Weak payrolls could add further fuel to USD selling

USD: NFP print more important than usual

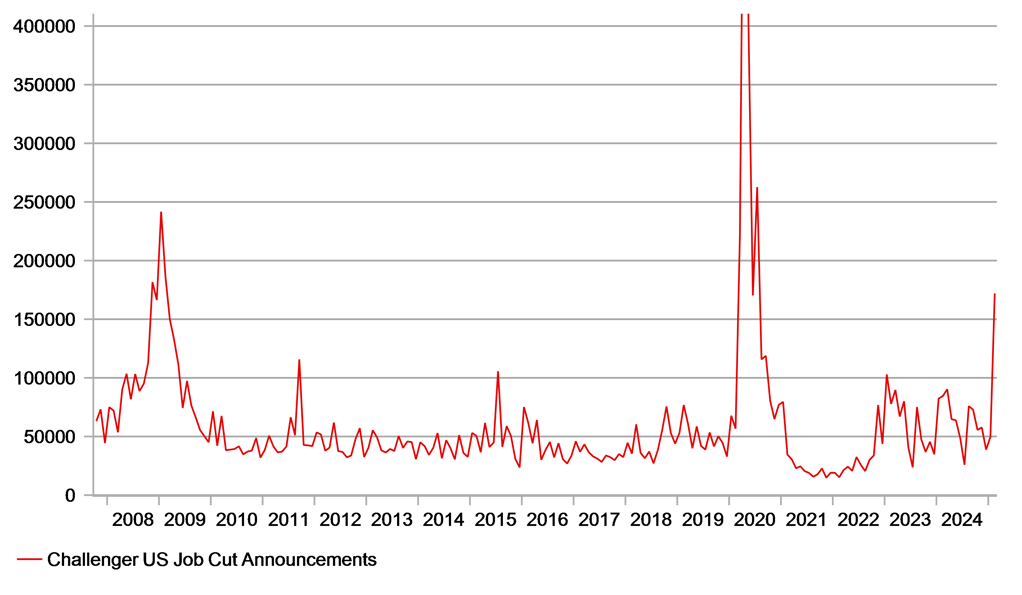

Given the current macro and geopolitical backdrop globally, the ECB yesterday were unwilling to provide much in the way of strong guidance but the description of the monetary stance being “more meaningfully less restrictive” helped to provide further modest support for yields with EUR/USD extending the significant gains already recorded this week (FX Focus here). Now the focus shifts to the US and crucially whether the weaker economic data of late extends to the key nonfarm payrolls report for February. Given the depreciation of the dollar is down to a shift in relative macro expectations in part due to weak economic data from the US, a weak payrolls report today would certainly further extend dollar losses and harden the view that the FOMC will cut sooner than expected. Market pricing is now implying a greater than 50% chance of a cut at the May FOMC meeting. The consensus is for a 160k nonfarm payrolls gain which in part reflects some weather-related bounce-back after a 143k gain in January. But the logical assumption in regard to today is that the downside risks appear greater given there were further weather disruptions in February too and Trump’s actions in announcing funding freezes (education was one, but was partially reversed) created disruptions to hiring and elevated uncertainty that still lingers and will be a drag on hiring rates going forward as well. Retail sales were very weak in January and that would impact hiring in the February data while the general sense of considerably higher uncertainty could well play a role in weaker hiring. Most alarming this week was the Challenger job cuts data – the increase in job cuts was the largest since July 2020 during covid. Ignoring covid, it was the biggest increase since the GFC.

The ADP employment print this week was weaker than expected (77k) but is a poor predictor of the NFP that follows while the ISM Service Employment index bounced sharply to 53.9 – the highest level since December 2021. The DOGE impact on today’s report is unlikely to have much negative impact with the survey week taking place before reported Federal job losses picked up. This factor will be more significant in the March data released in April.

A weaker jobs report today will certainly reinforce fears that the US economy could be headed for a downturn and that the US economy is therefore in no position to weather the wave of tariffs expected in April. Given the scale of shift in rates – the 2yr UST bond yield is 40bps lower since 12th February, the bar is higher for a big reaction to a weaker print. The same can be said in FX. DXY is currently having its largest weekly drop since November 2022 when inflation fears first began to recede following the global inflation shock. But if investors see a deeper downturn as an increased risk this afternoon, then EUR/USD trading closer to 1.1000 is likely.

CHALLENGER JOB CUT ANNOUNCEMENTS SURGED IN FEBRUARY WITH RETAIL & TECH SECTORS HIT MOST NOTABLY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Tariff back-and-forth continues

The scale of the dollar depreciation that has unfolded this week we maintain does also incorporate a degree of investor optimism over the extent to which the Trump administration will ultimately adopt tariffs on its global trading partners. We hear very often from clients that Trump is a dealmaker, Trump is an negotiator and that tariffs are only a tool in those negotiations – the implication being that tariffs will be reined back quickly if and when adopted. No doubt the decision yesterday by the Trump administration to exclude USMCA compliant products from the 25% tariffs on Mexico and Canada for a period through to 2nd April helps reinforce that view.

USD/MXN and USD/CAD dropped as you’d expect on the news of another postponement given this is just a delay and given according to Howard Lutnick that about 50% of imported goods are now excluded, the impact is still not insignificant with more to potentially come. The delay until 2nd April – the same day as the introduction of reciprocal tariffs – increases further the importance of the date for the financial markets. It is very difficult for the markets to have any clarity on what reciprocal tariff action could look like given those rates could be determined not just by tariff rates on imports from the US in the trading partner country but also perceived barriers to trade, domestic sales tax rates and currency misalignments. The actions that day could still be much more aggressive than currently assumed and hence assuming that this week’s FX move means the period for US dollar appreciation has passed could prove wrong.

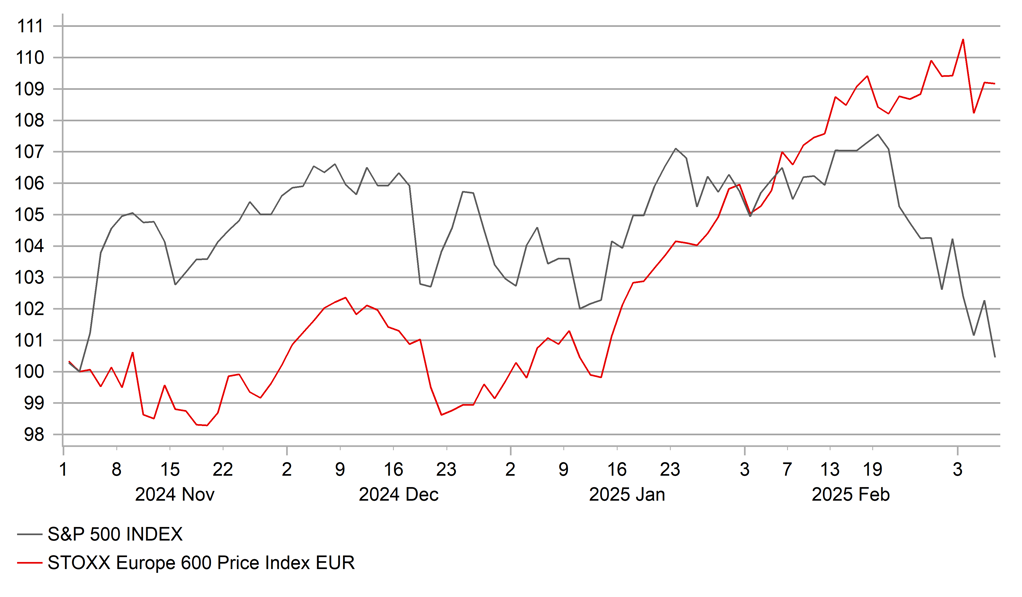

What is clear is that the back-and-forth on trade tariff policy announcements can’t be good for the US economy and it is surely creating an incentive amongst businesses to retrench from decisions around hiring and business investments. Equity market divergence between the US and elsewhere continues to highlight the bigger negative influence on equities in the US.

EURO STOXX 600 OUTPERFORMANCE VS S&P 500 CONTINUES

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Employment Change (YoY) |

Q4 |

0.6% |

0.6% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q4 |

0.1% |

0.1% |

! |

|

EC |

10:00 |

GDP (YoY) |

Q4 |

0.9% |

0.9% |

!! |

|

EC |

10:00 |

GDP (QoQ) |

Q4 |

0.1% |

0.1% |

!! |

|

US |

13:30 |

Nonfarm Payrolls |

Feb |

159K |

143K |

!!!!! |

|

US |

13:30 |

Private Nonfarm Payrolls |

Feb |

142K |

111K |

!!!! |

|

US |

13:30 |

Unemployment Rate |

Feb |

4.0% |

4.0% |

!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Feb |

4.1% |

4.1% |

!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Feb |

0.3% |

0.5% |

!!!! |

|

US |

13:30 |

Average Weekly Hours |

Feb |

34.2 |

34.1 |

! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

Feb |

-- |

3.7% |

! |

|

CA |

13:30 |

Capacity Utilization Rate |

Q4 |

79.2% |

79.3% |

! |

|

CA |

13:30 |

Employment Change |

Feb |

19.7K |

76.0K |

!!! |

|

CA |

13:30 |

Unemployment Rate |

Feb |

6.7% |

6.6% |

!!! |

|

US |

15:15 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

15:45 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Fed Monetary Policy Report |

-- |

-- |

-- |

!!! |

|

US |

17:20 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

US |

17:30 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!!!! |

|

US |

18:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

US |

20:00 |

Consumer Credit |

Jan |

15.60B |

40.85B |

! |

Source: Bloomberg