Risk sentiment remains fragile as yen remains at weaker levels

JPY: BoJ minutes support hawkish message from last policy meeting

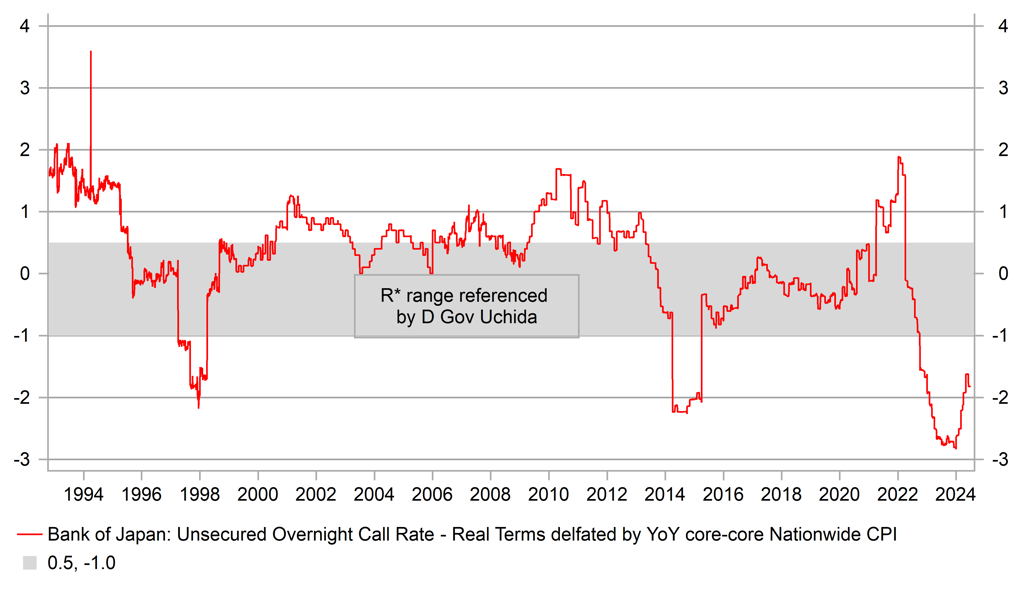

The yen has been more stable during the Asian trading session with USD/JPY trading between 145.50 and 147.00 following yesterday’s yen sell-off. The failure of US equity markets to hold on to initial gains yesterday has weighed on Asian equity markets overnight. After hitting an intra-day high yesterday at 5,331, the S&P500 index gave back all of those gains and fell back below 5,200 highlighting that global investor risk sentiment remains fragile in the near-term. The soothing comments yesterday from BoJ Deputy Governor Uchida who emphasized that the BoJ will not hike rates further if financial markets are unstable have only provided some relief for market participants who are not just concerned by the tightening of BoJ policy and unwinding of yen carry trades. The release of the minutes overnight from the BoJ’s last policy meeting at the end of July revealed that some board members described the policy rate as “significantly low” and that it will continue to be at a “highly accommodative” even after they raised rates to 0.25%. One member did note though that the normalization of policy must not be an end in itself, and future policy needs to be conducted “carefully”.

One member judged that raising the rate at a moderate pace means an adjustment in the degree of monetary accommodation in accordance with underlying inflation will “not have monetary tightening effects”. More importantly, one member noted that the BoJ should raise the policy rate to the level of the neutral interest rate which “seems to be at least around 1.00%” if their price stability target is achieved in the 2H of fiscal year 2025 while paying attention to how the economy and prices respond. One member also added that further hikes will be appropriate if it is confirmed that prices will develop in line with the Bank’s outlook and that positive corporate behaviour is maintained such as business investment, sustained wage hikes, and continued pass-through of cost increases to selling prices. Overall, the opinions in the minutes support the hawkish guidance delivered at the last BoJ policy meeting sending a clear signal that they will keep raising rates if the economy evolves in line with their outlook. If financial markets stabilize and the pace of yen gains slows, then at least one more BoJ hike still appears likely in the current fiscal year supporting outlook for a further reversal of yen weakness in the year ahead (click here).

The MoF also released their weekly report of international transactions in securities for the week ending the 2nd August. The report revealed that foreign investors were net sellers of Japanese bonds totalling JPY1.16 trillion in the week of the BoJ’s policy update although that did follow net purchases of JPY1.21 trillion in the previous week. So far this fiscal year, foreign investors have sold a net total of JPY2.99 trillion of Japanese bonds since the start of April. Foreign investors also sold Japanese equities for the third consecutive week totalling a net JPY642 billion. The last time there were three consecutive weeks of selling was at the end of the last fiscal year. Even after recent selling, foreign investors have still purchased a net total of JPY4.06 trillion of Japanese equities so far this fiscal year. In contrast, Japanese investors were net buyers of both foreign bonds and equities in the latest week totalling a net JPY670 billion and JPY1.29 trillion respectively. It was a record amount of weekly purchases of foreign equities. There have been some concerns that the recent unwind of the yen carry trade could trigger Japanese investors to sell foreign securities but so far that does not appear to have materialized.

BOJ POLICY STANCE STILL VIEWED AS HIGHLY ACCOMODATIVE

Source: Bloomberg, Macrobond & MUFG GMR

USD: Mixed performance as expectation for more aggressive Fed rate cuts intensify

The US dollar index is continuing to trade close to recent lows after the sell-off at the end of last week resulted in it falling close to year to date lows. The dollar index has declined by around 3.0% since the end of June. However, the breakdown of G10 FX performance over that period reveals a more mixed picture for the US dollar. The US dollar has mainly weakened against the other major currencies of the JPY (+10% vs. USD), CHF (+4.5%), and EUR (+2.0%). While it has weakened against the commodity currencies of the AUD (-1.7% vs. USD), NZD (-1.5%), NOK (-1.0%) and CAD (-0.4%). The GBP has also weakened more recently against the USD since global equity markets peaked in the middle of July and have since started to correct lower (-2.1% vs. since 16th July).

The recent price action is consistent with risk-off trading conditions that has meant high beta G10 currencies have weakened against the US dollar even as market expectations for more aggressive Fed rate cut expectations have intensified. US yields have fallen more sharply than in other G10 economies resulting in yield spreads moving against the US dollar. The adverse moves in yield spreads have though encouraged a weaker US dollar against the other major currencies of the Swiss franc, euro and yen. After the recent weaker nonfarm payrolls report for July, the US rate market is continuing to price in a higher probability of the Fed starting their rate cut cycle with a 50bps cut in September reflecting concerns that the Fed has fallen behind the curve and should have to cut rates last week. For the year ahead, the rate markets are pricing in around 200bps of Fed cuts compared to around 125-150bps of cuts for the ECB and around 100-125bps of cuts for the BoE.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

13:00 |

BoE Quarterly Bulletin |

-- |

-- |

-- |

! |

|

CA |

13:00 |

Leading Index (MoM) |

Jul |

-- |

0.15% |

! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,870K |

1,877K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

241K |

249K |

!!! |

|

US |

13:30 |

Jobless Claims 4-Week Avg. |

-- |

-- |

238.00K |

! |

|

CA |

13:30 |

Trade Balance |

Jun |

-- |

-1.93B |

!! |

|

US |

17:00 |

Atlanta Fed GDPNow |

Q3 |

2.9% |

2.9% |

!! |

|

US |

18:01 |

30-Year Bond Auction |

-- |

-- |

4.405% |

!! |

|

US |

20:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

7,178B |

!! |

Source: Bloomberg