premia. The point Lane was making was that assessing the monetary stance was not as simple as measuring the difference between the actual policy rate and some estimated theoretical estimate of the neutral rate.

So while today’s assessment update of the neutral rate is important, we would be sceptical of any initial market reaction lasting long. Market participants will likely conclude that in reality the ECB’s reaction function will still be the same and will respond to incoming economic data. If the economy worsens and inflation ease further then the ECB will likely continue easing, especially if there’s a demand shock related to tariffs being implemented by the Trump administration. In early 2024 the ECB in a previous assessment estimated only that R* was rising but high levels of uncertainty complicated reaching conclusions. That’s likely to be repeated today!

ECB'S REAL POLICY RATES ADJUSTED FOR INFLATION OVER TIME

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:45 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!!! |

|

US |

13:30 |

Nonfarm Payrolls |

Jan |

169K |

256K |

!!!!! |

|

US |

13:30 |

Unemployment Rate |

Jan |

4.1% |

4.1% |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Jan |

3.8% |

3.9% |

!!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Jan |

0.3% |

0.3% |

!!!! |

|

US |

13:30 |

Average Weekly Hours |

Jan |

34.3 |

34.3 |

! |

|

US |

13:30 |

Payrolls Benchmark |

-- |

-- |

-266.00 |

!!! |

|

US |

13:30 |

Payrolls Benchmark, n.s.a. |

-- |

-- |

-818.00K |

!!! |

|

US |

13:30 |

U6 Unemployment Rate |

Jan |

-- |

7.5% |

!! |

|

CA |

13:30 |

Employment Change |

Jan |

25.5K |

90.9K |

!!! |

|

CA |

13:30 |

Unemployment Rate |

Jan |

6.8% |

6.7% |

!!! |

|

US |

14:25 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Fed Monetary Policy Report |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Feb |

-- |

3.3% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Feb |

-- |

3.2% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Feb |

71.9 |

71.1 |

!! |

|

US |

17:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg