Trump trade policy uncertainty contributing to FX market volatility

USD: Uncertainty over Trump tariff policy triggers correction lower

The US dollar has continued to weaken overnight following yesterday’s sharp sell-off. It has resulted in the dollar index falling back towards the 108.00-level after hitting a high of 109.53 on 1st January. The US dollar sell-off was reinforced yesterday a Washington Post report suggesting that President-elect Trump could scale back plans to implement broad-based tariffs against major trading partners at the start of his second term. The report stated that President-elect Trump’s aides are exploring tariff plans that would be applied to every country but only cover critical imports rather than the “universal” tariffs of as high as 10 or 20 percent on all imported goods into the US that he called for when campaigning. The tariffs would reportedly only be imposed on goods from certain sectors that are deemed critical to national or economic security. Preliminary discussions have largely focused on several key sectors that Trump wants to bring back to the US including defence industrial supply chain (through tariffs on steel, iron, aluminium and copper), critical medical supplies (syringes, needles, vials and pharmaceutical materials), and energy production (batteries, rare earth minerals and solar panels). It remains unclear how these plans would intersect with outstanding threats to impose 25% tariffs on all goods imported from the Canada and Mexico, and to raise tariffs by a further 10% on goods imported from China although it would support market expectations that such disruptive tariffs are unlikely to be imposed at least on Canada and Mexico. According to the report, the narrower list of tariffs may partially reflect growing fears about the persistence of inflation in the coming years with one source claiming that “the sector-based universal tariff is a little bit easier for everybody to stomach out of the gate”. Yesterday’s price action highlighted that market participants have moved to price in the early implementation of aggressive tariff hikes during Trump’s second term which has helped the US dollar to strengthen sharply over the last couple of months. If there is any relief and the tariffs fall short of those fears then it could help to dampen US dollar strength. Our latest forecasts (click here) for further US dollar strength during the 1H of this year are based on the assumption that Trump will move quickly to implement aggressive tariffs.

However, President-elect Trump was quick to downplay the report on the Washington Post yesterday when he posted on Truth Social that the “the story in the Washington Post, quoting so-called anonymous sources, which don’t exist, incorrectly states that my tariff policy will be scaled back. That is wrong”. In the past 24 hours, Donald Trump has also said that Congress will use revenue from tariffs to help pay for extending his 2017 tax cuts in a “powerful bill” that would eliminate taxes on tips. The comments highlight that he remains strongly committed to using tariffs which he sees as a way to raise revenue, to help support a recovery in the US manufacturing sector and as a negotiating tool to force countries to meet his demand. Until there is more clarity over Trump’s plans to implement tariffs at the start of his second term, the uncertainty will generate volatility in FX market at the start of this year.

HEADLINE & ENERGY INFLATION IN THE EURO-ZONE

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Stronger inflation encourages scaling back of ECB rate cut expectations

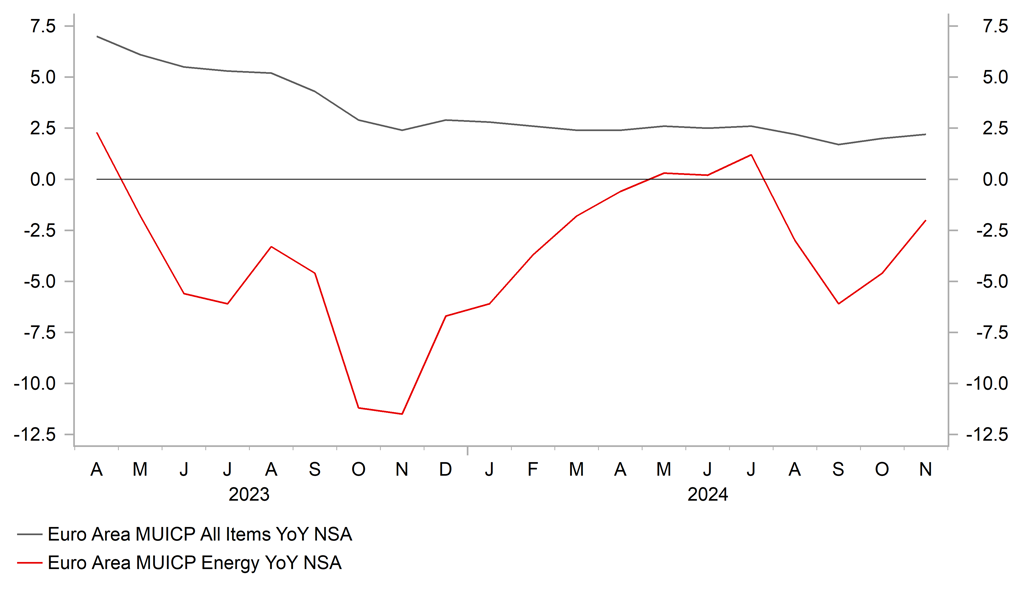

The euro has benefitted from the scaling back of US tariff fears helping to lift EUR/USD back above the 1.0400-level. Over the Christmas holidays, President-elect Trump had previously threatened to implement tariffs on the EU if they don’t make up their trade deficit with the US by large purchases of oil and gas from the US. A deal which we thought at the time could be a win-win for both the EU and US. Market participants have become more concerned over energy supply in Europe over the winter after a Soviet-era pipeline transporting Russian gas to Europe via the Ukraine was closed at the end of last year. It followed the expiration of five-year transit agreement. With this route now closed, European countries (Slovakia, Austria, Hungary, and Moldova would be mainly affected) are now having to seek alternative sources of energy such as LNG imports. The closure of the pipeline has coincided with natural gas prices in Europe rising to their highest level since the autumn of 2023. They are currently around 105% higher than the lows from last year in February which is a development that complicates the inflation outlook in the euro-zone in the near-term.

The release yesterday of the country by country CPI reports for December from the euro-zone revealed that headline inflation picked up more strongly than expected. Headline inflation in Germany picked up 0.5 points to 2.9%, and by 0.4 points to 2.8% in Spain. It strongly suggests that headline inflation in the euro-zone which is released this morning is likely to rise by more than the current consensus estimate of 2.4%. The rebound is mainly driven by a significant rebound in energy inflation while continued strength in services inflation is expected to prevent a fall in core inflation. The ECB has signalled that they remain comfortable to keep lowering rates back towards more neutral levels closer to 2.00%. However, further upside inflation surprises at the start of this year would cast some doubt on market expectations for the ECB to deliver 25bps cuts at the next three policy meetings. A development that could offer some support for the euro if ECB rate cut expectations are pared back further.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Construction PMI |

Dec |

54.3 |

55.2 |

!!! |

|

UK |

10:00 |

30-Year Treasury Gilt Auction |

-- |

-- |

4.747% |

! |

|

IT |

10:00 |

Italian HICP (YoY) |

Dec |

1.6% |

1.5% |

! |

|

EC |

10:00 |

CPI (YoY) |

Dec |

2.4% |

2.2% |

!!! |

|

EC |

10:00 |

Unemployment Rate |

Nov |

6.3% |

6.3% |

!! |

|

US |

13:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

Trade Balance |

Nov |

-78.30B |

-73.80B |

!! |

|

CA |

13:30 |

Trade Balance |

Nov |

-0.80B |

-0.92B |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

7.1% |

! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Dec |

-- |

53.7 |

! |

|

US |

15:00 |

JOLTS Job Openings |

Nov |

7.730M |

7.744M |

!!! |

Source: Bloomberg